- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: $54.99 per state. https://turbotax.intuit.com/small-busin...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

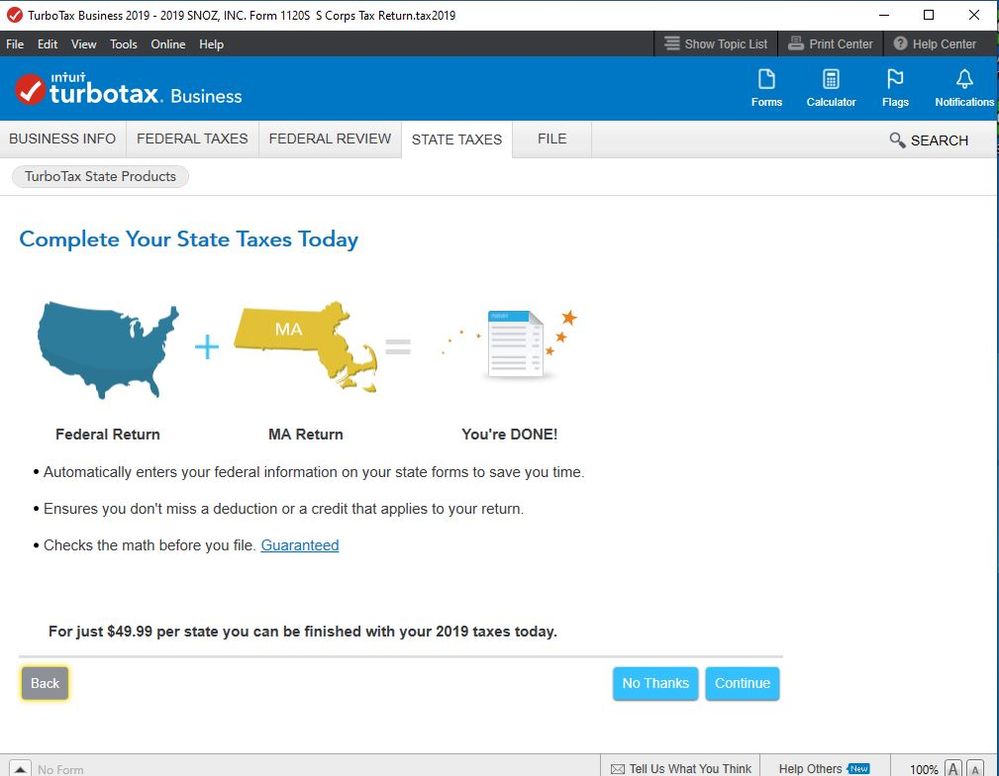

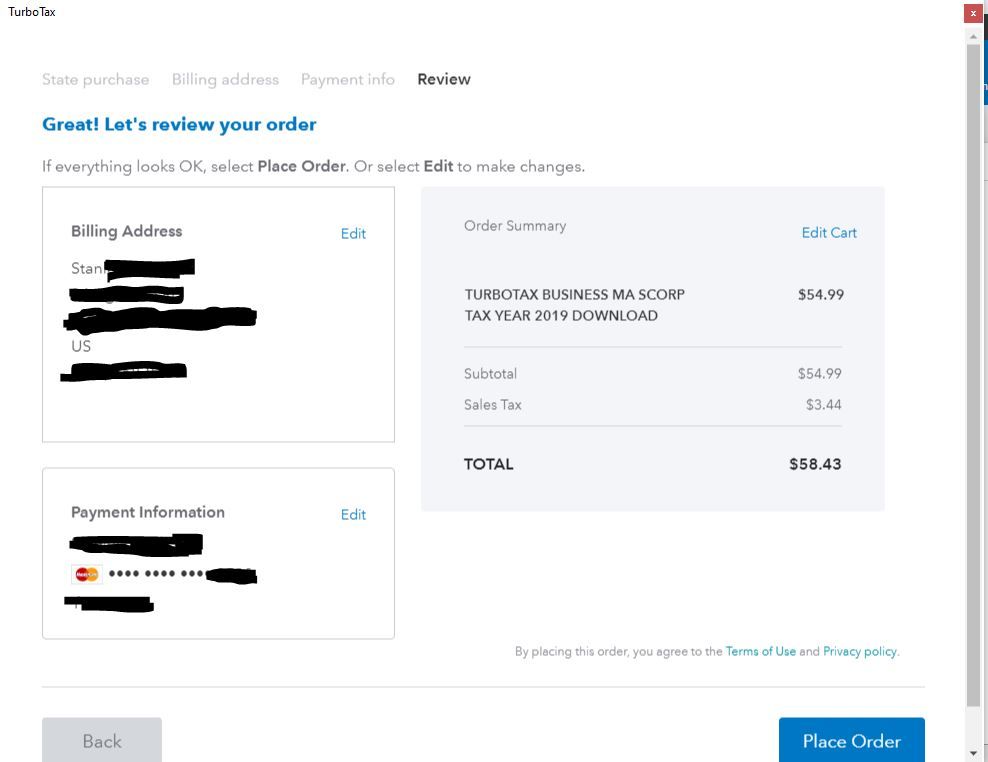

$54.99 per state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

To purchase your TurboTax Business State program, first prepare your federal taxes in TurboTax Business.

