- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Question about after-death tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

I’m using TurboTax to prepare returns for a relative who died.

I’m the "personal representative" for the estate.

IRS Publication 559 says the following about preparing Form 1040:

Write … the personal representative's NAME and address in the ADDRESS field.

In the Personal Info section of TurboTax, I answered YES to this question: I'm preparing this return for Edith who has passed away.

I added my address to the TurboTax address field.

But TurboTax does not provide any place to add my name as personal representative.

So when e-filing the return, it’s impossible to follow instructions in Publication 559 which say my name should be added to the address line.

TurboTax says it’s OK to e-file an after-death return.

So I would assume many people have successfully e-filed returns for deceased relatives without having their name on the address line.

But it makes me wonder why TurboTax omits information from the return that the IRS clearly says should be added.

Is it OK to e-file the return even though my name does not appear anywhere on it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

As you stated and found in IRS Publication 559 your name and address go in the address field.

In the "Personal info" section edit the address and in the "address" field type "C/O" and your name and your address."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

TurboTax should present a screen where you enter your name as personal representative.

Regardless, you might want to print and mail the return in any event since you should really also be filing Form 56.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

Many thanks for your reply.

Do you have any idea when or where TurboTax asks for your name as personal representative?

I can't find it anywhere.

I went through all steps right up to the point of submitting the return.

TurboTax never asked for my name.

I've already submitted Form 56 by mail.

So I really prefer to e-file the tax return.

IRS is saying paper returns will take much longer to process than e-filed returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

