- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what i...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

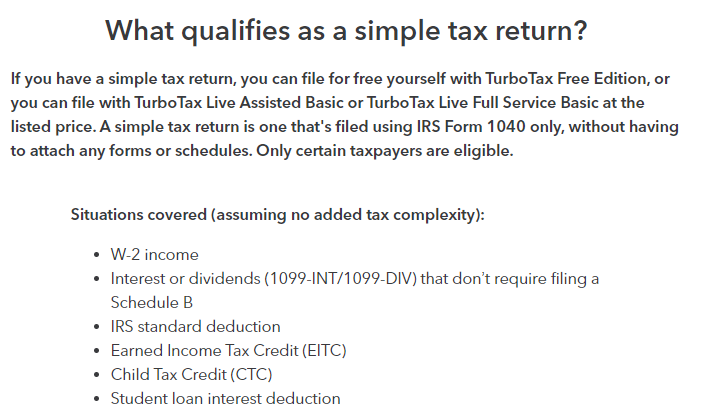

Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what is stated for being able to do simple tax return filing.

According to the above, IF "Interest or dividends (1099-INT/1099-DIV) that don't require filing a Schedule B". In my situation, Line 7 (1099-DIV) indicates "if not required, check in box". TurboTax put a check in the box. Just like last year, had a check in the box, I completed it in the FREE version. TurboTax didn't prepare a schedule B. This year TurboTax is FREE b/c I was NOT required to have a schedule B (in my case), but it created one which it should NOT have done. This is my issue and I was charged b/c I couldn't get any help. The tax expert said she was receiving many calls regarding this. They even tried to delete the Schedule B but that made no difference. Had I had more time and actual person that could assist, I wouldn't have submitted. IF Line 7 had the check in the box stating Schedule B was not required then why did it recreate one forcing me to Pay for Deluxe and Pay for State filing. Last year I had the same situation, no schedule was created and I filed, as it says FREE FED, FREE STATE, FREE filing and FREE printing. This year, when looking at a side by side to previous year, there is NO difference in my form other than regardless of the check in the box, a schedule B was created. Why? I have filed 3 refund requests but they simply send a generic statement (likely AI creating it) simply based on fact the online version was used. I had no issues last year. At this point, I have filed a complaint with the BBB. I hope senior quality control is able to fix this issue before next year. And next year, I will be sure to leave myself time to work with technical support, if I can get through to someone. I've been a user for years and this is disheartening to pay for a service, a schedule, that shouldn't have been created. Causing financial hardship...thanks Intuit.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what is stated for being able to do simple tax return filing.

Use Schedule B (Form 1040) if any of the following applies.

• You had over $1,500 of taxable interest or ordinary dividends.

• You received interest from a seller-financed mortgage and the buyer used the

property as a personal residence.

• You have accrued interest from a bond.

• You are reporting original issue discount (OID) of less than the amount shown

on Form 1099-OID.

• You are reporting interest income of less than the amount shown on a Form 1099

due to amortizable bond premium.

• You are claiming the exclusion of interest from series EE or I U.S. savings bonds

issued after 1989.

• You received interest or ordinary dividends as a nominee.

• You had a financial interest in, or signature authority over, a financial account in

a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what is stated for being able to do simple tax return filing.

Thank you for sharing; however, none of these apply to me! Not a single one! My return is simple. There is no added complexities to my return. It's exactly the same as the previous year; and I was able to submit. Can you please help me determine why the Schedule B was created? So far, everything I have been told does not apply to me. PLEASE, I AM ASKING FOR HELP! I would be totally find being charged if I met any one of the below criteria but I simply don't meet these or any others. I looked at my filings side by side to the previous year...and still, there is nothing that changed. I need someone to look at my filing and tell me, tell me why.

Use Schedule B (Form 1040) if any of the following applies.

• You had over $1,500 of taxable interest or ordinary dividends. - does not apply to me

• You received interest from a seller-financed mortgage and the buyer used the

property as a personal residence. - does not apply to me

• You have accrued interest from a bond. - does not apply to me

• You are reporting original issue discount (OID) of less than the amount shown

on Form 1099-OID. - does not apply to me

• You are reporting interest income of less than the amount shown on a Form 1099

due to amortizable bond premium.- does not apply to me

• You are claiming the exclusion of interest from series EE or I U.S. savings bonds

issued after 1989.- does not apply to me

• You received interest or ordinary dividends as a nominee.- does not apply to me

• You had a financial interest in, or signature authority over, a financial account in

a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust. - does not apply to me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what is stated for being able to do simple tax return filing.

I did my taxes in H&R Block...and guess what, it was FREE!!!!! I didn't consider trying another company but this situation left me disappointed. I knew I was right that I should NOT have been charged. Anyone going to refund me now? I see that TurboTax lost the settlement and is paying out $141 million to 4.4 million customers. The issue I had was not an isolated incident so maybe this will end up in court as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what is stated for being able to do simple tax return filing.

The checkbox on 1040 line 7 is not for Schedule B. It is for Capital Gains on Schedule D. If you have any Capital Gains on a 1099Div box 2a or qualified Dividends in box 1b. Those go on Schedule D and get taxed at capital gains rate.

If you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Buyer Beware: FREE simple tax return erroneously created Schedule B; 1040 Line 7 states "if schedule not required, check in box! Boxed Checked", forcing payment. Directly in conflict with what is stated for being able to do simple tax return filing.

Hello, Thank you for responding. You are correct. I got myself confused along the way. It did create a schedule B when it should not have.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gborn

Level 2

shanesnh

Level 3

Edawg2049

New Member

SkeeterB767

Level 2

PepeM

Level 1