- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Are you looking for the PTC from the 1095-A reported on the form 8962?

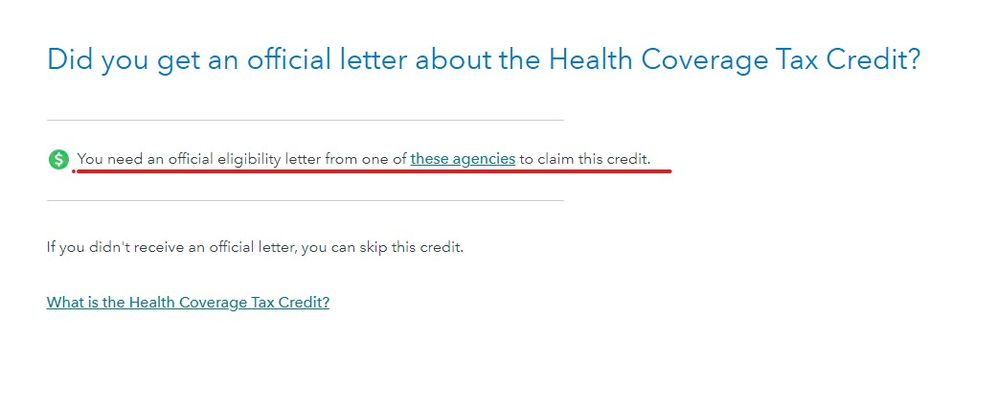

It is NOT the same thing as the Health Coverage Tax Credit that goes on the form 8885. If you are not eligible for that credit then the IRS will deny you the credit and to even enter the info requires information sent to you specifically for this credit entry.

How do I qualify for health insurance tax credit?

Claiming the HCTC requires that you are an eligible recipient of a qualifying trade adjustment assistance program, currently on an approved break from such training or receiving unemployment insurance in lieu of training. You may also qualify if you are 55 or older and a PBGC payee.

October 11, 2021

8:00 PM