- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Cash charitable donation deduction

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

I’m having the same issue. If I do as suggested by removing the itemized charitable contribution then they do not roll over to the state return. Definitely a bug in the program

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

Please review this thread for assistance with correcting this issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

"I should not get an error when I follow the step by step instructions."

Well, it's FEB 4 and the IRS made this change many months ago. Did you really expect TT to handle this properly??? Too bad for you. Too bad for many thousands of other MFJ people who are not smart enough to figure out the stupid workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

I am having the same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

The solution to the $300/$600 charitable contribution was addressed a while ago, but here it is again.

First, you must clear all donations from the Deductions & Credits input screen

In the Desktop version:

-

Go to Deductions and Credits

-

Scroll to the bottom of the page

-

Select Done with Deductions

-

Let's check your Deductions .. Continue

-

Here are your 2021 Deductions ... Continue

-

The standard deduction is right for you ... Continue

-

GET A TAX BREAK FOR DONATING CASH TO CHARITY

-

Enter your amount

Online version

-

Go to Deductions & Credits

-

Scroll to the very bottom

-

Select Wrap up Tax Breaks (Online)

-

Continue through the interview to

-

Charitable Cash Contributions under Cares Act

-

Enter your donation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

I'm sorry, but I have to agree with the others. TurboTax should be handling this appropriately. Some of my charitable contributions are coming through via payroll deductions and therefore are on my W2. How do I remove that amount without falsifying what my W2 says? My state also uses the individual donation information for state deductions, regardless if my federal return used the information or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

Again, as said multiple times, this solution does not work. Granted, it allows you to complete the federal return, it prevents you from having those deductions itemized on you state return. There has to be a solution that allows you to claim the standard on your federal return (and claim the $600) as well as itemize a larger value on your state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

I way I got around it was to go into the forms view instead of step by step. Went to the line 12b on the 1040 form. Then I either clicked on it or right clicked I can't remember. It asked me if I wanted to overwrite the number and then I put in $600 instead of $300.

Turbo Tax that I would not be able to file electronically if I did that per the previous conversation, but I was able to file just file and the tax refund has already been processed. I do not have to file a state return and I don't know if that would have made a difference.

But I agree this is a software issue that needs to be fixes. You can NOT zero out any possible deductions as you never know if this will lead to a higher deduction than the standard or affect any other deductions or credits due.

The bug needs to be fixed and I don't understand why they have not addressed it yet. Seems like an easy fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

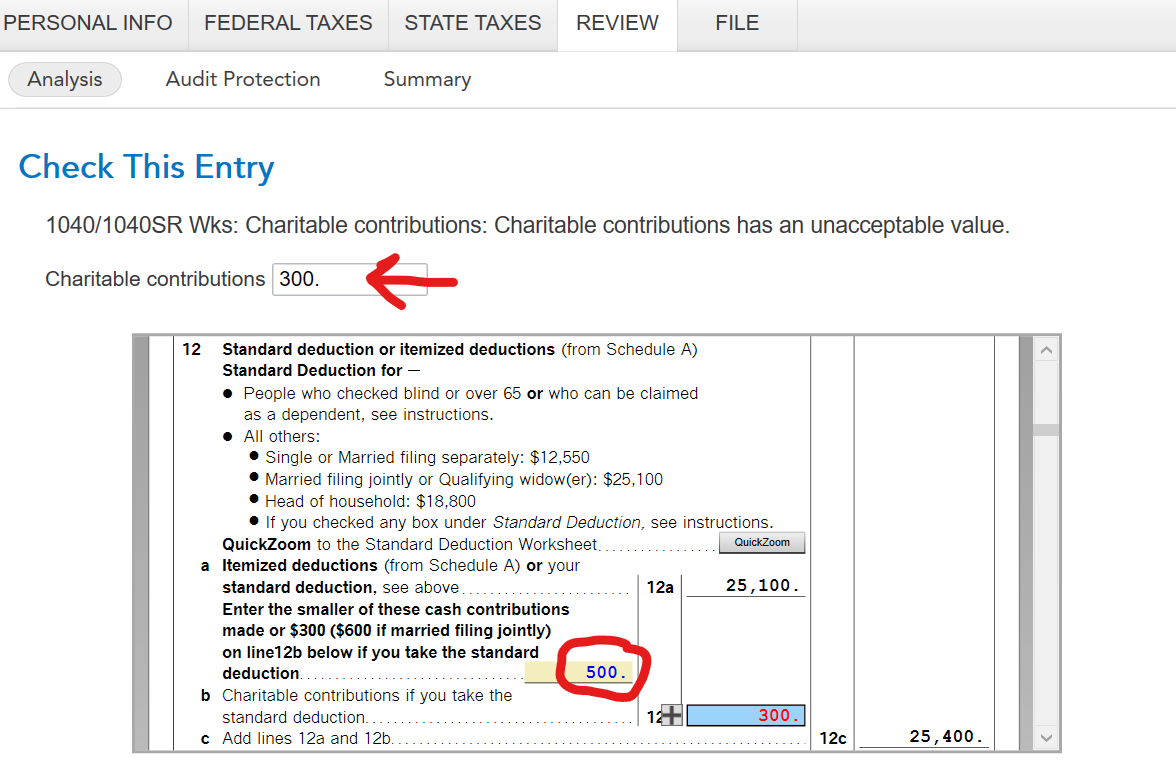

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash charitable donation deduction

It looks like Turbo Tax fixed their bug. I down loaded the latest version and did not have the issue any more. Thanks.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cwalters777

New Member

user17723057255

New Member

user17717051815

Level 1

paedge

New Member

Long_time_customer

New Member