- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Questions pertaining to 1099 Misc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions pertaining to 1099 Misc

Background:

The child who is 19 and is filing independently for the very first time, did part-time work as a Tutor and the company that employs students, does not give W-2s, they just issue 1099s.

The Kid DOES NOT own a Business per se! They just did tutoring for a company that does issue W-2s and only issues 1099-MISC, I guess they must have figured out the students don't know much about taxes and employment and they prefer to not consider the "tutors" as employees.

Anyway,...

So, I entered the 1099-Misc info, and when I was doing the final check, TT flagged the return for the following issues:

- Box 17 (state info) - the 1099-MISC has no information.

So, I did some research, and from what I gather if there is no information, and you file your taxes it won't flag your return. Plus, the 1099-MISC has no information, so I don't want to introduce info that is different from what was submitted by the company to Fed and State. The kid (is actually 19 but still my kid) earned $745, so that portion was entered in.

Now that I have entered the 1099-MISC, it appears to have opened a whole new set of Can of Worms. I repeat the "kid does not have a business, but once 1099-Misc information was entered TT or the IRS automatically considers you as I think "SELF-EMPLOYED BUSINESS".

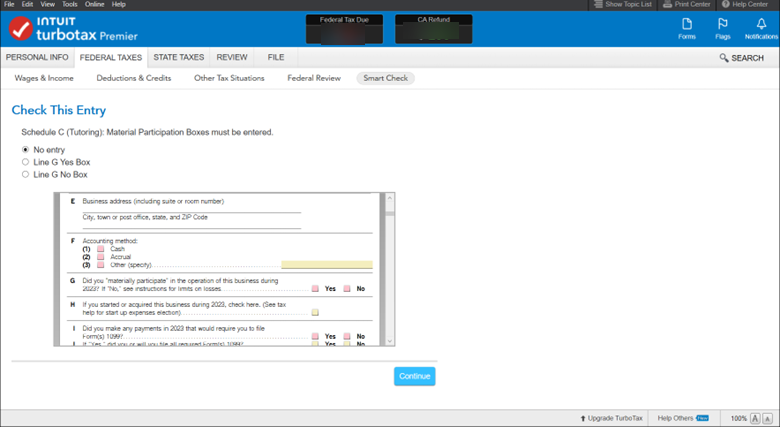

So the other flagged items all are centered around the following and deal with Schedule C.

- Schedule C Material Participation - Yes or No (only these two choices)

Will try to not enter too many images as it messes up the posting of the question...but they are dealing with Schedule C. - Enter Business Code (once again it is not a business; the kid just worked for a company that does not issue W-2s; only 1099-Misc), so not sure what to put and if I put something will it create issues in next year's taxes as the current year's file will be used as the base file.

- Tutoring Address must be entered: Tutoring was performed from Dorm Room and Home room on the weekends.

- City, State and Zip must be entered

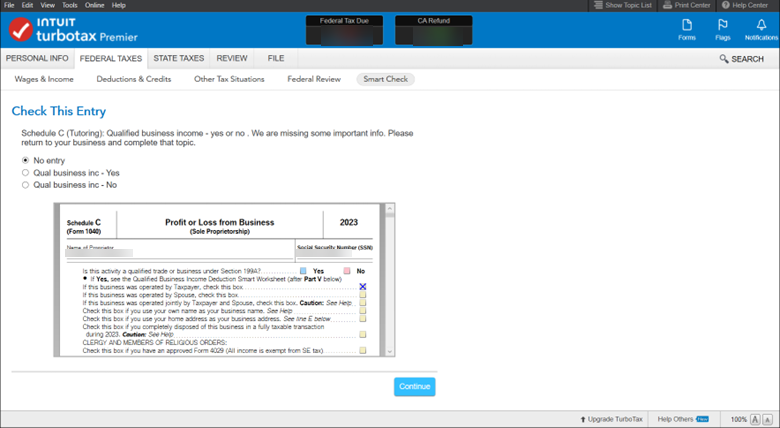

So, if I enter home or even dorm address, will it create any other issues (home and dorm are in California, CA, like would the FTB say you need a business license or some other stuff like that?) - Qualified Income: Yes or No

