- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Can I write off my laptop I bought primarily for my business?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

Thanks a lot for your prompt help 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

I bought my laptop a few years ago but I only started a job now where I have to use my laptop 12 hours a day for work. how do I deduct my laptop cost if I bought it so long ago or it doesn't matter how long ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

You would deduct the fair market value of the laptop when you started using it for your business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

1)"the fair market value" would be the price I bought it for? likewhatever it said on the receipt? the price I bought it for before taxes or after taxes?

2)how do I calculate the deductions. if I use it for 12 hours a day per work day.

if I gave you an example can you break it down please?

laptop costed : $1,6000 and like $1800 after taxes (bought a few years ago)

and I've been using it for my job I work 3 days a week. 12 hours per day sometimes 8 hours.

how much do I deduct for my taxes. in dollars

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

@rachelray101 The 'Fair Market Value' is what your computer is worth now, since you bought it a few years ago (what you could sell it for).

You will need to determine the % you can deduct. If you use your computer for an average of 80 hours a week, and 40 of those hours were for business, you can claim 50%, for example. You could keep a log or calendar to determine this.

If you are a W-2 Employee, you can't deduct your computer; only if you are Self-Employed and report Income/Expenses on a Schedule C.

If this applies to you, click this link for more info Business Tax Deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

I'm a W-2 employee but the majority of my income is from commission. I can still itemize business expenses including depreciating a laptop, correct? And if correct, which method of depreciation would you recommend?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

If you are a "W-2 employee", then you won't be able to deduct your employee business expenses - the 2017 Tax Cuts and Jobs Act eliminated deductions for unreimbursed employee business expenses (with some limited exceptions.

See Employee Business Expenses for a more detailed explanation of the subject.

Even if your compensation is based on a commission formula, you are still an employee. Your employer should still be reporting your commission-based income on your W-2, and withholding/payingemployment taxes accordingly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

This doesn’t make sense… first it says if you use your computer more than 50% for work, you can write off the entire cost. But then below in the example stating if you use it 60% for work, then you can only write off 60% of the cost…. Which is it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

Definitely only the business use portion (percentage) can be expensed. The personal use portion of any equipment which would include a laptop is not deductible. The key point is whether you are an employee or an independent contractor or a statutory employee (box 13 of W-2).

As an employee, with the exception of statutory employee, no job related expenses are deductible as stated by @ToddL99.

If you must file a Schedule C as a sole proprietor or a statutory employee, then you can use the expenses for your job.

Statutory Employee:

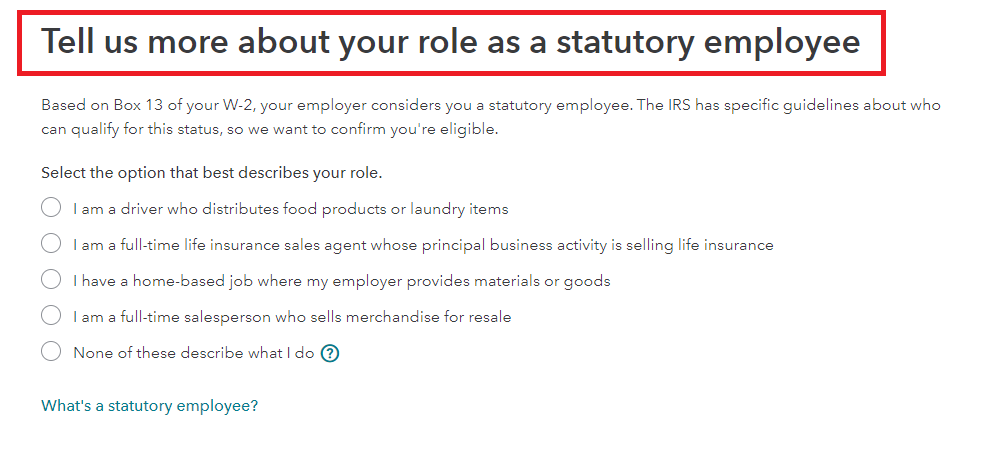

Statutory employees have been declared employees under federal tax laws, but are independent contractors under common law. These workers are usually working salespeople or have commission-based jobs. The information from the W-2 has to link with your Schedule C.

- In TurboTax Self-Employed Online, > Wages & Income and enter your W-2.

- Ensure that Box 13 "statutory employee" is checked.

- Answer the questions on the subsequent screens until you get to expenses (unless you select 'None of these describe what I do':

- "Any Related Business Expenses?" Click "Yes".

- Go through the interview questions.

- Your W-2 Income is now linked to Schedule C. See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

Where on Schedule C or what part of TurboTax deluxe do I answer the question for expenses related to the purchase of a laptop for my business?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I write off my laptop I bought primarily for my business?

You will enter this as an asset for your business. To do this in TurboTax Online please follow these steps:

- Within your tax return use the magnifying glass icon to search for Schedule C

- Click the Jump to link

- Click Edit for the line of work

- Scroll down and click Add expenses for this work

- Scroll to and click Add for Assets - if you don't see it on the list, scroll down to the Less Common section and click the down arrow and show more until you do

- Click Continue

- Click Start for Assets

- You will treat the whole cost of building the workshop as the asset so answer No to Did you buy any items for any business, rental property and/or farm that cost $2,500 or less in 2021?

- You will also choose No to Did you make improvements to a building you used for this business in 2021?

- Choose Real Estate Property to Describe the Asset

- The date purchased will be the date you started using the workshop for your business and then click Continue

- Choose Nonresidential real estate and Continue

- Name your asset - Workshop works!- and enter the total cost of buying the base structure and all the purchases to complete the building

- Leave the land cost blank since this is still your personal property

- Choose I purchased this asset new and Yes, I've always used this asset 100% for business

- Enter the date your business started (which is the date of purchase) and click Continue

TurboTax calculates the depreciation and enters it on your Schedule C for you.

@mkarmali

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17522839879

New Member

justine626

Level 1

pambrennan

New Member

Christine329

New Member

Jeff-W

Level 1