- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions pertaining to 1099 Misc

Background:

The child who is 19 and is filing independently for the very first time, did part-time work as a Tutor and the company that employs students, does not give W-2s, they just issue 1099s.

The Kid DOES NOT own a Business per se! They just did tutoring for a company that does issue W-2s and only issues 1099-MISC, I guess they must have figured out the students don't know much about taxes and employment and they prefer to not consider the "tutors" as employees.

Anyway,...

So, I entered the 1099-Misc info, and when I was doing the final check, TT flagged the return for the following issues:

- Box 17 (state info) - the 1099-MISC has no information.

So, I did some research, and from what I gather if there is no information, and you file your taxes it won't flag your return. Plus, the 1099-MISC has no information, so I don't want to introduce info that is different from what was submitted by the company to Fed and State. The kid (is actually 19 but still my kid) earned $745, so that portion was entered in.

Now that I have entered the 1099-MISC, it appears to have opened a whole new set of Can of Worms. I repeat the "kid does not have a business, but once 1099-Misc information was entered TT or the IRS automatically considers you as I think "SELF-EMPLOYED BUSINESS".

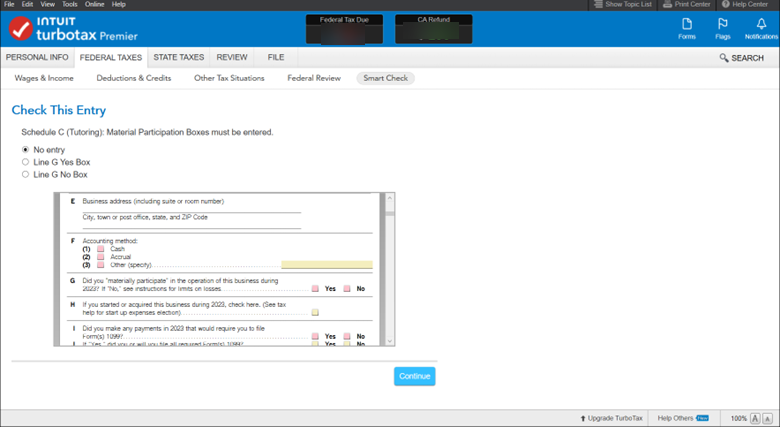

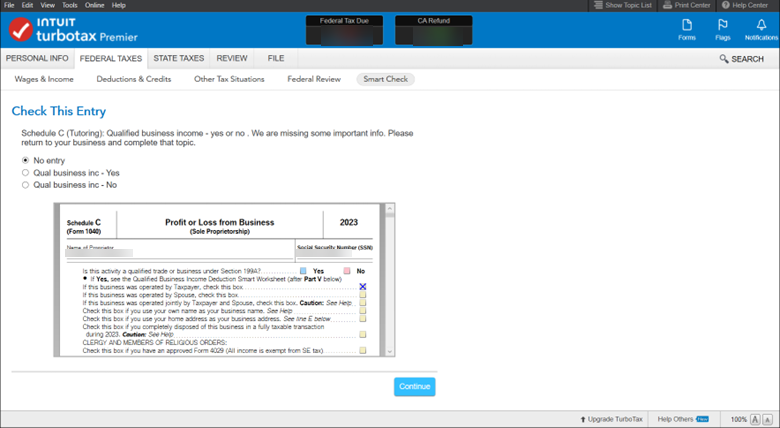

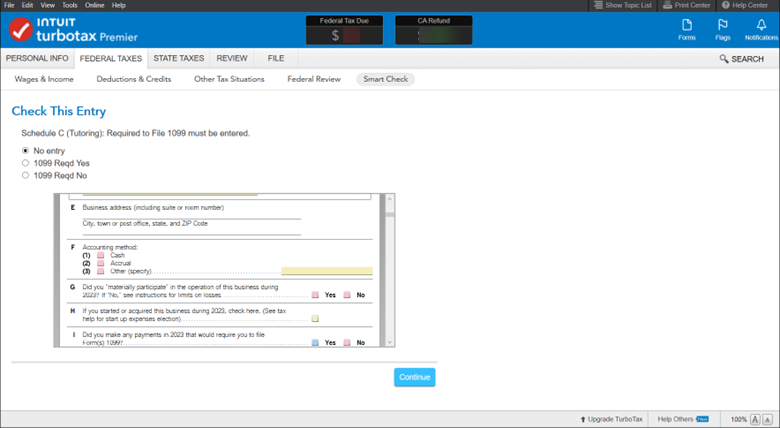

So the other flagged items all are centered around the following and deal with Schedule C.

- Schedule C Material Participation - Yes or No (only these two choices)

Will try to not enter too many images as it messes up the posting of the question...but they are dealing with Schedule C. - Enter Business Code (once again it is not a business; the kid just worked for a company that does not issue W-2s; only 1099-Misc), so not sure what to put and if I put something will it create issues in next year's taxes as the current year's file will be used as the base file.

- Tutoring Address must be entered: Tutoring was performed from Dorm Room and Home room on the weekends.

- City, State and Zip must be entered

So, if I enter home or even dorm address, will it create any other issues (home and dorm are in California, CA, like would the FTB say you need a business license or some other stuff like that?) - Qualified Income: Yes or No

- Required to File 1099 must be entered: Choices are Yes or No

- Accounting Method:

Line F: Cash, Accrual, Other

*they received check

Thank you in advance for your assistance. Any explanation to accompany the above would be help as well.