- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Only want to e-file Federal not State

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

Please help. Hello, I'm doing a free edition. I only want to e-file my Federal but at the very end it wants to send State first. How do I delete the state. There's no option to delete state or even start over. thankyou

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

See this TurboTax support FAQ for deleting a state - https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-delete-my-state-return-in-turbotax-on...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

there's no option to delete it anywhere. only "edit" "start over" and "add another state"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

I am seeing the same thing on one of my online test accounts. I will report this forward to see if it is working as designed or may be a bug.

Regardless, the state tax return Cannot be e-filed if the federal tax return is not e-filed.

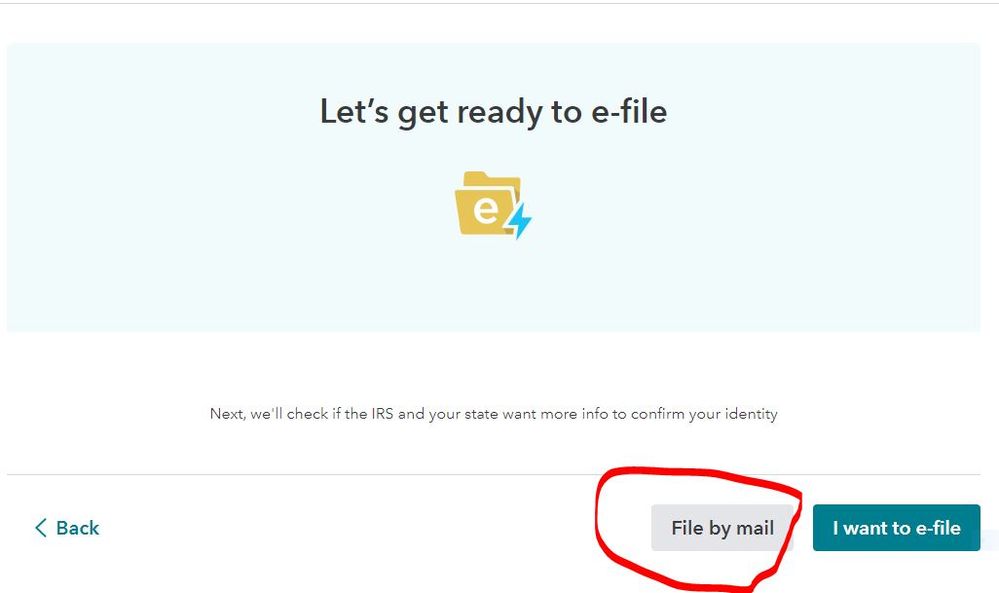

To e-file the federal tax return only, go to the File section and on Step 3 click on File by mail

