- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 83(b) - Not included in W-2 AND forfeited the units in the same year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

83(b) - Not included in W-2 AND forfeited the units in the same year

In May 2023, I was given a grant with a specified valuation - 6 figure valuation. In November 2023, I withdraw from that membership and the units. There is nothing included in the W-2. Do I need to report that valuation as income for 2023? Also, if I withdraw, I heard that I can claim some amount of loss or some way to claw back any income tax that may need to be paid on the 2023 return. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

83(b) - Not included in W-2 AND forfeited the units in the same year

I think what happened is you made an election to pay ordinary income tax on the value of the stock units when they were granted to you in the amount of $125,000. Then, you returned the units to the company, forfeiting your ownership. If so, you would report wage income in the amount of $125,000 and report a sale of the stock resulting in a capital loss of the same amount.

There are a couple of problems with this in that you only deduct a capital loss against capital gains, and then the amount left over against ordinary income in an amount up to $3,000 per year. So, it may take you a long time to realize a benefit from the capital losses, but the ordinary income needs to be recognized all at once. Also, in the case of restricted stock units or awards, the ordinary income associated with them is taxable for social security and Medicare purposes.

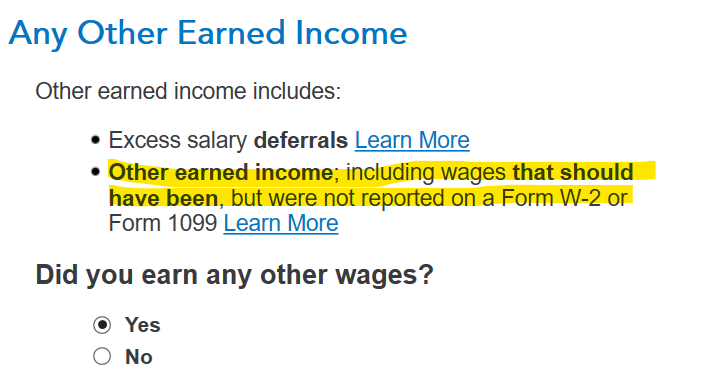

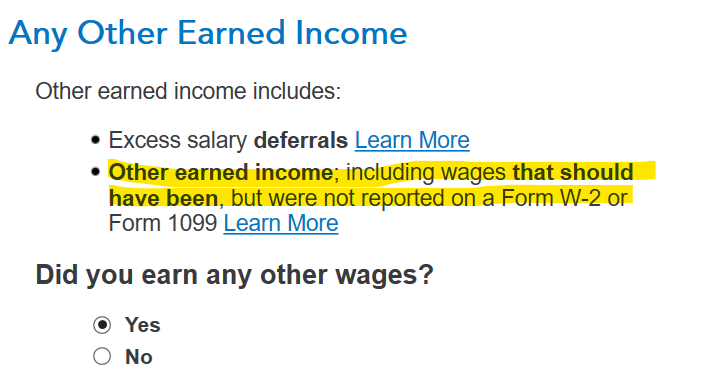

That said, if you want to report the ordinary income that should have been reported on your W-2 form, you can do that in TurboTax. Find the Less Common Income section in the Wages and Income area of TurboTax. Then choose Miscellaneous Income, then Other Income not already reported on a W-2 form or 1099. Answer "yes" on the screen that says Other Wages Received. Eventually you'll come to a page that says Any Other Earned Income to which you will answer "yes". On the ensuing pages you will be able to enter the value associated with your restricted stock grant and it will be reported as wage income on your form 1040, along with the associated social security and Medicare tax.

For the stock you returned, enter that as an investment sale in the Investment Income section, and then Stocks, Cryptocurrency, Mutual Funds, Bonds, etc.. Enter the sale of the stock you returned by using $0 for the sales price and $125,000 for the cost. It will show up as a short-term capital loss on schedule D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

83(b) - Not included in W-2 AND forfeited the units in the same year

To clarify, was this Restricted Stock Units?

RSU usually cannot make the 83(b) election, was this a Restricted Stock Award? Or did you not make a 83(b) election?

If the election and the withdrawal was in the same year, the 83(b) would be of no tax advantage.

