- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-MISC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1099-MISC

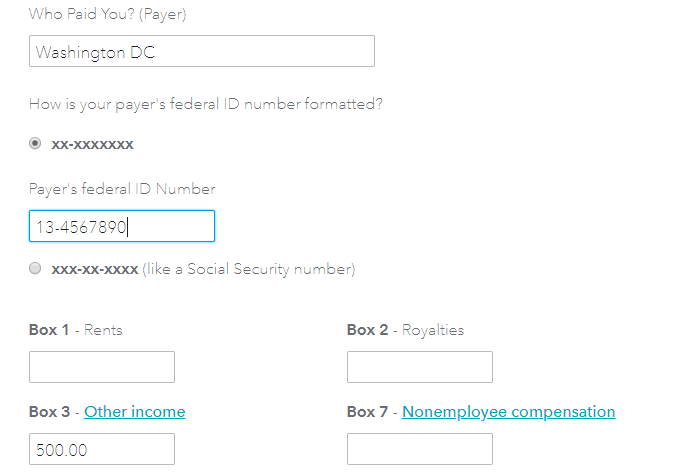

My mother received a 1099-MISC in the mail. She receives supplemental income from Washington DC each month to assist with her rent. How does she report this on her taxes? DC Housing noted the income in box 3.

I am in the process of filing for her but am unsure because everything I choose reads as if she owns a business.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1099-MISC

When you enter the Form 1099-Misc information the amount in Box 3 will show on her return as "Other Income".

To enter the 1099-Misc you should:

- Enter 1099-Misc in the Search Magnifying Glass in the upper right hand corner of your screen.

- Select Jump to 1099-Misc.

- Answer the questions on the screens.

Make sure you enter the income in Box 3 of the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1099-MISC

I misspoke...it is in box 1 labeled "rents"..do I follow the same steps??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1099-MISC

If the amount is in box 1, then it looks like your mother will have to prepare a schedule E. It means that she receives rent as a landlord. What I cannot understand form what you said is that "she received supplemental income to help pay her rent." If that's the case, why are they sending her a 1099-Misc as if she's a landlord.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: 1099-MISC

Thank you. This is a pilot program through DC Housing. It is for seniors to assist them with paying their rent every month. My opinion is it would have been better noted under box 3?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JoDaWa

Level 2

drmusedeb

New Member

ridgewoodfather

New Member

jerrywives

New Member

gmbassoc

New Member