- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- [Potential Bug] QBI Carryover Loss Not Populating Properly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

Hi,

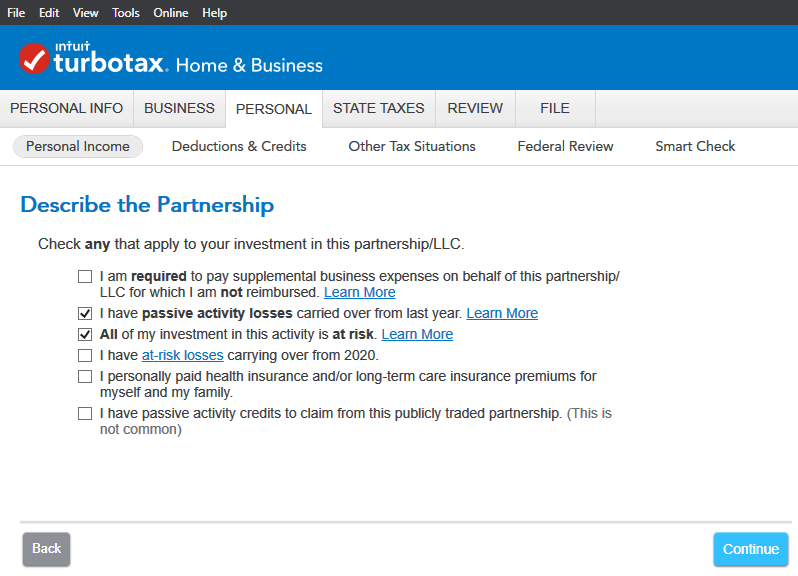

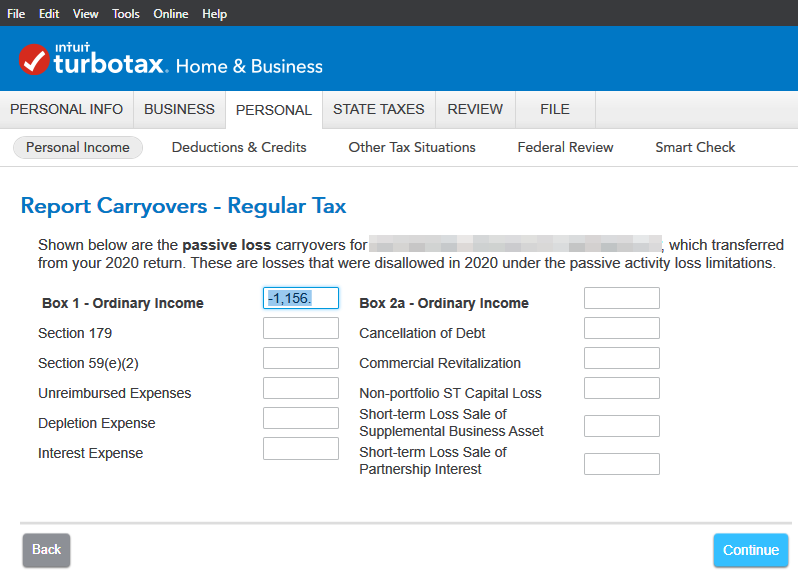

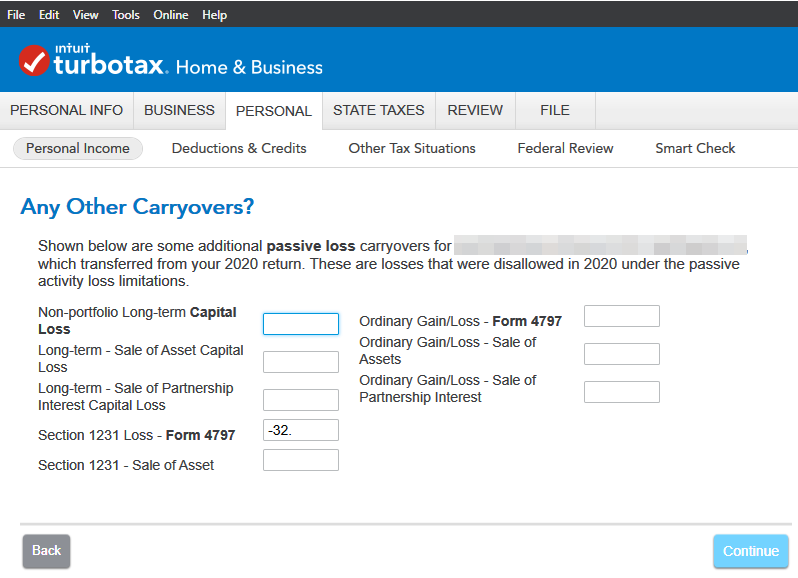

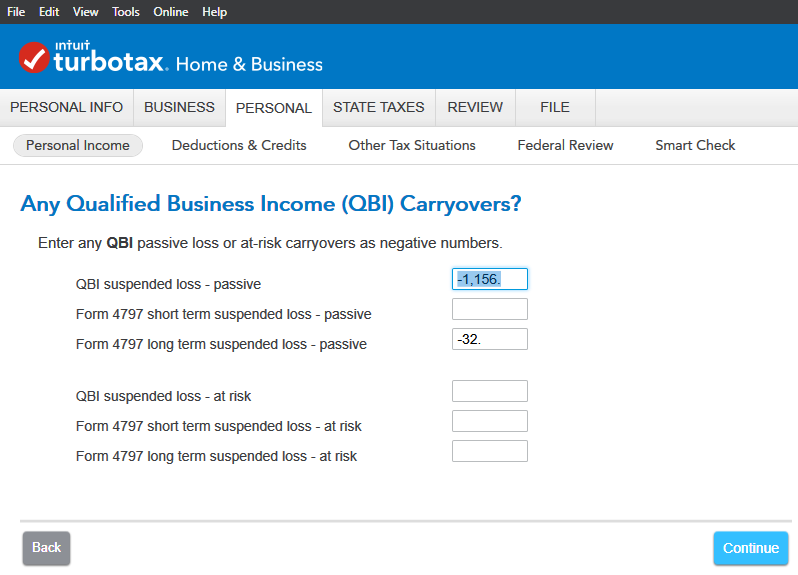

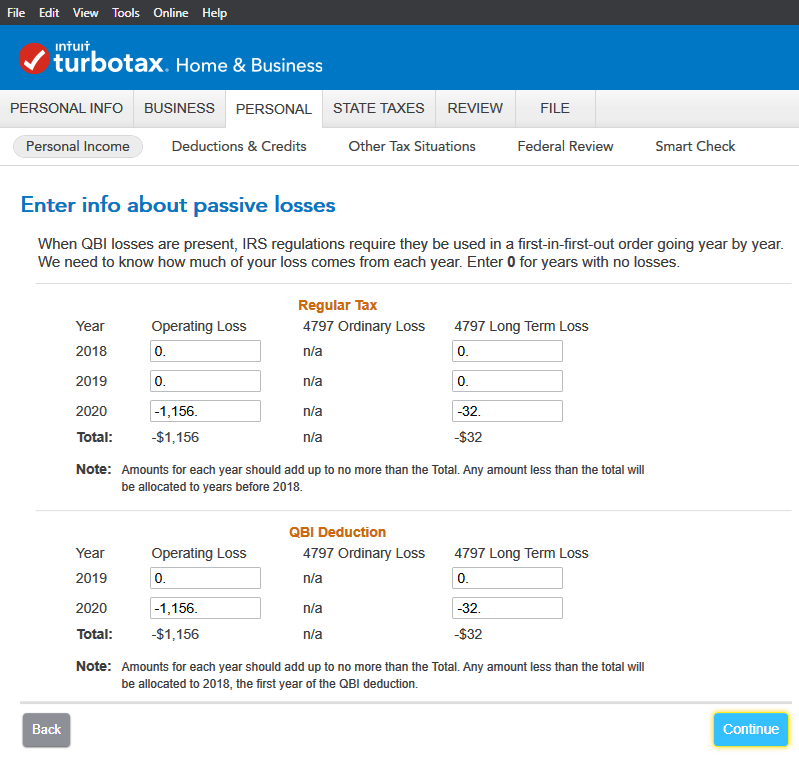

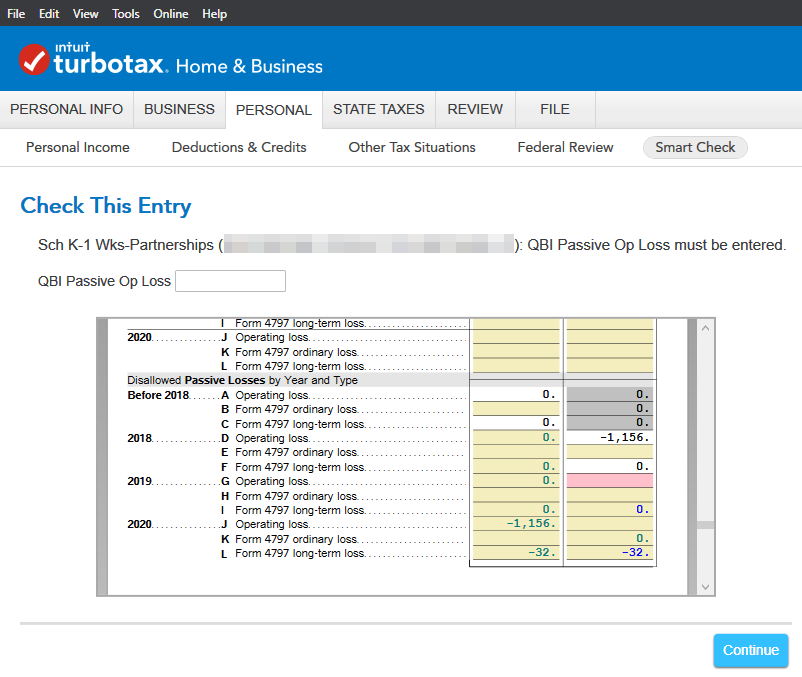

I am carrying over a 2020 passive activity loss from a partnership to 2021. Most of the guided screens automatically populated with the relevant information. The only one that didn't is the "QBI Deduction" section on the "Enter info about passive losses" screen so I filled it in manually. Nonetheless, during the Smart Check, TT complains about the information not having been filled in. Moreover, it allocates the entered 2020 loss to 2018 instead of 2020. See related screenshots below.

I assume this is a bug but was hoping someone could confirm / forward this to a moderator for review (@DoninGA?). I am using TurboTax Desktop 2021.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

Hi. I just had the same thing happen with my schedule E for rental properties. Not sure if the K-1 schedule has the same section, but I pulled up my 2020 return and reviewed the carryover to 2020 section (which is the 2019 amount) on the schedule E worksheet (in forms view) and manually entered this qbi amount in the box on 2021 when it came up as an error to fix. Ran the review again and it went through. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

