- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Question on loss carryover to 2025

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on loss carryover to 2025

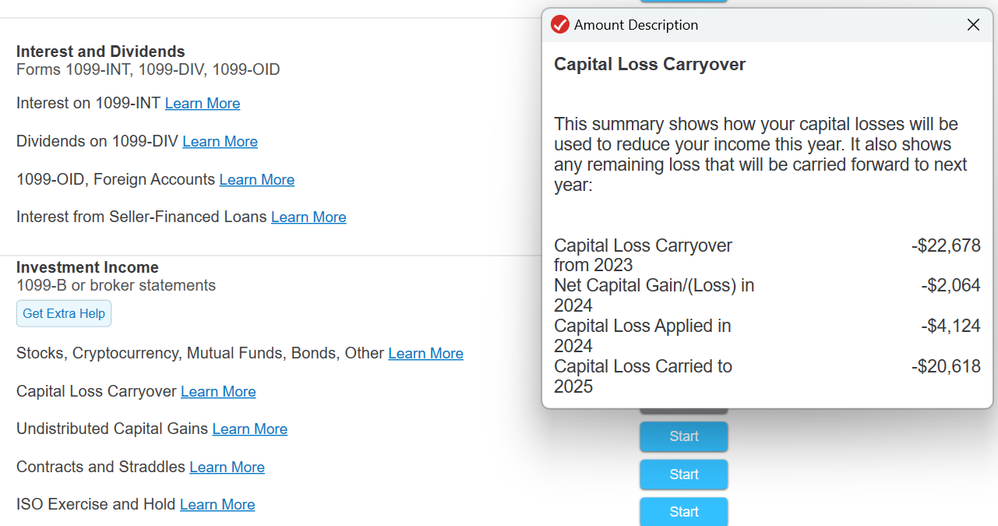

I don't understand how the capital loss carryover to 2025 was calculated

I have a capital loss carryover from 2023 of $22,678.

I also have a capital loss of -2,064 in 2024.

TT indicates it applied $3,000 against ordinary income, which I understand.

However TT indicates the loss carryover to 2025 is -20,618 after applying $4,124.

Where can I see where the 4,124 came from? (see snapshot).

And how do the numbers shown calculate out to a carryover of -$20,618?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on loss carryover to 2025

You have a carryover of 22,678 from 2023 to 2024 and a capital loss for 2024 of 2,064 so a total of 24,742 loss.

You must have had a 2024 gain of 1,124 so 1,124 of the loss can be applied that and 3,000 can be applied against your ordinary income. So 4,124 to 2024, that leaves 20,618 to be carried forward to 2025.

(24,742 - 1,124 - 3,000 = 20,618)

Please look at your Schedule D for the 1,124 loss taken.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on loss carryover to 2025

You have a carryover of 22,678 from 2023 to 2024 and a capital loss for 2024 of 2,064 so a total of 24,742 loss.

You must have had a 2024 gain of 1,124 so 1,124 of the loss can be applied that and 3,000 can be applied against your ordinary income. So 4,124 to 2024, that leaves 20,618 to be carried forward to 2025.

(24,742 - 1,124 - 3,000 = 20,618)

Please look at your Schedule D for the 1,124 loss taken.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

christoft

Returning Member

aprilshowersrt75

New Member

Priller

Level 3

george0707

New Member

jszorcsik181

Returning Member