- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Definitely only the business use portion (percentage) can be expensed. The personal use portion of any equipment which would include a laptop is not deductible. The key point is whether you are an employee or an independent contractor or a statutory employee (box 13 of W-2).

As an employee, with the exception of statutory employee, no job related expenses are deductible as stated by @ToddL99.

If you must file a Schedule C as a sole proprietor or a statutory employee, then you can use the expenses for your job.

Statutory Employee:

Statutory employees have been declared employees under federal tax laws, but are independent contractors under common law. These workers are usually working salespeople or have commission-based jobs. The information from the W-2 has to link with your Schedule C.

- In TurboTax Self-Employed Online, > Wages & Income and enter your W-2.

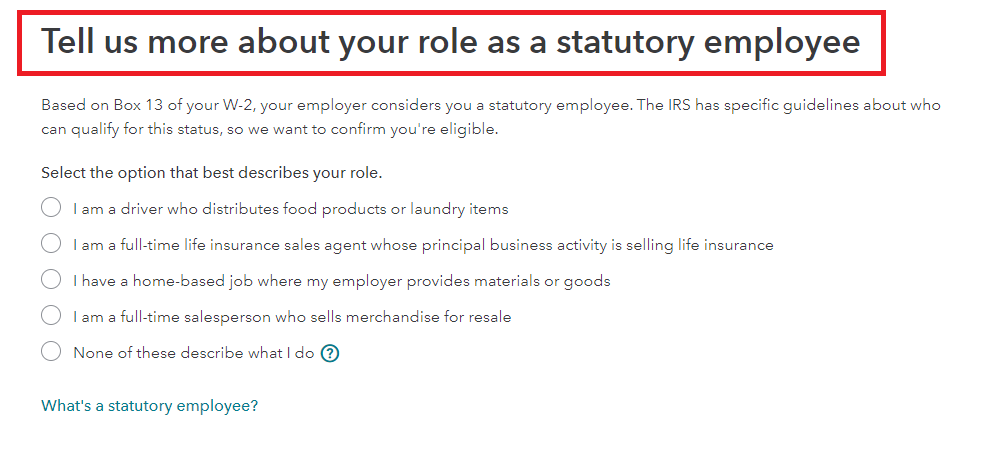

- Ensure that Box 13 "statutory employee" is checked.

- Answer the questions on the subsequent screens until you get to expenses (unless you select 'None of these describe what I do':

- "Any Related Business Expenses?" Click "Yes".

- Go through the interview questions.

- Your W-2 Income is now linked to Schedule C. See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"