- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099 MISC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 MISC

I received fund from the state as incentive for day care teacher making less than $15 an hour. Last year 2018 turbo tax has it as "other income or loss". This year 2019 it is under "business Sole P" and asking about expenses. Are they the same or should it be just extra income

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 MISC

file it as other income as per last year especially if the IRS accepted your 2018 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 MISC

Thanks

Turbo tax giving me the run around and insisting on calling it business

how do I get out of that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 MISC

I apologize for your frustration!

If I am understanding you correctly, you received Form 1099-Misc. for being a daycare worker.

If you earned the money as part of a self-employed business, you will need to input the information under the Federal interview section.

- Select Income & Expenses

- Select Self-employment income and expenses

- Proceed through the screens to enter your information.

If your income is not from self-employment, you will enter your information as follows:

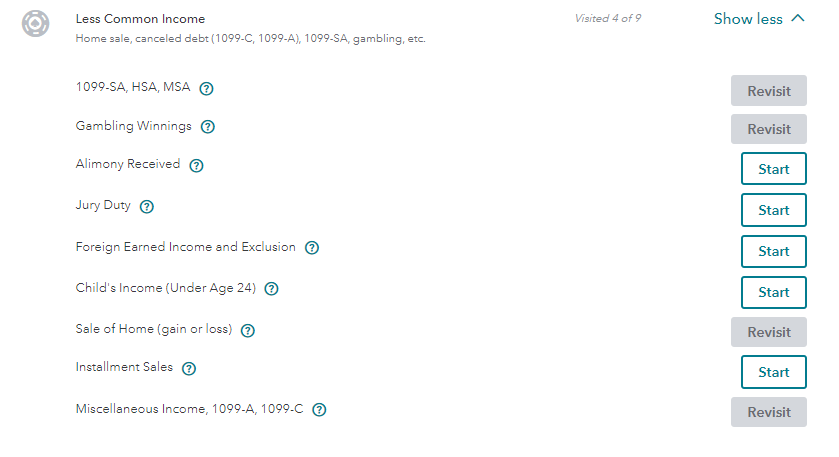

- Select Income & Expenses

- Go to the All Income section and select "Less Common Income"

- Select "Miscellaneous Income"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Paolooch

Level 3

cynthiamlambert

New Member

user17716281410

New Member

Rambo70

Level 3

don21480

Level 2