- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1095-A premium tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A premium tax credit

I input the information about 1095-A report and linked to a schedule C. However, I should have received premium tax credit as my income was low- AGI- $48K, but I don't see that. I didn't receive any advance payment of premium tax credit. Did I miss something here?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A premium tax credit

Review the entire return ... since you linked it to a sch C did you get the deduction on line 16 of the Sch 1 and did your entry of the 1095-A populate the form 8962 ... look at line 26.

You can peek at only the Federal form 1040 and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2019 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A premium tax credit

Thanks for your response. I'm using Turbo Tax deluxe. I qualify for the 1040- SR

Line 16 on sch 1 shows 6,977, but the total premiums paid and entered on 8962 is 11,265. Both columns of the 8962 have been populated.

Not clear in which form I should look at line 26

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A premium tax credit

The deduction is limited to your Sch C income which is why you only see $6977 on that line.

Look at form 8962 line 26... if there is a credit that is where it would come from.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A premium tax credit

Zero on that line of the 8962. Also, nothing on the calculations as I look at the form worksheet. It's as if I never entered data from the 1095-A. I did. Form 8962 is not even printing as part of the return. Not sure what's going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A premium tax credit

Mystery solved-

I had to go to Deduction and Credits > Medical > Health Coverage Tax Credit.

When I search for form 1095-A, go to the page, fill out the monthly amounts, policy last numbers etc., I'm in the wrong place for the Health Coverage Tax Credit and the 8962. The correct page is the one under Deduction and Credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A premium tax credit

Are you looking for the PTC from the 1095-A reported on the form 8962?

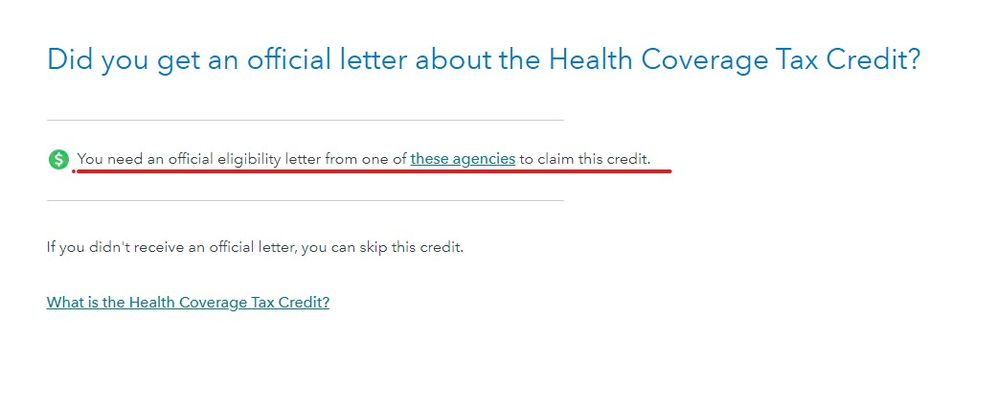

It is NOT the same thing as the Health Coverage Tax Credit that goes on the form 8885. If you are not eligible for that credit then the IRS will deny you the credit and to even enter the info requires information sent to you specifically for this credit entry.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

donnapb75

New Member

mattjefferson09

New Member

terry-l-harris

New Member

BillyWoolfolk

Returning Member

MSYRQUIN

New Member