- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Blockfi Cryptocurrency Interest Payments and 1099-MISC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

I earn interest income in the form of USDC, a stable coin (cryptocurrency) with the Blockfi savings account. Technically, this is a "payment of property" according to the Blockfi web site here: https://blockfi.com/what-to-expect-for-tax-season . They issued me a 1099-MISC, and the amount I earned is shown on box 3. When I enter this amount and my 1099-MISC in Turbotax, it keeps classifying it as business income subject to self-employment tax. I have read conflicting things about whether box 3 income should be subject to self-employment tax or not. Can anyone provide clarification? This is not business income. It is interest payments for loaning cryptocurrency to Blockfi, so I find it odd that they issued a 1099-MISC instead of a 1099-INT but that is what they issue. Turbotax is classifying it as business income and it is definitely charging me the self-employment tax from this amount. Is this correct?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

1099-Misc box 3 should be reported on line 8z of Schedule 1 Additional Income and Adjustments to Income and line 8 of the Federal 1040 tax return.

You are able to track where the income is reported by viewing the entries at Tax Tools / Tools / View Tax Summary / Preview my 1040 or at Tax Tools / Print Center / Print, save or preview this year's return.

You may also report the 1099-Misc using these steps:

- Click on the search magnifying glass in the upper right hand corner of the screen.

- Enter '1099-misc'.

- Click on 'Jump to 1099-misc'.

These questions can lead to reporting the income as self-employment income subject to self-employment tax. The income is rightly reported as other income on line 8 of the Federal 1040 tax return and can be checked by viewing the tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

As a follow up, on the back of the 1099-MISC, the instructions read: Box 3. Generally, report this amount on the "Other income" line of Schedule 1 (Form 1040 or 1040-SR), or Form 1040-NR and identify the payment. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other taxable income. See Pub. 525. If it is trade or business income, report this amount on Schedule C or F (Form 1040 or 1040-SR).

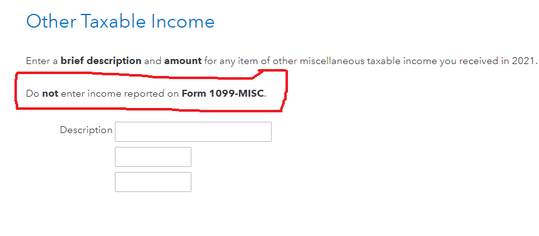

To me, this is not trade or business income. It is "other taxable income." But Turbotax will not let me enter it as such. When I go to the personal income section, and try to enter it as "Other Reportable Income," it specifically tells me not to enter 1099-MISC income here. But as a test, I did, and that is the only way I could get the amount to populate on the "Other income" line of Schedule 1, per the 1099-MISC form's instructions.

Please help if possible. Thanks 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

In case this comes up for anyone else, I think I may have accidentally solved the problem. I entered the 1099-MISC normally and it created an imaginary business for me, charging me SE tax etc. I then went all the way back to the beginning of the program and deleted the business. This removed the schedule c, and self employment tax but preserved the 1099-MISC information on schedule 1. Turbotax automatically populated "Other Income from box 3 of 1099-Misc" on Schedule 1 line 8, which is consistent with the 1099-MISC instructions now. I did this by accident, but I think it's correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

What do you mean when you say you deleted the business? All I see is "Your 2020 Self Employment work summary". I can delete that item but it deletes all info including the interest amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

"Other Reportable Income," it specifically tells me not to enter 1099-MISC income here. But as a test, I did, and that is the only way I could get the amount to populate on the "Other income" line of Schedule 1,"

For Line 3 amount, that's the right way.

you shouldn't be getting a Schedule C and then trying to delete it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

Ok. Now I see it.

Wages and Income>>Less Common Income (all the way at the bottom)>>Miscellaneous Income, 1099A, 1099C>>Other Reportable Income>>Start

You really gotta drill to find it, but this is a better solution than reporting it as self employment income then deleting it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

I found how to get the income to show up on Schedule 1 as other income without TurboTax creating a Schedule C (and making you pay self-employment income).

Enter it under Personal Income -> Other Common Income -> Income from Form 1099-MISC.

The important part is how you answer the questions after you enter the form.

Involve work that is your main job? No

How often? Only choose the current year (this is important to keep TurboTax from creating a Schedule C for it)

Intent to earn money? No (trust me, you have to choose No for this so TurboTax doesn't assume it's a business and creates a Schedule C).

That should do it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

Thank you. I had the same issue with self employment tax and your recommendation heled to solved it. CPAs seem to have no clue about crypto income. need to educate themselves a bit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

I looked there and it states; DO NOT enter income from form 1099-MISC. Any ideas if this is new or Am I missing the right category ?

|

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

Other income is the correct place to enter this in spite of the fact that it says not to enter 1099-MISC income there.

All this confusion comes from the IRS position that crypto is not currency, it is property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

I think part of my confusion is this thread started a year ago in 2021 and now Turbotax's interface for 2022's filings maybe a little different.

Can anyone confirm we file BlockFi's 1099-MISC under Income from Form 1099-MISC and not anywhere else such as Investments and Savings? I was able to file is successfully under 1099-MISC but did have to answer a bunch of questions where TurboTax thought it was misc income from work etc. I haven't checked yet what forms or schedules it will create as I'm still in the process of entering everything.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

If your 1099-MISC shows a figure in box 3, Other income, you are supposed to enter it in as Other Income.

I understand that may feel wrong to you, but the IRS considers crypto currencies as property, not as currency, since they are not backed by a Centralized authority. And, yes, I know that is the whole point of crypto.

Under current IRS guidance, only sales of crypto assets are treated like investments.

Here is how to enter your 1099-MISC box 3 amount:

- Select Federal on the left side menu.

- Select Income and Expenses toward upper left.

- Expand/ scroll down the list and find the section called, Less Common Income.

- Scroll all the way down and select Miscellaneous Income, 1099-A, 1099-C.

- Select Other reportable income.

- Answer the first question Yes.

- Enter a description and amount on this page, click Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

When I go through the process you detailed, it specifically says "Do not enter income from 1099-MISC." Are you sure the steps you gave are still correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

I see the warning too. Which gave me pause on submitting the Blockfi 1099-MISC through other taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blockfi Cryptocurrency Interest Payments and 1099-MISC

1099-Misc box 3 should be reported on line 8z of Schedule 1 Additional Income and Adjustments to Income and line 8 of the Federal 1040 tax return.

You are able to track where the income is reported by viewing the entries at Tax Tools / Tools / View Tax Summary / Preview my 1040 or at Tax Tools / Print Center / Print, save or preview this year's return.

You may also report the 1099-Misc using these steps:

- Click on the search magnifying glass in the upper right hand corner of the screen.

- Enter '1099-misc'.

- Click on 'Jump to 1099-misc'.

These questions can lead to reporting the income as self-employment income subject to self-employment tax. The income is rightly reported as other income on line 8 of the Federal 1040 tax return and can be checked by viewing the tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kristen25r

New Member

markmcf

New Member

noursaleh98

New Member

user17673716559

New Member

JQ6

Level 3