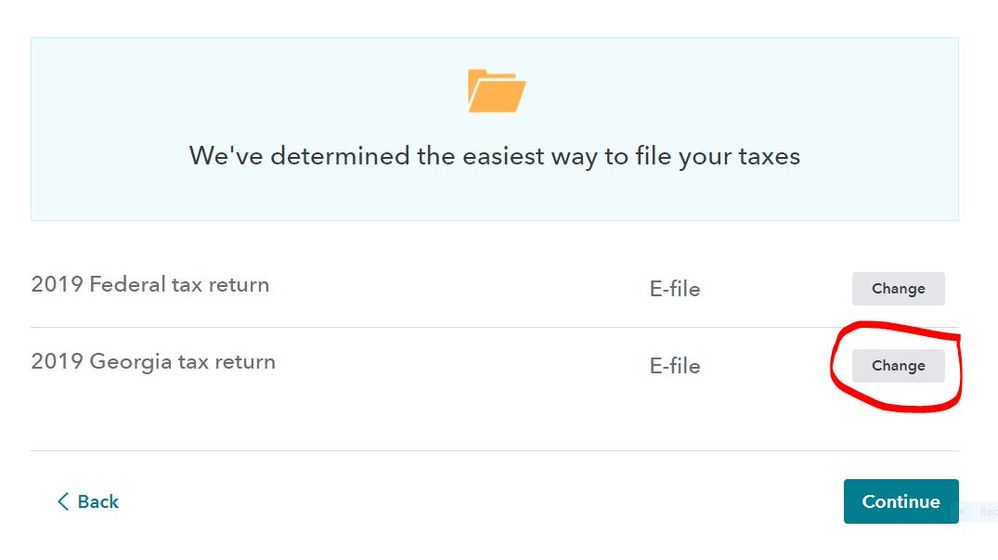

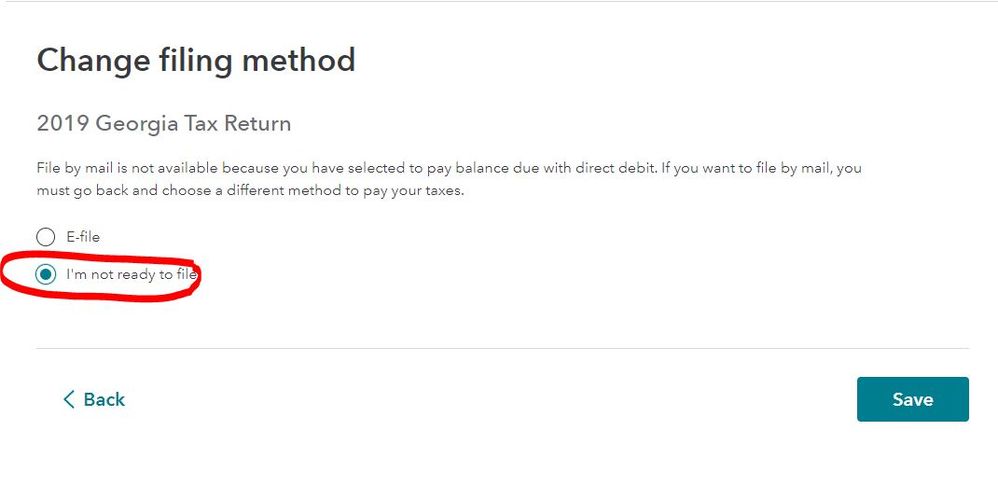

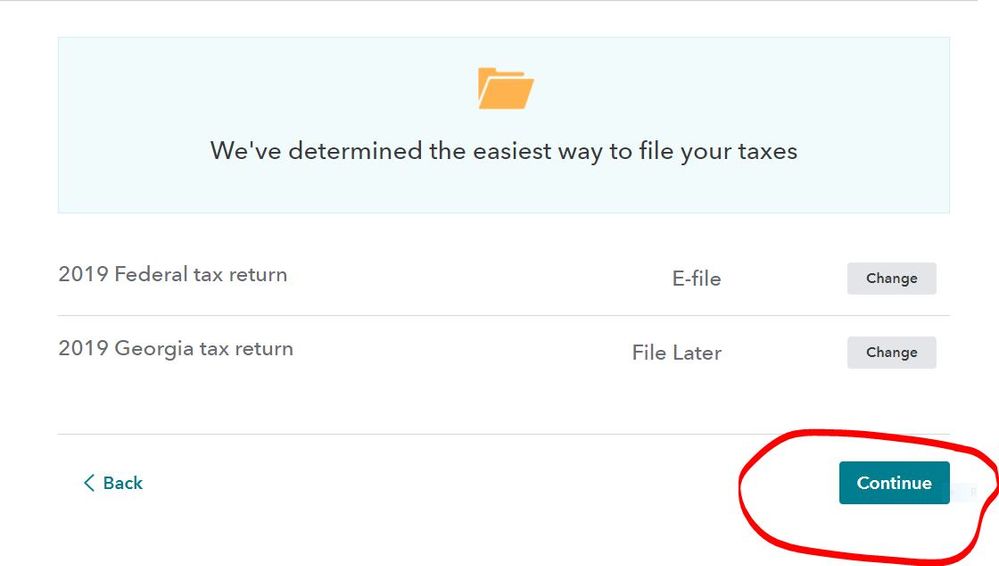

On the following screen click on Change for the state tax return. Then select either File by mail or I'm not ready to file, click on Save

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

After reviewing the TurboTax FAQ, the following is stated -

If you don't see the option to delete your state (you'll probably see Edit instead), you've already paid your TurboTax fees (including the state fee) or registered your free version while the state was on your return. If you've done either of these things, you can't delete your state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

but how do I even "not file" my state? If I have no income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

@txkpt wrote:

but how do I even "not file" my state? If I have no income?

Change the method of filing the state tax return in the File section of the program on Step 3. See screenshots

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

thanks for your fast response. Right now it wants me to pay for both federal and state before I can even e file or mail. I have a refund for federal but no refund or owe tax for state. The system is charging me both for federal and state because I have to do self employment form. How do I even start everything over? Should I just use a different service like H&RBlock or Tax Slayer?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

@txkpt wrote:

thanks for your fast response. Right now it wants me to pay for both federal and state before I can even e file or mail. I have a refund for federal but no refund or owe tax for state. The system is charging me both for federal and state because I have to do self employment form. How do I even start everything over? Should I just use a different service like H&RBlock or Tax Slayer?

Can you delete the state tax return? See this TurboTax support FAQ for how to delete the state return - https://ttlc.intuit.com/community/using-turbotax/help/how-do-i-delete-my-state-return-in-turbotax-on...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

god bless your kind heart. It's impossible because "If you don't see the option to delete your state (you'll probably see Edit instead), you've already paid your TurboTax fees (including the state fee) or registered your free version while the state was on your return. If you've done either of these things, you can't delete your state return."

so I'm screwed. I might just jumped to H&R or Taxslayer. last question. Do I need to send in state file if I efile Federal tax? Last year I mailed my federal tax and it required a copy of state tax copy to go along with it. Be safe!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only want to e-file Federal not State

@txkpt wrote:

god bless your kind heart. It's impossible because "If you don't see the option to delete your state (you'll probably see Edit instead), you've already paid your TurboTax fees (including the state fee) or registered your free version while the state was on your return. If you've done either of these things, you can't delete your state return."

so I'm screwed. I might just jumped to H&R or Taxslayer. last question. Do I need to send in state file if I efile Federal tax? Last year I mailed my federal tax and it required a copy of state tax copy to go along with it. Be safe!

You may have misunderstood something when mailing the federal tax return. A state return is never required to be sent with a federal tax return. Some states require the federal tax return, Form 1040, be sent with the state tax return.

The e-filed federal tax return does Not require the state tax return to be e-filed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 1

catoddenino

New Member

borenbears

New Member

FroMan

New Member

curts314

New Member