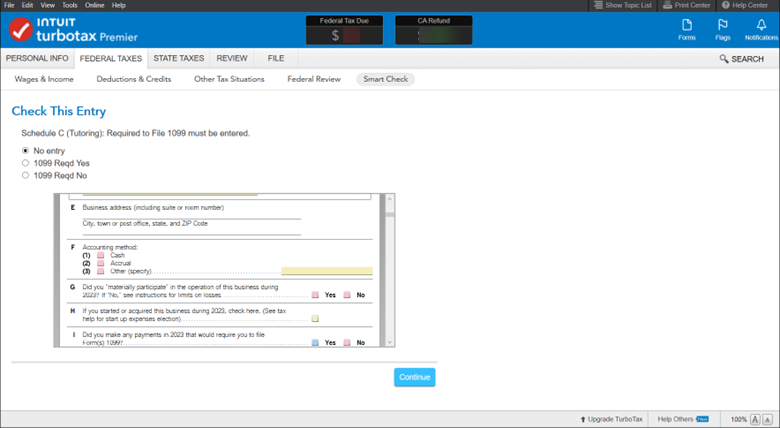

- Required to File 1099 must be entered: Choices are Yes or No

- Accounting Method:

Line F: Cash, Accrual, Other

*they received check

Thank you in advance for your assistance. Any explanation to accompany the above would be help as well.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions pertaining to 1099 Misc

- Schedule C Material Participation - Yes or No (only these two choices) Yes, since they did the work, they materially participated

- Enter Business Code (once again it is not a business; the kid just worked for a company that does not issue W-2s; only 1099-Misc), so not sure what to put and if I put something will it create issues in next year's taxes as the current year's file will be used as the base file. Here is a link to the NAICS codes or Business Codes for Tutoring.

- Tutoring Address must be entered: Tutoring was performed from Dorm Room and Home room on the weekends. You can use his dorm address

- City, State and Zip must be entered

So, if I enter home or even dorm address, will it create any other issues (home and dorm are in California, CA, like would the FTB say you need a business license or some other stuff like that?) It would not create another tax issue, but you would have to check with the FTB for business license requirements in the state of CA - Qualified Income: Yes or No Yes. This is about QBI and will reduce the taxable income by 20%.

- Required to File 1099 must be entered: Choices are Yes or No No. Not if he did not pay anyone.

- Accounting Method:

Line F: Cash, Accrual, Other Most people are cash. You would generally know if it was other as it would require other types of accounting for income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions pertaining to 1099 Misc

Thank you, Vanessa. Appreciate your response and more importantly, your time.

Best wishes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions pertaining to 1099 Misc

Vanessa,

For item #7 Accounting Method, the received a cheque. So, would that be considered the same as cash?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions pertaining to 1099 Misc

You probably use the cash method. The most common method is CASH. It means you report your income in the year you actually receive it and report your expenses in the year you actually pay them. See,

https://ttlc.intuit.com/community/business/help/what-is-the-cash-method-of-accounting/00/25658

The ACCRUAL method of accounting is often used by businesses that carry an inventory. You report your income in the year you earn it (not when you receive it) and report the expenses in the year you incur them (even if they aren't paid yet). See,

https://ttlc.intuit.com/community/business/help/what-is-the-accrual-method-of-accounting/00/26034

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions pertaining to 1099 Misc

"For item #7 Accounting Method, the received a cheque. So, would that be considered the same as cash?"

Yes, check, cash, debit card...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

gxt1

Level 2

mkttaxer

Returning Member

kpkruse7574-comc

New Member

consultqiqi

New Member

weaslebub

Level 2