- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Please help! Accidentally submitted a Non-Filer form

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Why are you saying “See the IRS warnings below”?

1) Those aren’t IRS warnings. They aren’t “warnings” at all, they are advisories.

2) These advisories don’t come from the IRS. That is the TurboTax website that you’re referencing.

3) The IRS has not published any guidelines for this. Not to the public. Not to Turbo Tax. Not to accountants. Not to anyone.

So instead of mis-attributing this information to the IRS, your first thought aught to have been... “Why is TurboTax publishing an advisory that the IRS has not. And where is TurboTax getting this information from?”

THAT would be the skepticism and line of questioning that these annotated screen shots should have prompted you to make.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Glennboulder, I appreciate your refreshing perspective on this issue. Not to mention the 10,000 word thesis(') you've hammered out here on the subject.

Godspeed to you sir, as you travel into the belly of this wretched situation in order to retrieve for us ... confirmation, be it yay or nay.

If you dont make it back, I got dibs on your keyboard hahahhahaaha

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

@glennboulder Thank you very much for shedding light with this issue!

My previous question regarding AGI info

So after realizing that I made a mistake on filing the non-filer form on the IRS website. I have been checking the “ get my payment status” portal on the IRS website. So for a week I’ve been getting a “payment unknown” message and finally when I checked it last week, I got a “need more information” message. So not only did it ask my DD info but also asked my 2018 or 2019 AGI. I remember someone from another thread suggested to put both $1 on my AGI and amount refunded since I filed a non filer. IRS rejected it and says “didn’t match their record” so tried to put $0 for both my AGI and amount refunded and same message I got, “didn’t match their record. So I finally tried to put my 2018 AGI and they accepted it and now waiting for the payment date.

So I guess I’ll just get a lower stimulus check since I can’t put my 2019 return because IRS has been rejecting it since I mistakenly filed the non filer. I just wished I didn’t file the non filer so I could file my 2019 because we have a significantly lower AGI on my 2019 return.

lesson learned: To be PATIENT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Hello!

My situation is little different. I have submitted my 2019 e-file at end of March and it was showing as 'received' but somehow just before the stimulus payment started all the info disappeared from "where's my refund tool" with the message we don't have your info.

So, I have went crazy and filed the non-filer info for the stimulus payment. That was a mistake.

Now when I check my refund status with $1 as my refund amount; it shows refund amount as $0 with the message as "Your tax return is still being processed.A refund date will be provided when available.".

I have went to the non-filer portal and deleted my details clicking the start over info.

Now can you please suggest, whether I should 1) try e-filing again 2) Wait till IRS help desk open and talk to them. or 3) File a paper based 1040 return or 1040X amended return.

My federal refund amount was around $2000. I did get my state refund already.

I know I did some crazy mistake filing a non filer detail; but can you please suggest how can I get my refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

If you efiled the fed & state at the same time and the state has processed then the federal was also accepted for processing .... thus the stimulus filing you did should have been rejected. Do NOT file anything else ... let the original return process thru when they finally get to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Understand, but I am afraid that the non filer I submitted did overwrite the first one I filed. I don't how that's how their system allowed it, but that's what it seems. Else, I can't justify any other logic how they changed my refund amoount from the original to $0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I made this same mistake so did this work out for you was you able too file once you deleted your information from the non filer site

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I filled out the non-filer form and it was accepted.....

I went back and deleted it. Does that mean it deleted within the IRS system and now I can file my taxes online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

The return was accepted by the IRS ... there is nothing you can do to change that. NOW if you need to actually file a real 2019 return you must amend the return you just deleted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

But I guess, earlier you suggested me NOT to do anything.

Also, I am not sure if IRS has some sort of override on the data they found on the non-filer portal; as I mentioned my previously e-filed 2019 data was overwritten with $0 AGI and refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Hi,

Were you able to e-file again after you waited 24-72 hours when you deleted the non-filer details?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Critter is incorrect.

You DO NOT file a 1040X Amended Return.

A 1040X is for FINANCIAL changes. It is NOT for the purpose

Just file your ACTUAL Form 1040 with either a cover letter explaining why you are submitting a paper return after having already filed a 'blank' erroneous initial e-file return.

