- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Alternative Calculation for Year of Marriage on Form 8962

Like many other people's situation. I married my wife in the middle of the year. She earns much more than me and she had her emplyer povided health insurance. Now we filed a MFJ return, and turbotax determined that I have to pay back the PTC.

PTC was calculated only be the AGI. I don't want to complain how unreasonable it is.

Now I just want to use the alternative calculation to lower the PTC I need to pay back.

I did follow turbotax to put all info on 1095-A and mentioned that I was married and the month.

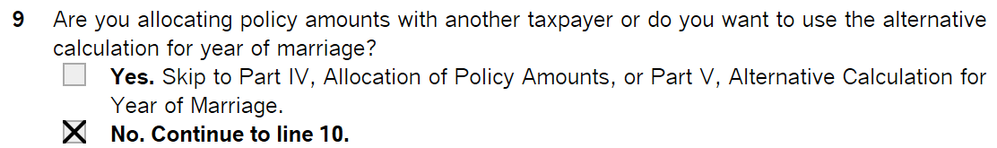

But nothing has changed, and when I checked the form 8962,

In the line 9 as shown below, 'No' is always checked and can't be changed, no matter how I changed the numbers.

I understand some people say that turbotax did calculation and determine not to use it. But I wanted to see the results, I want to see how things change if 'Yes' was checked, otherwise I don't know if it was really used or it is just a bug.

Does anyone know how to check the 'Yes' using turbotax?