- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Online sales at a loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Online sales at a loss

I sold a personal collection of items piecemeal online. I am not a business, just a regular person, I have a 1099 K showing income over $5000. However these items were all sold for less than I bought them, though I no longer have receipts since they were purchased over many years. Is this still considered income I need to claim? Is there some way I can show that they were sold at much less than their original value?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Online sales at a loss

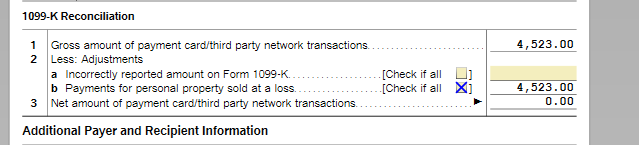

To enter the 1099 K and then back it out immediately take the following steps:

- Income

- 1099-K under Other Common Income

- Select Personal Items Sales

- Enter the information from the 1099-K

- Then on the next screen select All items were sold as a loss or had no gain.

You cannot take a deduction for a loss, however, this will cause the income you entered to be "erased" but still reported on your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

brian94709

Returning Member

Investor_

Level 1

johntheretiree

Level 2

justine626

Level 1

titan7318

Level 1