- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 2020 TurboTax Premier - NO DROPDOWN TO INDICATE NQSO WHEN ENTERING A 1099-B SALE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 TurboTax Premier - NO DROPDOWN TO INDICATE NQSO WHEN ENTERING A 1099-B SALE

Hi, I received the following guidance when trying to enter a 1099-B sale related to Nonqualified Stock Options that was also reported as income on my W2. However, I have the following issues:

>>> The guidance states to "select Nonqualified Stock Options (NQSO) from the first dropdown at the top." - however there is no dropdown box on the screen in 2020 TurboTax Premier

>>> The guidance states "put a checkmark in the cost basis is incorrect right below it", however there is no box or place to put a checkmark in 2020 TurboTax Premier.

Please assist.

Thank you!

Oftentimes, the cost basis of an NQSO sale reported on a 1099-B doesn't include the stock's discount (also called the compensation). If the compensation was reported on your W-2 in box 12, you could be paying more taxes than you need to.

Here's how to make sure the cost basis is right when reporting the sale from your 1099-B:

On the Let's get the details about this sale from your 1099-B screen, select Nonqualified Stock Options (NQSO) from the first dropdown at the top.

Fill out the other fields on that screen, and when you get to the last field for box 1e, enter the cost basis from your 1099-B and be sure to put a checkmark in the cost basis is incorrect right below it. Then continue.

On the following screen, select the middle option, I know my cost basis. Then enter the correct cost basis from your W-2 (the box 12, code V amount).

Select Continue and the transaction will now reflect the corrected cost basis.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 TurboTax Premier - NO DROPDOWN TO INDICATE NQSO WHEN ENTERING A 1099-B SALE

Perhaps if you imported the 1099-B directly from your brokerage house, it did not prompt with the questions that would activate this drop-down menu.

In TurboTax Online please navigate to:

- Federal on the left menu

- Wages & Income tab

- If you don't see Stocks as an option in the highlighted area click the Add More Income button

- Select Investment Income

- Then Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- If you previously imported the 1099-B from your Broker, please click the trashcan icon on the right to delete the current entry.

- Then click the I'll type it myself button at the bottom of the Let's import your tax info screen

- On the Tell us about the sales on your Brokerage House 1099-B screen Click the Yes button for Do these sales include any employee stock? This includes ESPP, RSU, RS, NQSO, and ISO.

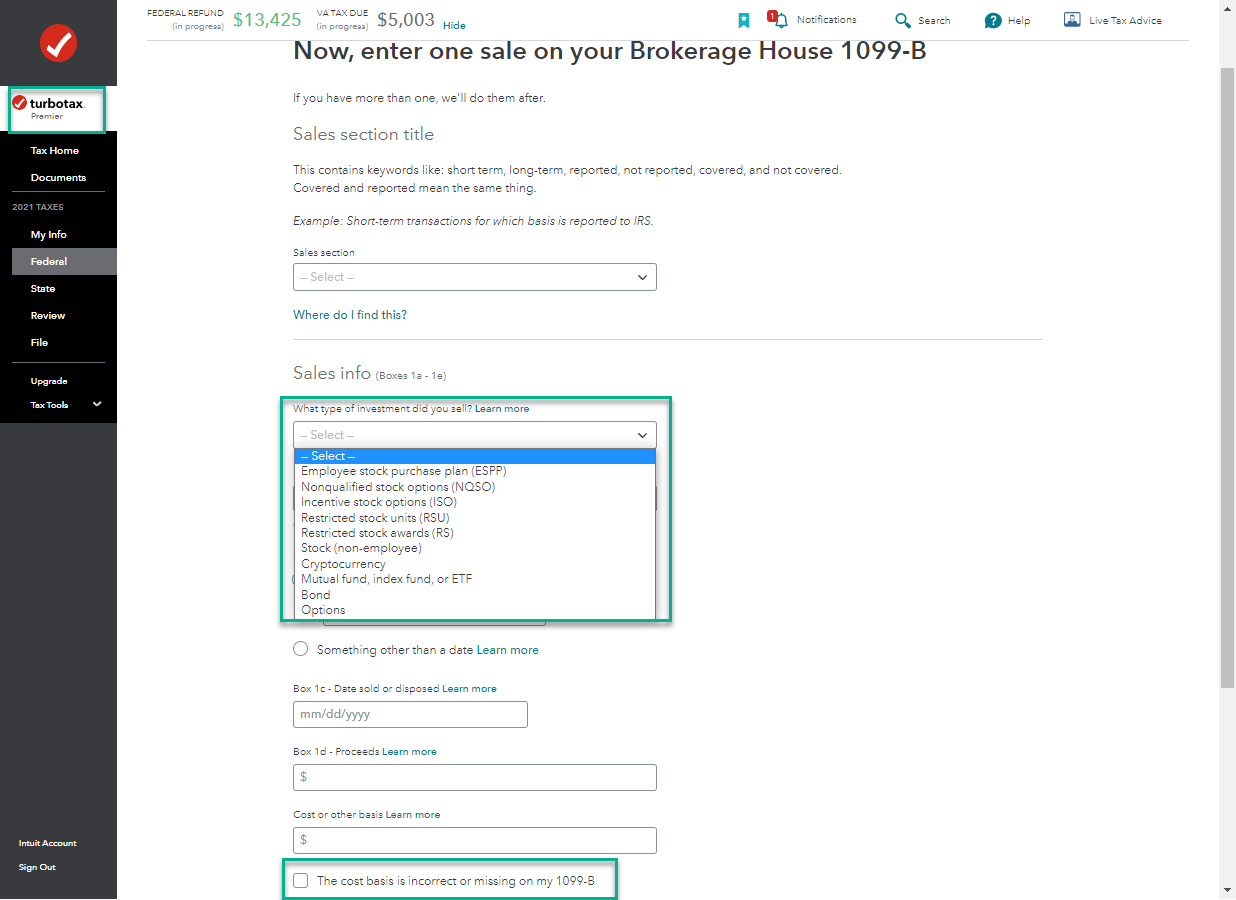

The next screen should now match the image below

Then, the instructions should match those in this Help Article which I believe you were following.

How do I fix the basis for an NQSO sale

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

curtis-sawin

New Member

levind01

New Member

seple

New Member

ekudamlev

New Member

ke-neuner

New Member