- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

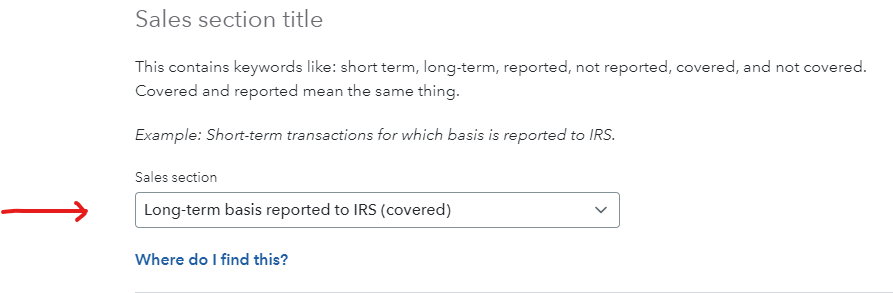

You can report a long-term transaction reported to the IRS by selecting Long-term basis reported to IRS (covered) under Sales section title.

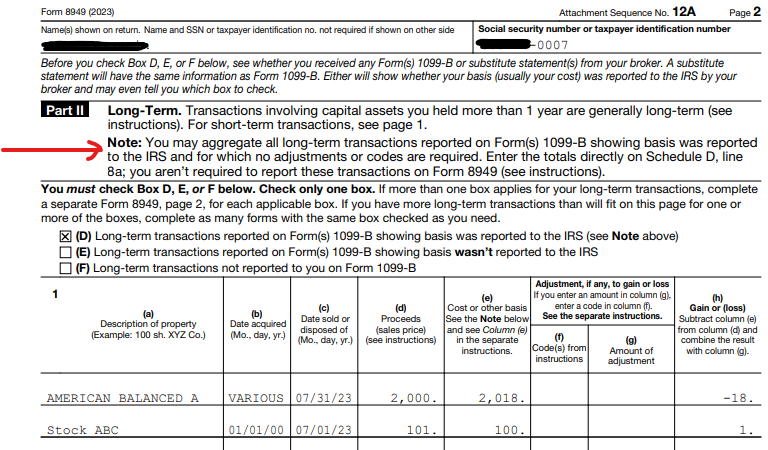

However, see the NOTE under Part II of IRS form 8949 page 2:

Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you are not required to report these transactions on Form 8949 (see instructions).

So, even if long-term code D transactions are selected, an IRS form 8949 may not print out unless the transactions require adjustment codes.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 18, 2024

9:25 AM

407 Views