- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Adding form 8949 page 2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding form 8949 page 2

I noticed on long term transactions not reported to IRS on form 8949 CANNOT be grouped with reported long term transactions and need to be reported on a separate page 2 of form 8949. Page 1 of form 8949 has a check in the F box and this does not apply to all the long term transactions but only the sale of an inherited property. How do I include a separate page 2 of form 8949 and get the appropriate box checked for long term transactions that ARE REPORTED.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding form 8949 page 2

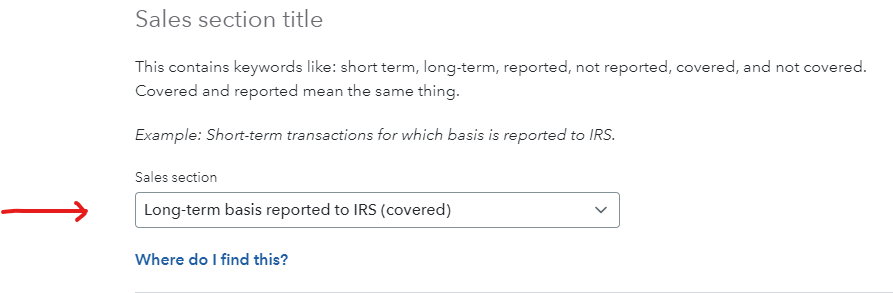

You can report a long-term transaction reported to the IRS by selecting Long-term basis reported to IRS (covered) under Sales section title.

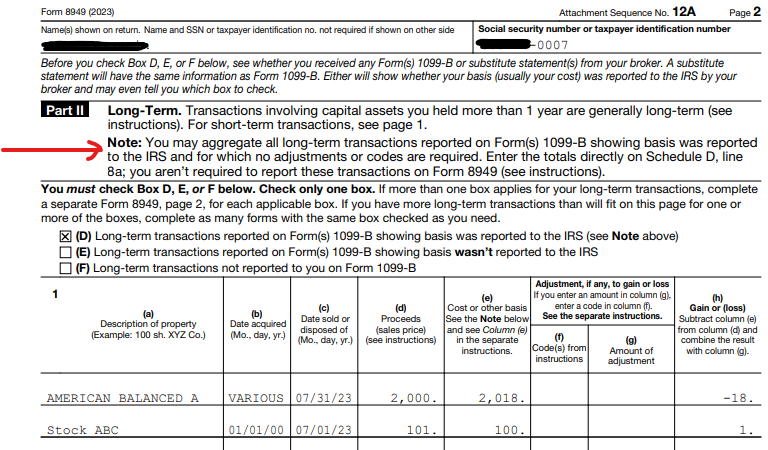

However, see the NOTE under Part II of IRS form 8949 page 2:

Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you are not required to report these transactions on Form 8949 (see instructions).

So, even if long-term code D transactions are selected, an IRS form 8949 may not print out unless the transactions require adjustment codes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cazamo

New Member

robsuts

Level 1

besmith07

New Member

SoItGoes

Level 1

crrenison

New Member