Once you've completed the federal error check, you'll move on to the State Taxes section where we'll prompt you to download your state (you can also download at any time by choosing Download State from the Online menu in TurboTax).

TurboTax Business State is not available on a CD or as a stand-alone program.

Related Information:· Which states are not supported in TurboTax Business?

· State forms availability for TurboTax Business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

$54.99 is correct. Just know that even though TT Business 2019 stays that it will be $49,99 they will charge you $54.99 plus tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

I have five federal licenses with one cd purchase. If I add a state can I use the same state for all 5 businesses or do i need to pay $55 for each time I file that same state for various businesses? I have five businesses in NY and I can file all five businesses using turbotax business cd. I need to pay $55 for NY state. When I am preparing state taxes for other 4 states do I need to pay each time ($55 x 5 times)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

I purchased TurboTax 2019 Business for my multi partner LLC and my S Corp.

I reside in AL, so when I completed my Fed LLC return, I purchased the AL State software, for the $54.99 as others have stated.

My question is when I proceeded to do my S Corp, why did I have to purchase the AL State software again?

I assumed since the Turbo Tax Business did multiple partner LLC and S Corp and you can do several of these,) I would not need to purchase the Turbo Tax AL state software again so i could do my AL state S Corp return.

However, I had to purchase the AL state software again to do my AL state S Corp, even after purchasing the AL state software to complete my AL state LLC return.

Should I have had to purchase the AL state software twice to do the LLC and S Corp returns?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

The federal program has the ability to file different business entities however the state software is entity specific ... so you needed one for the partnership and one for the corp.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

Preparing state tax returns for more than one business?

When they are the same types of businesses (such as two S Corps) and file taxes in the same state, buy one state product $54.99 and use for all at no extra charge. Business State efile included.

When they are the same types of businesses (such as more than one LLC), but file taxes in different states, buy one product per state for $54.99. Business State efile included.

When they are different types of businesses (such as an S Corp and a partnership) and file taxes in the same state, purchase one product for each business type for $54.99 per each business type. Business State efile included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

I have tb business CD in my pc, for my llc -partnership, I am in California, to file state i have to pay $54 for each filer?. this means, if my family members files another llc and files california, pay another $54.. reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

hello, is this is for each filer or one time fee? my son will use it for his llc too and state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

There are two different costs associated with state returns using TurboTax.

First, there is the cost to download each state return. This is ~$55 per state as far as I know but some states may have a different cost. Some TT versions include one state with your purchase cost. If your version does not include a state or you need more than one state, as I do, then you have to pay that the $55 cost for each state downloaded. This lets you transfer information from your federal return to the state return and then do all the state specific things to create a return for that state. You can use a downloaded state return for multiple filers without paying again for each additional filer in that state.

The second cost is to e-file your state return. This is charged for each e-file for each state. Even though you paid to download a state file, that only lets you create a return. It does not allow you to e-file it, that is an additional cost. Depending on your state you may be able to print your return and file it for free or copy the information from TT into a state provided web site to file on-line for free.

For example, I have two corporations. Both corporations do business in Massachusetts and one also did business in New Jersey. I had to pay $55 to download the MA forms and $55 for the NJ forms. I was able to complete the MA return for both corporations without an additional payment.

BUT, if I wanted to e-file the MA returns for both corporations I would have had to pay again for each corporation to e-file. That would have been three e-file fees, two to MA and one to NJ. I chose to print and mail them for free to MA. NJ requires e-filing so I had no choice for that return.

Hope this clarifies the way TT charges. This information is valid for last year's returns as I have not filed my 2020 returns yet but I expect that it still works this way

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

I am a bit confused about selecting state returns. As a Delaware Corporation doing business in Missouri, I am trying to file Missouri state return. But when I am adding states, the drop down list says "Delaware Corporation", "Missouri Corporation", etc. Am I supposed to choose "Missouri Corporation" to do Missouri state return even though I am filing for a Delaware Corporation? Thanks in advance for help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

Yes, you are correct. You would need to add Missouri Corporation from the drop down list and follow the questionnaire completely to ensure the system knows you are a Delaware Corporation doing business in MO. It would have been on the Federal questionnaire that you would have identified the "home state" of the Corporation (Delaware).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is cost of TurboTax Business State

I can't seem to find where I should indicate the "home state" of corporation (incorporated in Delaware). Is the "Federal questionnaire" the first section called "Business Info" before the "Federal Taxes" section? It asked for the mailing address and "primarily doing business in" but not the home state. Thank you for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rprincessy

New Member

ilovesantos

New Member

4md

New Member

Mary625

Level 2

2022 Deluxe

Level 1