OR

You can send a Form 14039 (as shown in the final image above) and attach it to the back of your paper Form 1040, as per the ACTUAL IRS instructions for the Form 14039.

Be sure to....

- include a color copy of your Drivers License or State issued ID card.

- sign and date the form

- attach it to the back of your 1040

- send it to the correct IRS address assigned to your ZipCode (available on the IRS web site)

This is critical because there are many IRS addresses. There are different addresses for different geographic locations, AND there are different addresses for people sending their return in with a PAYMENT enclosed, vs returns NOT with payments enclosed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

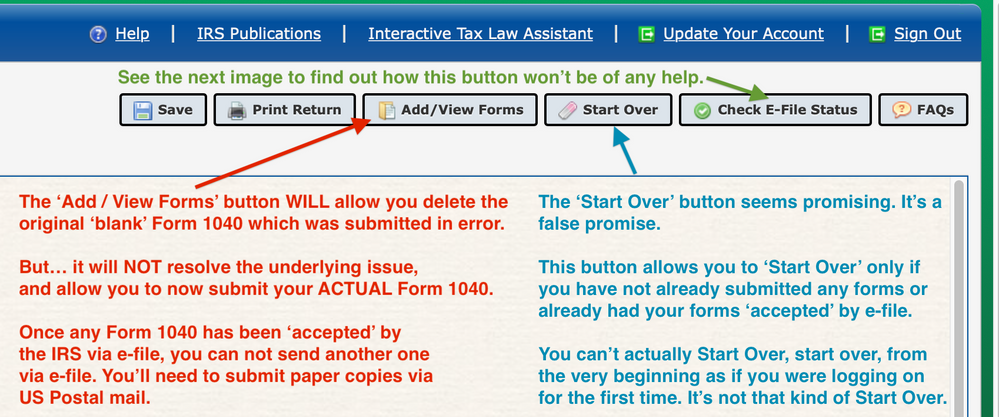

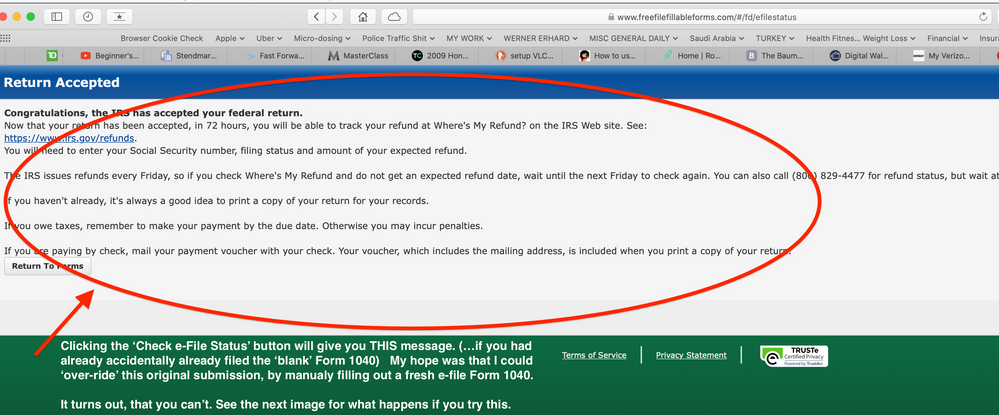

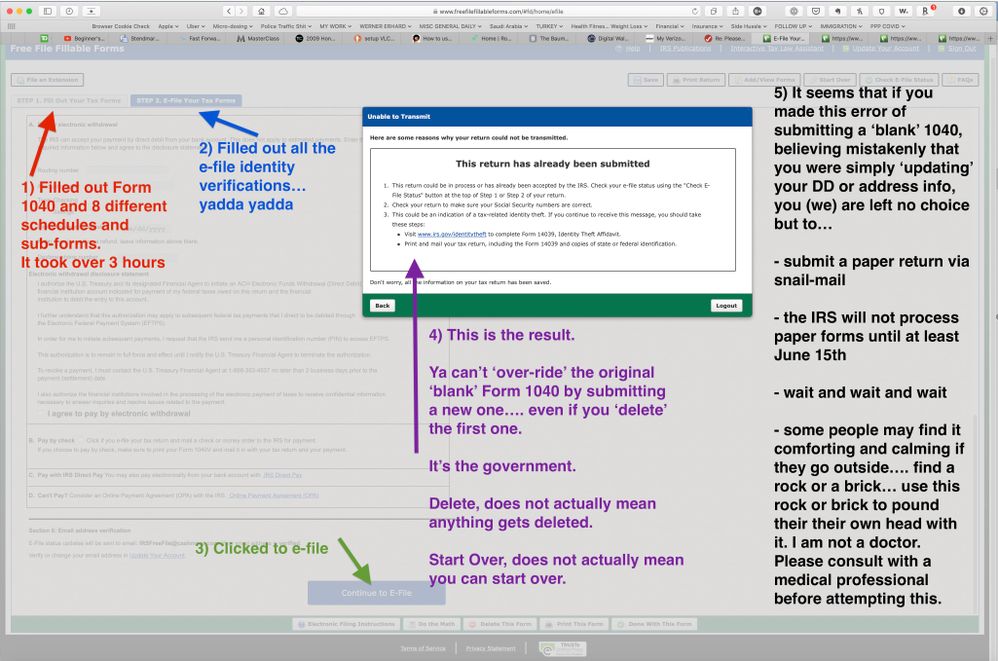

The only complete remedy at this point, is to file a paper return via US Postal snail-mail and wait until at least June 15th for the IRS to process it.....

These are screen shots which explain in detail why this is your only option remaining.

Critter is incorrect.

You DO NOT file a 1040X Amended Return.

A 1040X is for FINANCIAL changes. It is NOT for the purpose

Just file your ACTUAL Form 1040 with either a cover letter explaining why you are submitting a paper return after having already filed a 'blank' erroneous initial e-file return.

OR

You can send a Form 14039 (as shown in the final image above) and attach it to the back of your paper Form 1040, as per the ACTUAL IRS instructions for the Form 14039.

Be sure to....

- include a color copy of your Drivers License or State issued ID card.

- sign and date the form

- attach it to the back of your 1040

- send it to the correct IRS address assigned to your ZipCode (available on the IRS web site)

This is critical because there are many IRS addresses. There are different addresses for different geographic locations, AND there are different addresses for people sending their return in with a PAYMENT enclosed, vs returns NOT with payments enclosed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

No.... I'm sorry to report that my "experiment" produced undesirable results.

The only complete remedy at this point, is to file a paper return via US Postal snail-mail and wait until at least June 15th for the IRS to process it.....

These are screen shots which explain in detail why this is your only option remaining.

Critter is incorrect.

You DO NOT file a 1040X Amended Return.

A 1040X is for FINANCIAL changes. It is NOT for the purpose

Just file your ACTUAL Form 1040 with either a cover letter explaining why you are submitting a paper return after having already filed a 'blank' erroneous initial e-file return.

OR

You can send a Form 14039 (as shown in the final image above) and attach it to the back of your paper Form 1040, as per the ACTUAL IRS instructions for the Form 14039.

Be sure to....

- include a color copy of your Drivers License or State issued ID card.

- sign and date the form

- attach it to the back of your 1040

- send it to the correct IRS address assigned to your ZipCode (available on the IRS web site)

This is critical because there are many IRS addresses. There are different addresses for different geographic locations, AND there are different addresses for people sending their return in with a PAYMENT enclosed, vs returns NOT with payments enclosed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I suggested that people who OWE money to the IRS, wait.

This is because the filing deadline has been extended from April 15th, until July 15th.

The suggestion to "wait" was based on the idea that .... if you OWE money to the IRS and you have until June 15th to pay them and send in your return... then there is no point in sending it in right now. Theres no benefit to you to send in your return and pay now, when you can legally wait until the 15th.

Then... possibly within the next 6 weeks sometime... the IRS may come out with official guidance. (Or maybe they won't. But you have 6 weeks to wait it out and see if they do.)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taylormnye

New Member

jimenezdiego513

New Member

adriyana-allen2000

New Member

229hawk

New Member

229hawk

New Member