- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-NEC Sign on Bonus

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

I work in NY and received a 1099-NEC for tax year 2020 as a sign on bonus for a job I am taking in NC in tax year 2021.

How do I report that? Turbo tax is classifying it as a sole proprietor business requiring a schedule C. Is this the correct way to report it?

On the Nonemployee Compensation Worksheet could I just check "other income" and complete a schedule C?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

According to the IRS ruling you have to report amounts on your Form 1099-NEC as self-employed income and pay self-employment taxes on that income. However, you can offset part of the income with expenses. In you case it could be travel expenses, associated with your new job.

To report that income in TurboTax follow these steps:

- Open or continue your return, if you're not already in it.

- Search for 1099-NEC and select the Jump-to link.

- Answer Yes to Did you get a 1099-NEC?

- Enter the info from your form into the corresponding boxes.

You can learn more here:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

"I work in NY and received a 1099-NEC for tax year 2020 as a sign on bonus for a job I am taking in NC in tax year 2021".

What does that mean"?

1. The company you worked for, in NY, and issued you a W-2 in 2020, wants you to work in NC next year and paid you a bonus in 2020, but reported it on a 1099-NEC instead of your W-2?

2. You will start work for a new company in 2021, in NC, and they will pay you a salary and issue a W-2 for 2021 but paid you a bonus in 2020 for agreeing to do so? And reported the bonus on a !099-NEC.

3. Something else? Please explain.

If #2, you have self employment income and must file a Schedule C and Schedule SE.

If #1, there's a different way to report it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

#2 is the reason.

Thank you for the reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

I have #2 scenario. Since it is joining bonus paid in 2022..once I fill 1099-NEC schedule C has income. Can I claim my expenses like I stayed in Airbnb in NYC for my internship. I understand not exactly related to this particular transaction for sign on business but I paid. what other qualifies expenses I can claim in schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

That is other income that is not subject to self-employment tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

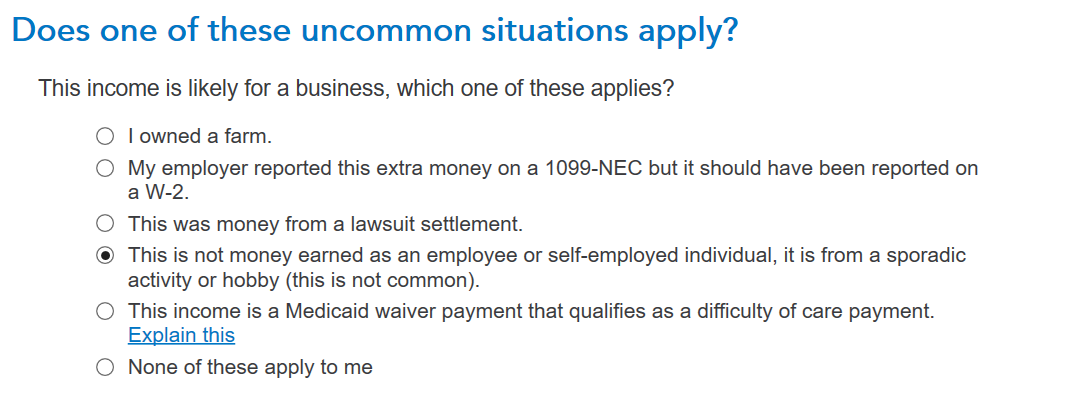

It is debatable whether the income is self-employment income. Self-employment normally means that you are selling a product or providing a service with the intent to earn a profit. That doesn't appear to be the case here. It appears more likely that you are receiving an advance for future services as an employee. You could choose the option in TurboTax This is not money earned as an employee or self-employed individual, it is from sporadic activity or hobby and the income would not be treated as self-employment income. You could also choose the option My employer reported this extra money on a 1099-NEC but is should have been reported on a W-2 and the income would be treated as wage income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

Thanks! However I see challenge is I do no think I cannot select option 2 - 'should be reported as W2' since it means I am employee which I am not and it was a miss from employer side.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

To clarify, what does

"it was a miss from employer side."

mean?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

I meant technically I am not employee yet so saying W2 should have sent may not be appropriate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

If you received a 1099-NEC, I assume you did not pay any Federal, State, Medicare, or Social Security tax on your sign-on bonus. While the IRS may not consider bonuses regular wages, they are still regarded as supplemental wages and are subject to Federal, State, Medicare, and Social Security taxes. Although you're not self-employed, the self-employment entry allows you to enter the income, and the calculation occurs for Federal, State, Medicare, or Social Security tax. To enter into TurboTax, you will follow these steps:

- Click Wages and Income

- Scroll Down to Self-Employment Income

- Click Start next to self-employment income and expenses

- Click Add another line of work

- Fill out interview questions

For more information on how bonuses are taxed, see the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

thanks for detailed answer. Hope I should be able to claim expense like my stay in NYC (Airbnb), meal etc. since it is self employed income not typical W2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Sign on Bonus

Yes, since the company issued you a 1099-NEC, you can write off expenses related to the income received. However, you will need to make sure to mark the income earned for a former employee during the self-employment interview section. Non-employee income earned that is for an employee is not entitled to the Qualified Business Income Deductions.

See the information below provided by the IRS on income earned as self-employment income from an employer.

(3) Presumption that former employees are still employees--(i) Presumption. Solely for purposes of section 199A(d)(1)(B) and paragraph (d)(1) of this section, an individual that was properly treated as an employee for Federal employment tax purposes by the person to which he or she provided services and who is subsequently treated as other than an employee by such person with regard to the provision of substantially the same services directly or indirectly to the person (or a related person), is presumed to be in the trade or business of performing services as an employee with regard to such services. This presumption may be rebutted upon a showing by the individual that, under Federal tax law, regulations, and principles (including common-law employee classification rules), the individual is performing services in a capacity other than as an employee. This presumption applies regardless of whether the individual provides services directly or indirectly through an entity or entities

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bo32792

New Member

KoushikD

New Member

rwhrampton

New Member

MangoMink

Level 1

variant

Level 2