- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 8915-F error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

It would be helpful to have a TurboTax token. The token provides a sanitized version of your return. We will be able to see the numbers but not any personal information such as your name, SSN, or address.

If you would like to do this, here are the instructions:

In TurboTax Online, go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen, and you will get a Token number.

In TurboTax CD/Download versions, go to the black panel on your screen and select Online.

- Scroll down and select Send tax file to Agent.

- You will see a message explaining what the diagnostic copy is. Click send through this screen, and you will get a Token number.

Reply to this thread with your Token number.

We will then be able to see precisely what you are seeing, and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

Hello Brittany,

Thanks for advice. here is my token number: 1105016.

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

For some reason, Turbo Tax won't let me submit my tax return because of 8915-F, I checked every 1099-R to make sure that I didn't inadvertently check disaster box and none seem to be checked. It still won't let me submit. Please advise me. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

I re-did my taxes this morning and I was successful! The federal was already accepted. I had to delete to old 8915 and re-enter the information.

Thank you so much!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

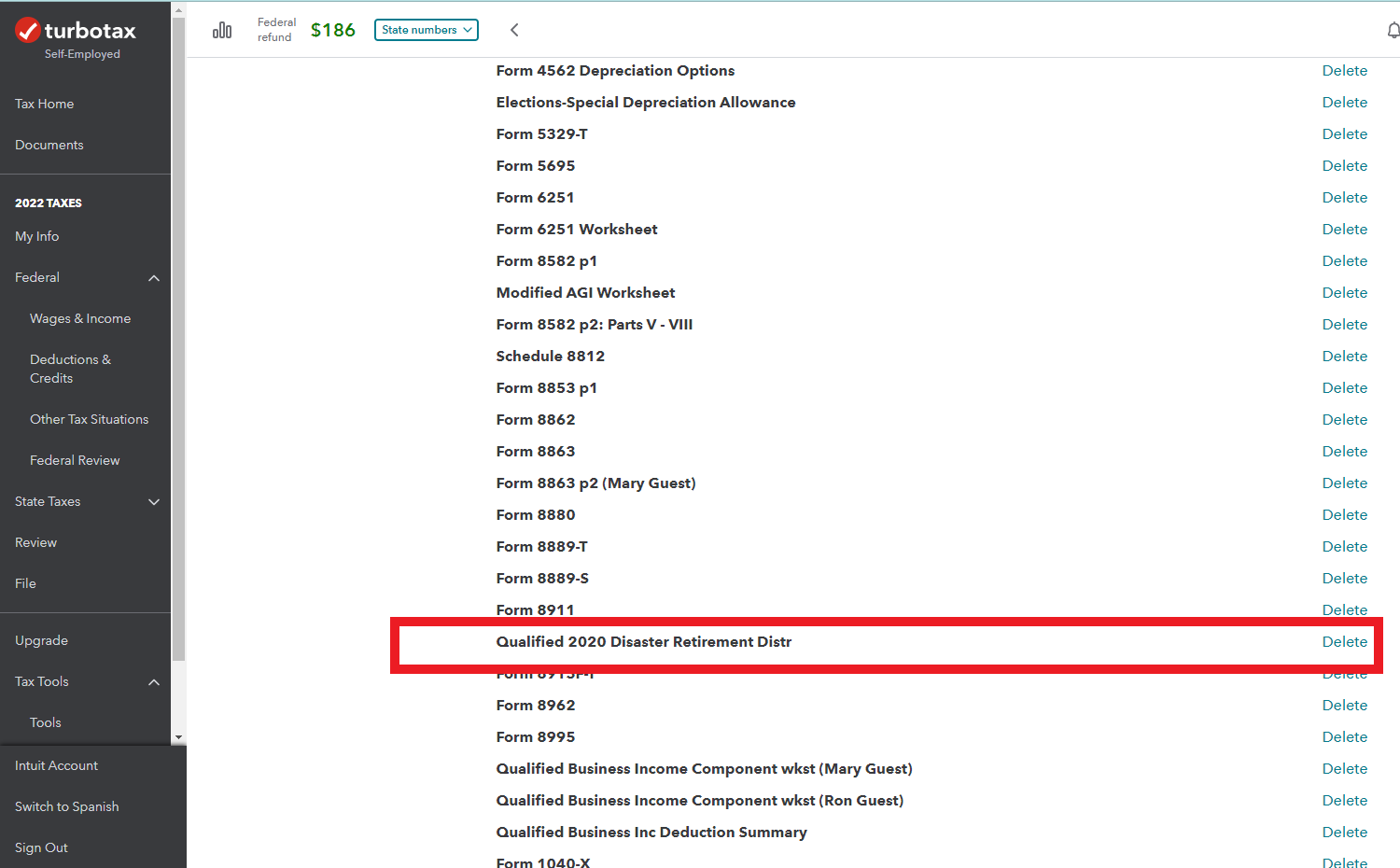

Using the token, I got the return to move past the review stage by deleting the 8915 and then entering the 1099 form again. Follow these steps to complete:

- Open or continue your return in TurboTax.

- Select "Tax Tools" and " Tools " in the left menu.

- In the pop-up window Tool Center, select "Delete a form."

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R.”

- Click on “Jump to 1099-R.”

- If you do not have any 2022 1099-R, answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R, then enter all 1099-R and after entering your last 1099-R, click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020, check here" and enter your information.

Please let me know if this works for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

Thanks for this - I just needed to delete 8915 because I took no disaster distribution. The 2020 box was checked on the form. I think I accidentally checked yes once, went back and changed it, and was stuck with the form thereafter. It would NOT delete no matter what I tried, and wouldn't even let me edit the form. I even called TT and the fellow who answered plus his supervisor were zero help.

Based on your answer I searched forms for "qualified" and deleted both that said "qualified 2020 disaster retirement dist", and now it's cleared and I have no more errors. Here's hoping this will help somebody else because I've seen lots of questions about it but few useful answers.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

"I found the fix! Make a copy of save your current 8915-F because when you do this, it will not auto fill. Go back in your return to Tax Tools. Select "delete a form". Deleting the 8915 is not enough, find the 2020 Qualified Distribution worksheet and delete that. Then go back to income and redo the section. When the questions come up about your 2020 distribution fill in this numbers (generally, the 1/3rd amount will go in 12, 13 and 15 and 14 will be zero). Double check the new tax form and it the "covid" should be gone."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

