- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

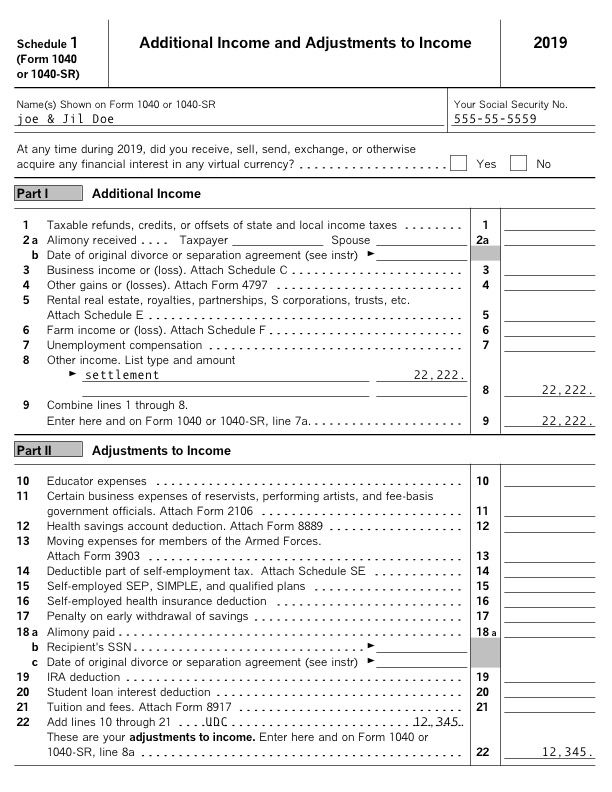

OH - I get what you are asking. Yes the deduction is attorney fees and count costs. The deduction you're claiming can't be more than the amount of the judgment or settlement you're including in income for the tax year.

You must include the settlement as misc. income. If over $600 you should have received a 1099-MISC with box 3 income for that. You might check with the payer for that form.

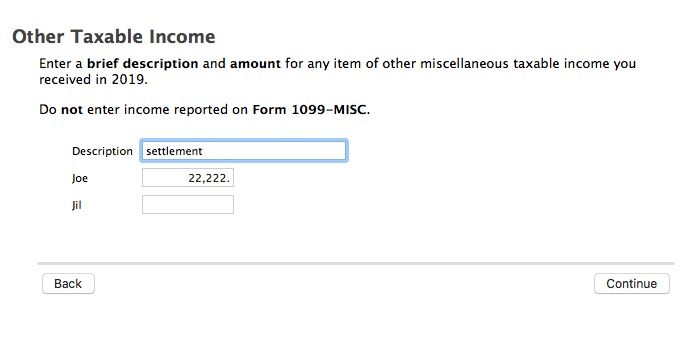

Or enter it like the link shows.

Enter "lawsuit settlement" into the search topics box.

That will put it on Schedule 1 line 8 and the 1040 line 7a.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

February 25, 2020

10:24 AM