Yea, manually entering the numbers using the Forms view or when the error appears during the "Smart Check" worked for me too. I was just pointing out that the numbers don't seem to automatically transfer properly when using the guided wizard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

Your screenshot #4 "Any QBI Carryovers" need the entries to be listed as negative amounts per the guidance under the page header.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

Screenshot 4 does show negative numbers (-1156 and -32). What do you mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

We are now investigating this presentation and I will post an update when it is available.

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

I found the same exact problem as the original poster. Smart Check reported an issue asking me to enter the 2020 QBI Loss Carryover. When I investigated the form I found TT had entered the 2020 carryover in the 2018 row instead of the 2020 row. I manually fixed it and the Smart Check passed OK.

[ TT Premier version 021 ... 000 0538 ]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

There will be an update to TurboTax on April 8, 2022, that will resolve this issue. If you are using one of the desktop versions you will need to install updates before you proceed.

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

I'm getting an error stating QBI Passive loss should not have a value when no previously disallowed losses are present for regular tax purposes. This is on the Schedule E worksheet. The field was automatically populated with a negative number that i verified is correct. Is this a related error to this string of messages that will be fixed too on April 8th?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

Yes, the information does not populate through to the correct boxes for calculating any Qualified Business Income Deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

The bug was NOT fixed, at least not in the online version. Now it populates any QBI carryover loss that occurred in 2020, but doesn't populate any loss that occurred in 2019. So if you don't correct it, it will assume it occurred in 2018. Since I doubt it will be fixed before taxes are due, I manually updated the numbers to what I think is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

The update did not fix the error. How should i address the problem now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

any help here? filing day is coming and it's not very encouraging this software bug is not being fixed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[Potential Bug] QBI Carryover Loss Not Populating Properly

Your error seems slightly different to mine and that of the original poster, but perhaps the root cause is the same. Namely, that Turbotax may not be populating the previous few years losses correctly in the Form. (i.e. the boxes shown in the screenshot above for 2018/2019/2020 etc. ) If you can find those values from your 2020 return / worksheets then you might be able to enter them manually into the form and proceed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

raja_singh

New Member

Auto1

Returning Member

Retiree25

New Member

mannye

Level 2

merrill-heddy

New Member