- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

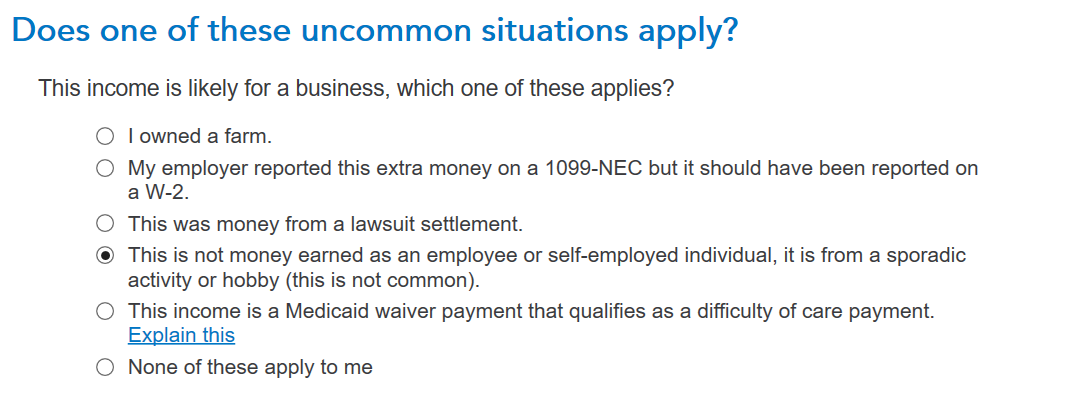

It is debatable whether the income is self-employment income. Self-employment normally means that you are selling a product or providing a service with the intent to earn a profit. That doesn't appear to be the case here. It appears more likely that you are receiving an advance for future services as an employee. You could choose the option in TurboTax This is not money earned as an employee or self-employed individual, it is from sporadic activity or hobby and the income would not be treated as self-employment income. You could also choose the option My employer reported this extra money on a 1099-NEC but is should have been reported on a W-2 and the income would be treated as wage income.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 26, 2023

5:46 AM