Is there an amount in Box 11?

Were you employed wen the distribution was made?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

83(b) - Not included in W-2 AND forfeited the units in the same year

They are described as Membership Units (LLC filing as a partnership for tax purposes). An 83(b) was given to me and it was filed. It showed a valuation of ~$125k. The units are unvested but would have vested over years and some other performance obligations.

There is nothing in Box 11 on the W-2 but I believe that is more to do with the company and their poor administration of these events - i.e., not understanding how to do this in the HRIS system.

I withdrew from the membership as I saw that they were not living by the agreement (not reserving for tax liabilities as described in the operating agreement). I was employed when I withdrew but have subsequently left the business in early January.

It seems like I have to pay the income tax on the $125k but ultimately have no other recourse to record the withdrawal or be able to reverse the income tax impact.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

83(b) - Not included in W-2 AND forfeited the units in the same year

Membership units represent equity in an LLC. If you received the units and sold them for $125,000 then you have $125,000 in taxable gain. If you purchased the units by contributing to the LLC then you can deduct whatever amount you paid for the membership units when you sold them.

If you received the membership units and were not vested in them and then they were returned to the LLC when you left then you have no taxable gain. The units were never technically yours and you received no compensation from them.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

83(b) - Not included in W-2 AND forfeited the units in the same year

That's interesting as I have been finding information that seems contrary. Essentially, what I have seen is that I received the Grant (for "free") with that valuation. It seems like everyone to date has paid taxes on their grant in the year of receipt due to the 83(b) filing.

SECTION 4. CONSEQUENCES OF ELECTIONS UNDER § 83(b) .01 Under § 1.83-2(a), if property is transferred in connection with the performance of services, the person performing such services may elect to include in gross income under § 83(b) the excess (if any) of the fair market value of the property at the time of transfer (determined without regard to any lapse restriction, as defined in § 1.83-3(i)) over the amount (if any) paid for such property, as compensation for services. If this election is made, the substantial vesting rules of § 83(a) and the regulations thereunder do not apply with respect to such property, and except as otherwise provided in § 83(d)(2) and the regulations thereunder (relating to the cancellation of a nonlapse restriction), any subsequent appreciation in the value of the property is not taxable as compensation to the person who performed the services. Thus, the value of property with respect to which this election is made is included in gross income as of the time of transfer, even though such property is substantially nonvested (as defined in § 1.83-3(b)) at the time of transfer, and no compensation will be includible in gross income when such property becomes substantially vested.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

83(b) - Not included in W-2 AND forfeited the units in the same year

I think what happened is you made an election to pay ordinary income tax on the value of the stock units when they were granted to you in the amount of $125,000. Then, you returned the units to the company, forfeiting your ownership. If so, you would report wage income in the amount of $125,000 and report a sale of the stock resulting in a capital loss of the same amount.

There are a couple of problems with this in that you only deduct a capital loss against capital gains, and then the amount left over against ordinary income in an amount up to $3,000 per year. So, it may take you a long time to realize a benefit from the capital losses, but the ordinary income needs to be recognized all at once. Also, in the case of restricted stock units or awards, the ordinary income associated with them is taxable for social security and Medicare purposes.

That said, if you want to report the ordinary income that should have been reported on your W-2 form, you can do that in TurboTax. Find the Less Common Income section in the Wages and Income area of TurboTax. Then choose Miscellaneous Income, then Other Income not already reported on a W-2 form or 1099. Answer "yes" on the screen that says Other Wages Received. Eventually you'll come to a page that says Any Other Earned Income to which you will answer "yes". On the ensuing pages you will be able to enter the value associated with your restricted stock grant and it will be reported as wage income on your form 1040, along with the associated social security and Medicare tax.

For the stock you returned, enter that as an investment sale in the Investment Income section, and then Stocks, Cryptocurrency, Mutual Funds, Bonds, etc.. Enter the sale of the stock you returned by using $0 for the sales price and $125,000 for the cost. It will show up as a short-term capital loss on schedule D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Romper

Level 6

sunsetview45

Level 2

jblevin

New Member

TAHERION65

New Member

Raph

Community Manager

in Events