- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: amended return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

amended return

Is the tax refund shown in addition to the original tax refund? The amount shown after the amended information is less than the original amount refunded.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

amended return

You will still get the refund from the first original return or still need to pay the first tax due. In fact you should not even amend until the first return has fully processed and you get the first refund or your tax due payment has cleared.

Then the amended 1040X return is only for the difference you get back or owe. I think the cover sheet shows what the original return WOULD have been if you did it right the first time. Ignore the new 1040 that might print out.

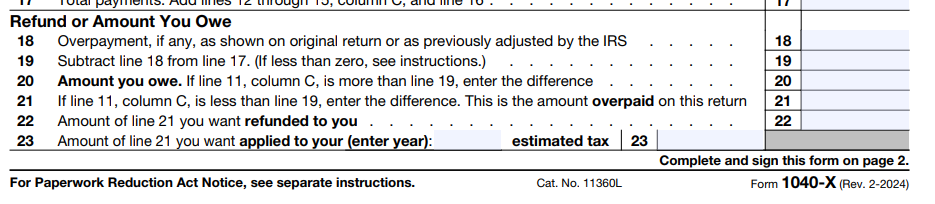

Go by the actual 1040X. Line 18 should be your original refund amount and line 22 should be your additional refund. If you paid on your original return it will be on line 16. If there is an amount owed with the amendment, it will be on line 20.

If you have a tax due, do not send the 1040V. Just include a check with the 1040X. Ignore the 1040V. That is for the original return or what the original return would have been if it didn’t need correcting. Don’t pay the amount on the 1040V. Pay the amount on the actual 1040X line 20.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

amended return

When preparing an amended income tax return, make sure that you are correctly accounting for and reporting:

- The amount that you paid in payment of a balance due, or

- The amount that was refunded to you by the tax authority.

Follow the software prompts to correctly report these amounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

amended return

I was trying to add medical expenses for home health care (just found out I could claim that). Is the refund amount it shows in addition to what I already received on the original filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

amended return

The 1040X should only reflect the changes. When you prepared the amendment, did it start out as $0? Look at the bottom of Form 1040X, page 1, Lines 18-23.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

amended return

yes, it started out as zero. Just wanted to be sure the amount shown to be refunded was in addition to what i have already received.

thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

amended return

You will still get the refund from the first original return or still need to pay the first tax due. In fact you should not even amend until the first return has fully processed and you get the first refund or your tax due payment has cleared.

Then the amended 1040X return is only for the difference you get back or owe. I think the cover sheet shows what the original return WOULD have been if you did it right the first time. Ignore the new 1040 that might print out.

Go by the actual 1040X. Line 18 should be your original refund amount and line 22 should be your additional refund. If you paid on your original return it will be on line 16. If there is an amount owed with the amendment, it will be on line 20.

If you have a tax due, do not send the 1040V. Just include a check with the 1040X. Ignore the 1040V. That is for the original return or what the original return would have been if it didn’t need correcting. Don’t pay the amount on the 1040V. Pay the amount on the actual 1040X line 20.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

twhuddleston60

New Member

LJerdon

Level 1

MaryM3

New Member

AFarkas103

New Member

edwardpaige451

New Member