- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I apologize for your frustration!

If I am understanding you correctly, you received Form 1099-Misc. for being a daycare worker.

If you earned the money as part of a self-employed business, you will need to input the information under the Federal interview section.

- Select Income & Expenses

- Select Self-employment income and expenses

- Proceed through the screens to enter your information.

If your income is not from self-employment, you will enter your information as follows:

- Select Income & Expenses

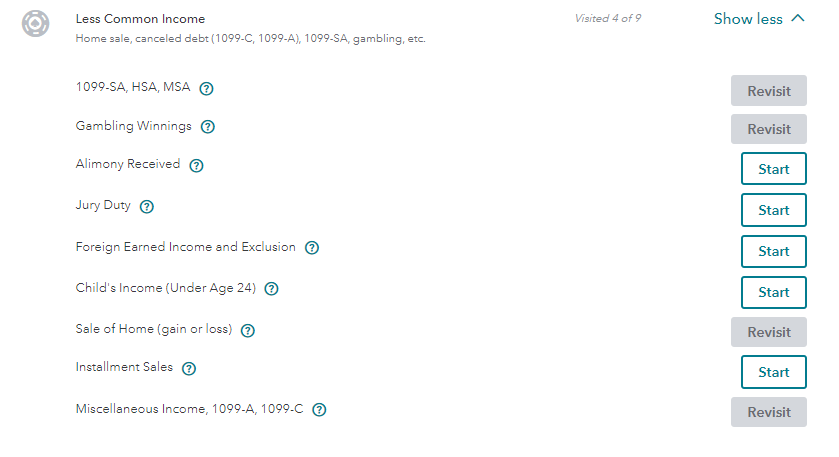

- Go to the All Income section and select "Less Common Income"

- Select "Miscellaneous Income"

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 18, 2020

11:59 AM

861 Views