- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Alternative Calculation for Year of Marriage on Form 8962

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Like many other people's situation. I married my wife in the middle of the year. She earns much more than me and she had her emplyer povided health insurance. Now we filed a MFJ return, and turbotax determined that I have to pay back the PTC.

PTC was calculated only be the AGI. I don't want to complain how unreasonable it is.

Now I just want to use the alternative calculation to lower the PTC I need to pay back.

I did follow turbotax to put all info on 1095-A and mentioned that I was married and the month.

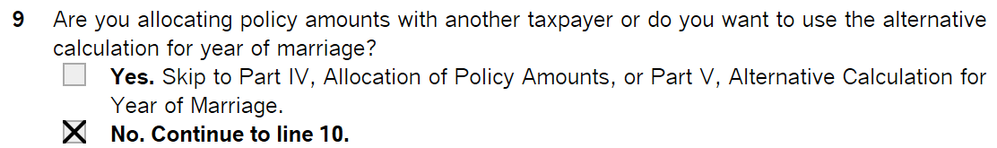

But nothing has changed, and when I checked the form 8962,

In the line 9 as shown below, 'No' is always checked and can't be changed, no matter how I changed the numbers.

I understand some people say that turbotax did calculation and determine not to use it. But I wanted to see the results, I want to see how things change if 'Yes' was checked, otherwise I don't know if it was really used or it is just a bug.

Does anyone know how to check the 'Yes' using turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Long story short, it is likely that if 4.25% of your household income exceeds the total SLCSP premium for the year, no advanced premium tax credit is owed even with the alternate calculation.

After taking a closer look at the calculation, it appears that the alternate calculation is based on half your household income for the pre-marriage months. It is not based on who earned it. Your tax household size is also reduced by one and the monthly contribution amount is recalculated based on half your household's income and your tax household size without your spouse.

If your household income is large enough that your monthly contribution amount based on this calculation exceeds the SLCSP premium, the entire amount of premium tax credit received would have to be refunded.

If your income is 401% above the federal poverty level, based on household size then 8.5% of your income is the monthly contribution amount. If your total income was more than 401% for a tax household of 2, half your family's income may still be 401% for a household of one. At that point, if 8.5% of half your income, or 4.25% of your total income exceeds the total SLCSP premiums for the year, no premium tax credit is owed and the entire advanced amount received must be paid back, even using the alternate calculation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

TurboTax does appropriately apply the alternative calculation for the year of marriage in cases where it reduces the repayment of the premium tax credit. The form does not allow an override in instances where it does not provide a benefit. If you are higher-income yourself then it is unlikely the alternative calculation will yield a benefit.

If it does not seem to calculate correctly, you can make sure that you are selected as the primary policyholder on the 1095-A for the year of marriage calculation, not your spouse. You can also ensure that all the income in your tax return is correctly allocated to the spouse who earned it.

If you want to ensure the calculation is working correctly, you can switch your W-2 to your spouse's name or reduce the Box 1 federal income amount. That should make the marriage calculation kick in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

My wife has higher income, I do think it doesn't calculate correctly.

I did double check what you suggested, I am the primary poilicy holder and our earns are also correctly allocated. I also tried to modify the amount in w2 and change back. Nothing happened in form 8962.

I double checked the instruction of form 8962 on IRS. And I am absolutely eligible to elect the alternative calculation for year of marriage.

@RaifH Do you have any suggestions? How can I make it right. Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Long story short, it is likely that if 4.25% of your household income exceeds the total SLCSP premium for the year, no advanced premium tax credit is owed even with the alternate calculation.

After taking a closer look at the calculation, it appears that the alternate calculation is based on half your household income for the pre-marriage months. It is not based on who earned it. Your tax household size is also reduced by one and the monthly contribution amount is recalculated based on half your household's income and your tax household size without your spouse.

If your household income is large enough that your monthly contribution amount based on this calculation exceeds the SLCSP premium, the entire amount of premium tax credit received would have to be refunded.

If your income is 401% above the federal poverty level, based on household size then 8.5% of your income is the monthly contribution amount. If your total income was more than 401% for a tax household of 2, half your family's income may still be 401% for a household of one. At that point, if 8.5% of half your income, or 4.25% of your total income exceeds the total SLCSP premiums for the year, no premium tax credit is owed and the entire advanced amount received must be paid back, even using the alternate calculation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Great, but how do you get TurboTax to do this!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Can you clarify what you are trying to get TurboTax to do?

@dconstanzino

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Get it to calculate the alternate PTC form. My wife barely had any income for most of last year and we got married at end of Oct. and TurboTax is saying we need to refund all the premiums that were paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

TurboTax will do the alternate year of marriage calculation behind the scenes if you tell it to:

- Click Deductions and Credits

- Scroll down to Medical and Click Show More

- Click Start or Revisit next to the ACA

- Once you enter the 1095-A or verify the information that has already been entered you will come to a screen that says Let us know if these situations apply to you. Click I got married in 2021 and answer the two follow-up questions.

Once you have entered that information, TurboTax will automatically apply the calculation that yields a better result. It will not show its work if the alternate calculation does not yield a better result. As I said above, if 4.25% of your family's total income exceeds the annual SLCSP premiums and half your income is more than 400% of the federal poverty level, it is unlikely that the alternate calculation will lead to a better result, even if you currently have to repay the entire advanced premium tax credit. The household size for the poverty level would be one less than your actual household size since you would not be including the spouse for the alternate calculation.

@dconstanzino

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Hi RaifH, thanks for the reply. So what you're saying is that if I make enough money, it doesn't matter how little money my wife made before getting married the last couple of months of 2021, we'd still have to pay back all the APTC (though Turbotax is showing an even higher amount to refund that the total APTC from the 1095-A)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Yes, that's correct. Even though one would think the alternate calculation would only involve the income the spouse makes who is covered by the marketplace insurance, the IRS instead just takes the total household income and divides it in half.

If your taxes are going up even more than the total amount of advanced premium tax credit received, TurboTax may be assessing additional underpayment penalties on the amount owed. Depending on your tax situation, you may be able to get those waived. TurboTax should ask you automatically if this pertains to you, but you can also visit the underpayment section in Federal > Other Tax Situations > Additional Tax Payments > Underpayment Penalties.

@dcostanzino I finally got your name right this time. Sorry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Thanks RaifH. My error on turbotax ATPC not matching.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

There are many questions here about Alternative Calculation for Year of Marriage on Form 8962,

But your answers @RaifH are absolutely the best!!! Thank you!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Asorsen

New Member

johnmn

New Member

heather-gwilt

New Member

boru

Returning Member

McGoon

Returning Member