- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Above the line deductions for legal fees

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Hmmm. In a discrimination lawsuit, as I understood it, the attorney's fees are not taxed but the amount I receive ARE. Is this not true?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

OH - I get what you are asking. Yes the deduction is attorney fees and count costs. The deduction you're claiming can't be more than the amount of the judgment or settlement you're including in income for the tax year.

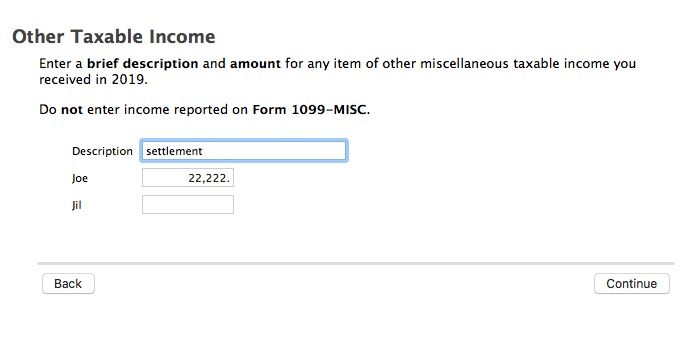

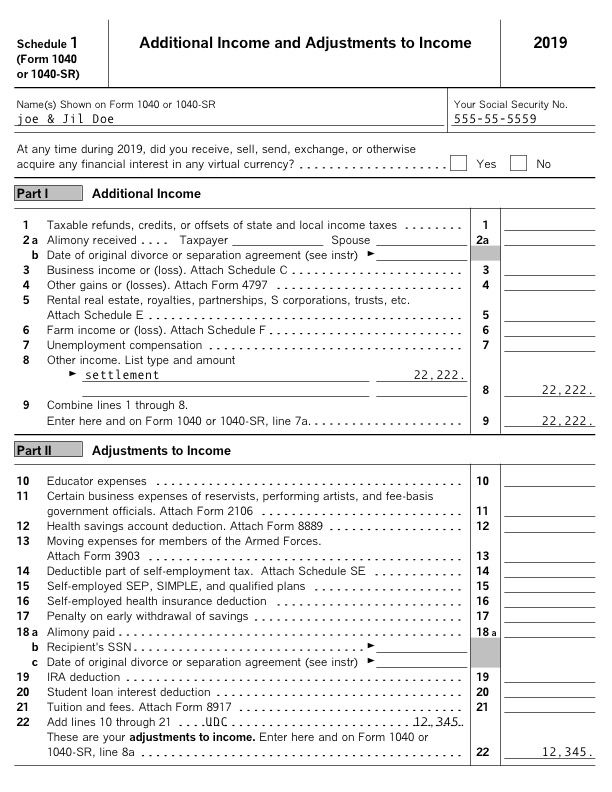

You must include the settlement as misc. income. If over $600 you should have received a 1099-MISC with box 3 income for that. You might check with the payer for that form.

Or enter it like the link shows.

Enter "lawsuit settlement" into the search topics box.

That will put it on Schedule 1 line 8 and the 1040 line 7a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Above post edited to add how to get to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

I wish to express my appreciation to "rjs Level 15" for your directions on how to enter legal fees regarding whistleblower/discrimination cases. They are not directly supported in TT, with the exception of this workaround. If I had to guess, I must have made over one hundred searches on-line, as well as Intuit searches-including speaking to live TT experts.

It appears that legal fees are/may also be 100% deductible for SSDI and LTDI and other claims against an employer if the award is taxable (or deductible proportionately depending upon your individual circumstances). Caveat: In these sorts of specialized cases, it's probably prudent to consult a well-informed professional tax law source. Also, it was recommended to me by a tax professional to include a written explanation along with your tax return in order to elaborate on the details of the legal fee deductions, as well as the resultant income awarded.

I would like to add an excerpt from the current tax code which may be helpful and seems to apply in the above cases:

Section 62(e) (18) defines an unlawful discrimination claim to include:

(18) Any provision of Federal, State, or local law, or common law claims permitted under Federal, State, or local law–

(i) providing for the enforcement of civil rights, or

(ii) regulating any aspect of the employment relationship, including claims for wages, compensation, or benefits, or prohibiting the discharge of an employee, the discrimination against an employee, or any other form of retaliation or reprisal against an employee for asserting rights or taking other actions permitted by law.

Regards,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Instructions were perfect. Solution worked great!

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Hello, I was hoping you could let me know if there is an update for TY2023 for this situation? I am trying to use TurboTax online to file but can’t seem to find how to enter an above the line deduction for attorney fees for an ERISA case, which I believe still falls under the “above the line” category of covered deductions. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Hello, following up on this as well

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Above the line deductions for legal fees

Here's how to enter the above-the-line deduction for attorney fees for an unlawful discrimination claim in desktop TurboTax for 2023 or 2024. In forms mode open the "Form 1040 or Form 1040SR Worksheet" (1040/1040SR Wks). Scroll down to the Schedule 1 section (Additional Income and Adjustments to Income), then to Part II Adjustments to Income, and then to the Other Adjustments to Income Smart Worksheet between lines 23 and 24. Enter the attorney fees on line K of the Smart Worksheet. The deduction will then appear on Schedule 1 line 24h.

Refer to IRS Publication 525 for important additional information about this deduction.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rprincessy

New Member

asrogers

New Member

Ninaya1

New Member

AE_1989

New Member

edthilbert

New Member