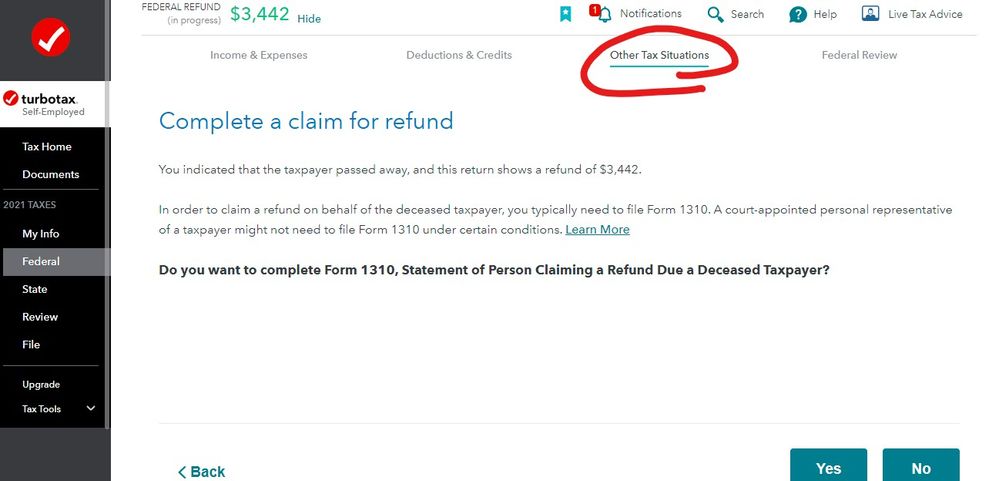

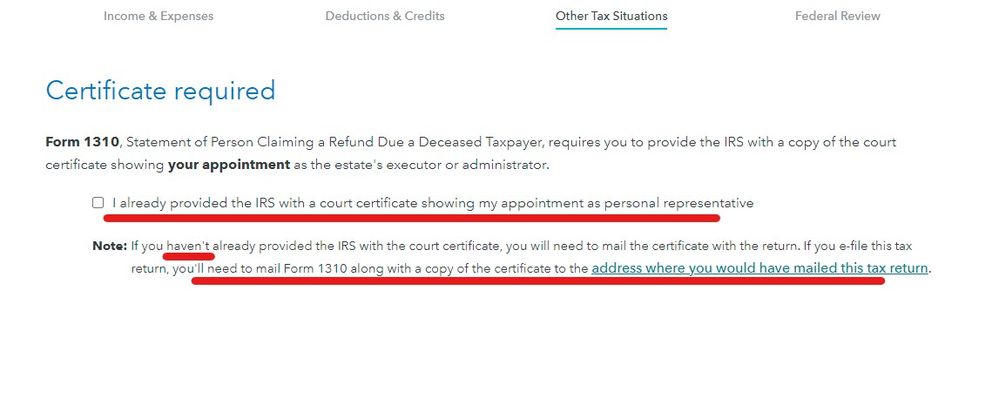

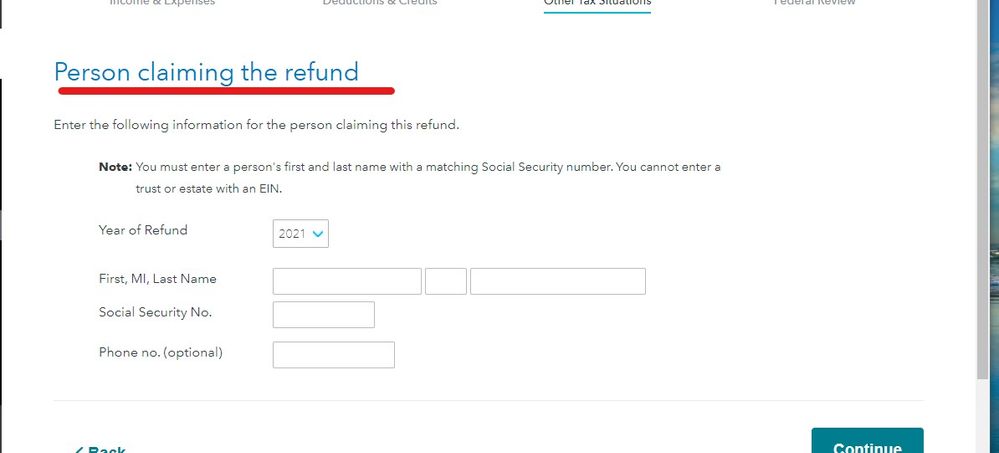

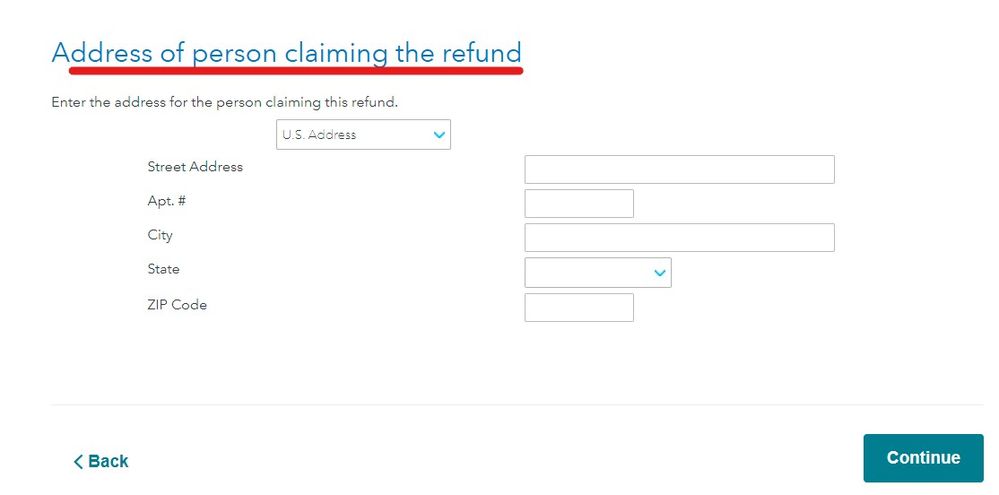

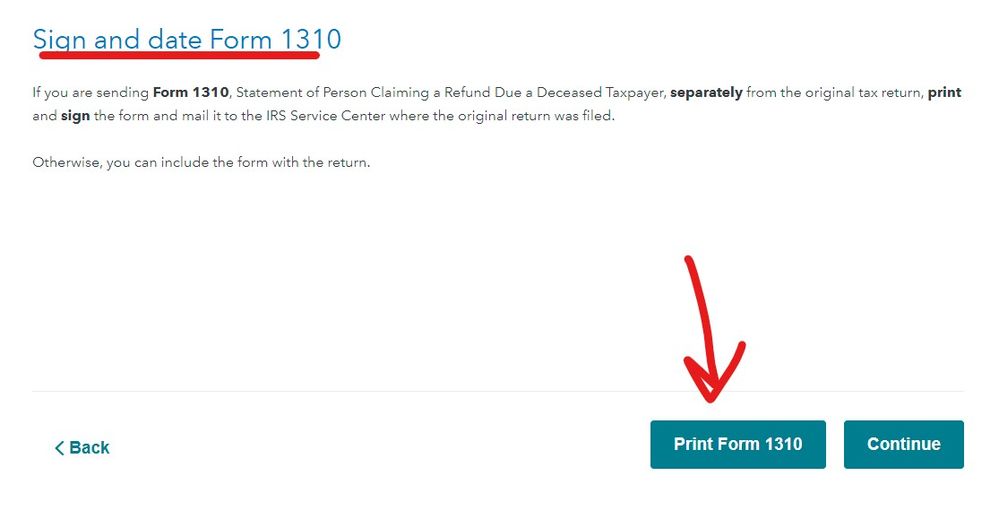

You should come across the following screen.