It's stupid, not fixed still.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

I agree with you. I spent 50 minutes on the phone with support and got NO where. Apparently they don't know it's a problem on their end. I already paid for the State e-return and the program won't let me submit my taxes due to the 8915 F error. I've been using Turbo Tax for a decade and I'm done with Turbo Tax. I can't get anyone to help solve the problem.

I also tried what other customers have suggested....when through income and answered no on the disaster questions, went to forms, picked 8915F and pressed delete, answered yes, I'm sure I want to delete, still won't do it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

Delete the Disaster Distribution Worksheet, then go back and answer the Disaster Questions after the 1099-R entry section. Don't select Coronavirus as the disaster if you did take a 2020 Disaster Distribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

Did you try deleting the 2020 Qualified Disaster form instead? Deleting the 8915-F doesn’t work but if you delete the 2020 Qualified everything should go with it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

I couldn’t find the 2020 Qualified Disaster form in the list of forms to delete it. Where is it located? Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

The 2020 Qualifying Disaster Form isn’t on my list of forms on my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

Here is a workaround provided by expert DanaB27 that is working-

Be sure to follow the instructions carefully. Try both options if necessary.

Please try these steps to fix the rejection issue:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R, answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R, then enter all 1099-R and after entering your last 1099-R, click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen, I selected the blank entry and clicked "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020, check here" and continue.

Another option is to delete "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- Select "Tax Tools" and then "Tools" in the left menu.

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R, answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R, then enter all 1099-R, and after entering your last 1099-R, click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020, check here" and enter your information.

Please let us know if this works for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

I did not check any freakin boxes for this relief. Why do I have to fill out this form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

8915-F error

If you took a 401-K distribution in a prior year and indicated that you would pay the tax on it over the following three years, then you would need form 8915-F to report that in the current year. So, that form may be in your program from a previous year entry. @HMCSWFMF

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DIY998

Level 2

hannah-e-schumacher

New Member

fish1947

Returning Member

jfoster219

New Member

yvedaddy

New Member