- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I think what happened is you made an election to pay ordinary income tax on the value of the stock units when they were granted to you in the amount of $125,000. Then, you returned the units to the company, forfeiting your ownership. If so, you would report wage income in the amount of $125,000 and report a sale of the stock resulting in a capital loss of the same amount.

There are a couple of problems with this in that you only deduct a capital loss against capital gains, and then the amount left over against ordinary income in an amount up to $3,000 per year. So, it may take you a long time to realize a benefit from the capital losses, but the ordinary income needs to be recognized all at once. Also, in the case of restricted stock units or awards, the ordinary income associated with them is taxable for social security and Medicare purposes.

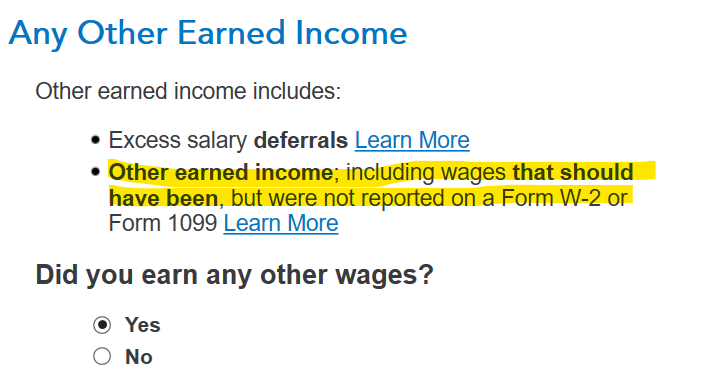

That said, if you want to report the ordinary income that should have been reported on your W-2 form, you can do that in TurboTax. Find the Less Common Income section in the Wages and Income area of TurboTax. Then choose Miscellaneous Income, then Other Income not already reported on a W-2 form or 1099. Answer "yes" on the screen that says Other Wages Received. Eventually you'll come to a page that says Any Other Earned Income to which you will answer "yes". On the ensuing pages you will be able to enter the value associated with your restricted stock grant and it will be reported as wage income on your form 1040, along with the associated social security and Medicare tax.

For the stock you returned, enter that as an investment sale in the Investment Income section, and then Stocks, Cryptocurrency, Mutual Funds, Bonds, etc.. Enter the sale of the stock you returned by using $0 for the sales price and $125,000 for the cost. It will show up as a short-term capital loss on schedule D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"