If you do not, then you should see the following screen at the final review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

Thanks again for your reply.

I'm unable to find any screens like those you posted.

I'm using the online version of Turbo.

The screens you posted look like they're from a different version.

Are they from desktop version? Or maybe a professional version?

I went thru all steps on Turbo.

A small tax is due. No refund is due so there's no Form 1310.

When I view the 1040 form, top of form correctly says: DECEASED JOHN DOE 11/05/2021

When I select REVIEW, Turbo says everything is OK.

When I select FILE, I request to e-file the return.

Final step asks me to enter 5-digit number and click this button: Transmit my returns now.

I'm never asked about In Care of Representative or Personal Representative.

When I search for those terms in Turbo, there are no results.

IRS Publication 559 says my name should be added to ADDRESS LINE as personal representative.

But my name does not appear because Turbo never asks for it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

As you stated and found in IRS Publication 559 your name and address go in the address field.

In the "Personal info" section edit the address and in the "address" field type "C/O" and your name and your address."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

DMark,

Many thanks for your answer. I will follow your instructions.

I would like to make a suggestion for a revision to Turbo.

Many people preparing an after-death return will not be aware that IRS requires adding their name to the Address line.

In the Personal Info section, Turbo asks this question:

I'm preparing this return for Taxpayer, who has passed away. Yes / No

If answer is Yes, you are asked to enter date of death.

This would be a good place for Turbo to tell a preparer that on the street address line, the preparer's name & address should be added like this: C/O John Doe 123 Elm St

Without an instruction like this, many people will file the return incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

@jello77 wrote:Without an instruction like this, many people will file the return incorrectly.

Frankly, it is more important that Form 56 be filed as any correspondence from the IRS will be sent to the address on the return, regardless. Yet, the form is only included in TurboTax Business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

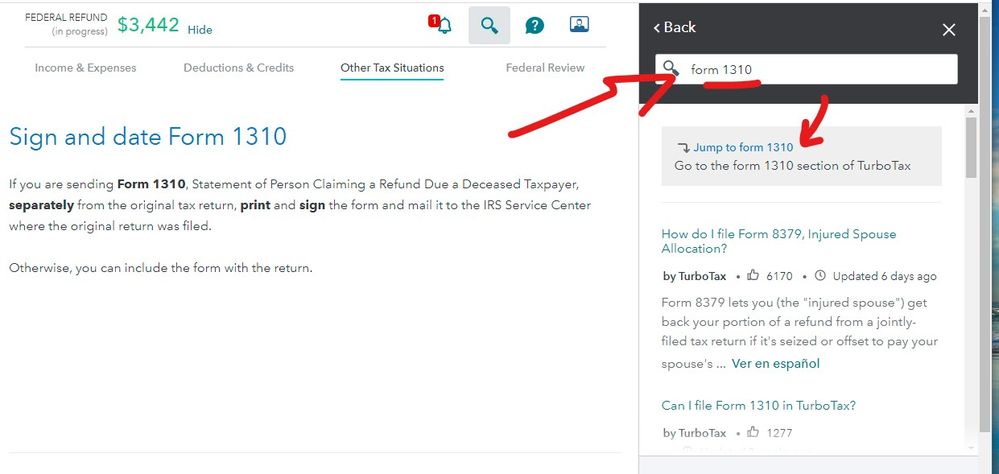

First the 2021 program is not yet fully functional or you would have been lead to the 1310 section automatically ... you can get to it this way ... in the search box enter "form 1310" then use the Jump To option to complete all the steps needed ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about after-death tax return

Critter,

Thanks for the information about Form 1310.

For the return I working on, there's no refund so Form 1310 is not needed.

But it's good to know Turbo will automatically alert about 1310.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nickjwang

New Member

faithbeerose

Level 1

Lavien

Level 2

sweetnloveable1

New Member

cynthiajestings376

New Member