- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: CALIFORNIA MIDDLE CLASS TAX REUND $350.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

I filed my tacked prior to the decision!

I guess I got screwed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

Hi,

IRS have very clearly stated that the CALIFORNIA MIDDLE CLASS TAX REUND is not taxable for both the Federal and State. However, the TurboTax (deluxe) that I'm using is still charging the taxes on it in the calculation. I hope the TurboTax team could correct this error as soon as possible, and meanwhile, everybody needs to pay a great attention to it when you are using TurboTax for your tax return!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

I used TurboTax Deluxe ("TTD" under Windows 11) Version 022~000~0407 and the TT executable version 2022.47.17.39 on Friday Feb 10th, 2023 to successfully file taxes.

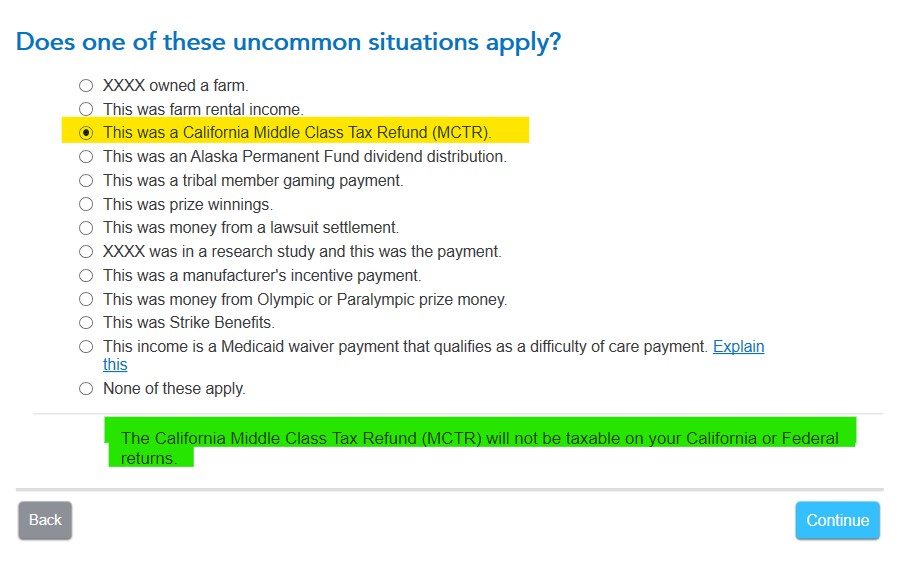

I reported CA-MCTR income as 1099-MISC from EIN 68-0204061 (California's State Revenue Department) and when TTD asked Does one of these uncommon situations apply? "California Middle Class Tax Refund" was selected.

See the snapshot below of how this was handled by TTD at that time -- note the "general welfare exclusion" amount. Artificially increasing the MCTR amount to the maximum value ($1,050 per CA-FTB) made no difference to my Federal or State refund amounts. This observation and the "general welfare exclusion" convinced me that the MCTR income was not being treated as taxable by TTD.

As of the date of this post (2023-02-25) with the latest updates applied, my TTD software versions are now:

022~000~0437 and 2022.47.18.40 respectively (note: the tilde symbols have been used to replace periods, otherwise, this website thinks it's a phone number and removes the information). I have not re-tested my taxes with this latest version of TTD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

Hi NormallyAspirated,

Following your suggestion, I updated my TTD and got the additional "Describe what reason for this 1099-MISC", and finally resolved this problem! Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

I still get the error, I used the right California EIN680204061 and my amount was1050, I still get the error message!!! No fix yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

JM132:

Suggest you double check the following:

1) If you are using TurboTax under Windows or other operating system, ensure the latest software updates have been applied. (Navigate: Online-->Check For Updates from TurboTax's menu bar) See snapshot below for the version IDs of my TurboTax Deluxe "fat client" under Win11 -- the latest updates were applied a few minutes ago today (2023-03-09)

2) In step-by-step (i.e. 'interview') mode use a 1099-MISC to report your MCTR. Enter 68-0204061 as the EIN and $1,050 as your refund. When TurboTax asks "Does one of these uncommon situations apply?" select "California Middle Class Tax Refund"

I've had no experience with Internet based versions of TurboTax, but I would suspect that they should already be current with all applicable software upgrades applied.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

As mentioned above, please make sure your software is updated if using the desktop software. Also, make sure that you tell TurboTax that the income is a CA Middle-Class Tax Refund. You will come to a screen asking about uncommon situations for this income. If you mark the appropriate box, TurboTax will not tax the income on either the federal or your CA state return. @JM132

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

Actually, You do not need to enter or report the 1099Misc for the CA Middle Class Tax Refund

2/10/2023 IRS determined the CA Middle Class Tax refund is not taxable IRS issues guidance on state tax payments to help taxpayers | Internal Revenue Service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

Yes, on 2/10/2023, the IRS determined the CA Middle Class Tax refund is not taxable. However, some tax experts (CPAs) on cnbc.com and other news media outlets stated that if you received a 1099-MISC from CA-FTB for your MCTR, it may still be best to report it when you file taxes, in order to avoid a mis-match situation at the IRS, since CA-FTB will have reported it to the IRS already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CALIFORNIA MIDDLE CLASS TAX REUND $350.

A 1099-MISC is only sent if it needs to be reported for taxes. Since the amount was less than $600, it doesn't need to be reported. The link and info copied from the website is below:

https://www.ftb.ca.gov/about-ftb/newsroom/middle-class-tax-refund/help.html

1099-MISC income tax information

Individuals who received a California Middle Class Tax Refund (MCTR) of $600 or more will receive a 1099-MISC for this payment.

Taxable income

The MCTR payment is not taxable for California state income tax purposes. You do not need to claim the payment as income on your California income tax return.

Individuals who received an MCTR payment of $600 or more but did not receive a 1099-MISC should contact [phone number removed] to request a 1099-MISC. When prompted, individuals should press 1 for personal income tax assistance.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

trust812

Level 4

ekmk

Level 2

cwr64

New Member

Lord_Tasho

Returning Member

user17621839383

New Member