- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: CA (540NR) - Line #7: I owned a home/property in CA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

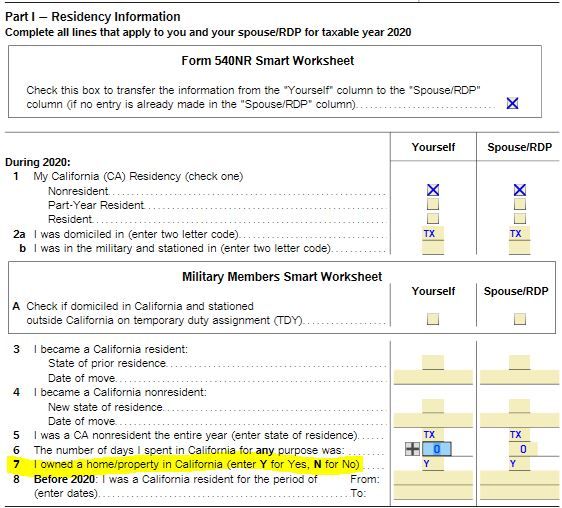

CA (540NR) - Line #7: I owned a home/property in CA?

Hello,

I own rental properties in California but my home is in Texas and I am a resident of Texas. How do I answer this question in the CA (540NR) form? Are they only interested in if my home is in California or are they interested to know if I have ANY property in California?

Line #7: I owned a home/property in CA (enter Y for Yes, N for No)

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA (540NR) - Line #7: I owned a home/property in CA?

Perfect. Thank you. Your answer to owning property in CA by itself has no effect on your taxes. None.

California asks that question, in conjunction with the other questions on this form to determine if nonresidents truly are nonresidents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA (540NR) - Line #7: I owned a home/property in CA?

Yes, you own property in CA. Answer yes. Your welcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA (540NR) - Line #7: I owned a home/property in CA?

Thank you for the answer!

How does this answer (Yes or No) affect my California taxes?

What I mean is that, as a California non-resident, there is a section where I enter my income from each rental property and I specify whether the income was derived from California sources. So I get taxed on the income that was earned from California sources and not on the income earned elsewhere. So how does answering this question Yes or No affect my taxes?

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA (540NR) - Line #7: I owned a home/property in CA?

Please clarify where you are seeing this question. That question is not part of the CA 540NR tax form :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA (540NR) - Line #7: I owned a home/property in CA?

Please see Line #7 in the California Adjustments form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA (540NR) - Line #7: I owned a home/property in CA?

Perfect. Thank you. Your answer to owning property in CA by itself has no effect on your taxes. None.

California asks that question, in conjunction with the other questions on this form to determine if nonresidents truly are nonresidents.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teewilly1962

New Member

berniek1

Returning Member

Kenn

Level 3

realestatedude

Returning Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill