- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

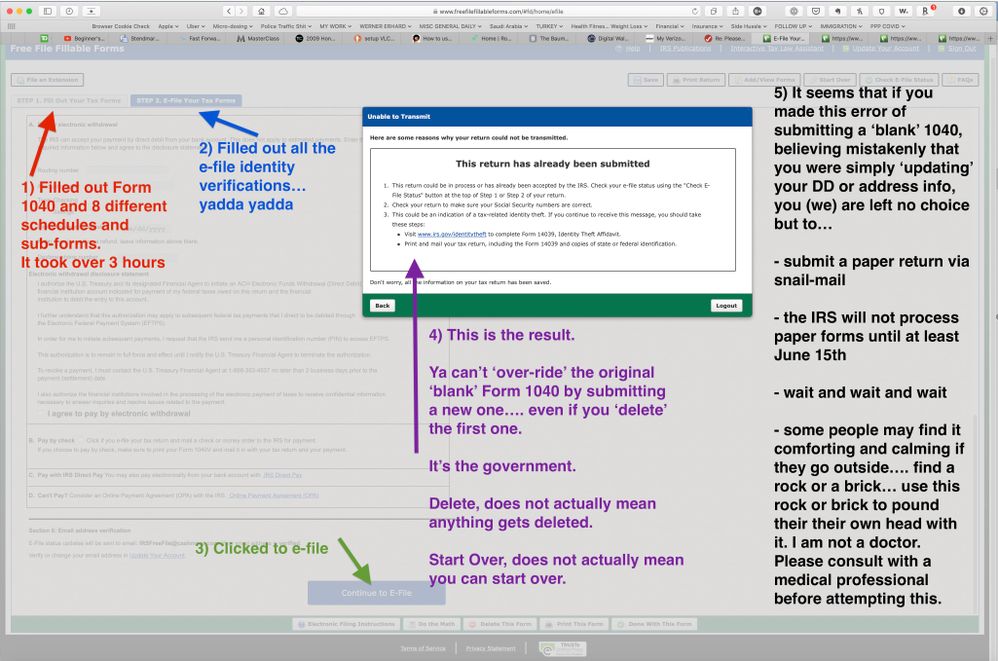

No.... I'm sorry to report that my "experiment" produced undesirable results.

The only complete remedy at this point, is to file a paper return via US Postal snail-mail and wait until at least June 15th for the IRS to process it.....

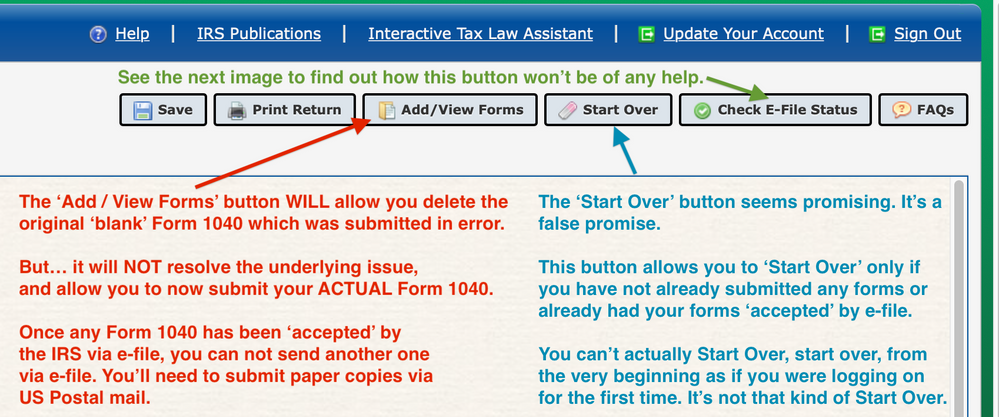

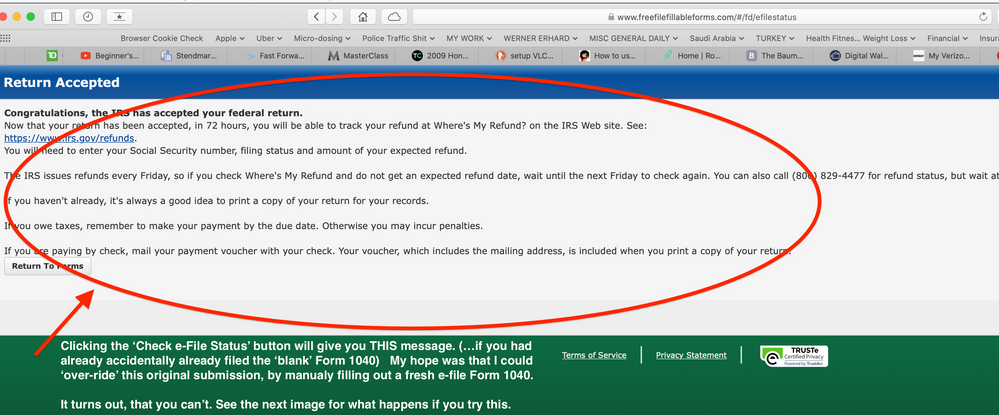

These are screen shots which explain in detail why this is your only option remaining.

Critter is incorrect.

You DO NOT file a 1040X Amended Return.

A 1040X is for FINANCIAL changes. It is NOT for the purpose

Just file your ACTUAL Form 1040 with either a cover letter explaining why you are submitting a paper return after having already filed a 'blank' erroneous initial e-file return.

OR

You can send a Form 14039 (as shown in the final image above) and attach it to the back of your paper Form 1040, as per the ACTUAL IRS instructions for the Form 14039.

Be sure to....

- include a color copy of your Drivers License or State issued ID card.

- sign and date the form

- attach it to the back of your 1040

- send it to the correct IRS address assigned to your ZipCode (available on the IRS web site)

This is critical because there are many IRS addresses. There are different addresses for different geographic locations, AND there are different addresses for people sending their return in with a PAYMENT enclosed, vs returns NOT with payments enclosed.