- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Old Form 4835 (Income and Expenses from my Ranch) - Form Deletion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Old Form 4835 (Income and Expenses from my Ranch) - Form Deletion

I had some old farm rental income back many years. I sold that farm at least 5 years ago. Every year I do my desktop home/business return I'm asked by TT whether or not I have this farm rental income and I answer "No" and then it tells me that I need to keep the form anyway! (I believe b/c their was a passive loss associated with this).

Is there any way just to delete the form completely and forego the passive loss carryover? If so, can you give me the steps to complete that deletion (probably too late for this year, but I'll do it next return).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Old Form 4835 (Income and Expenses from my Ranch) - Form Deletion

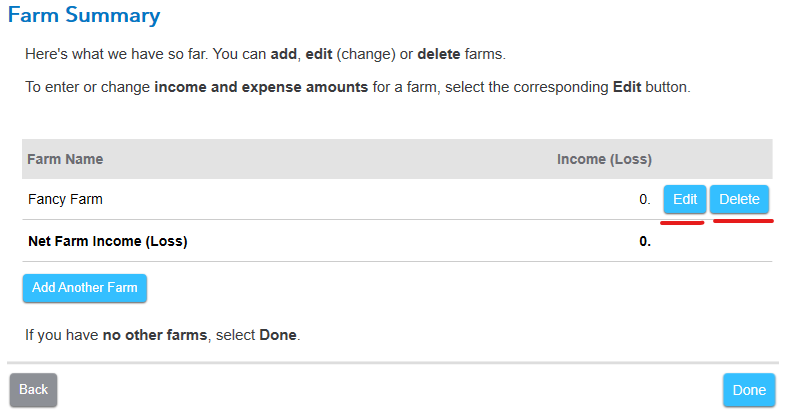

- Consider selecting Edit at the screen Farm Summary.

- Scroll down and click to the right of Final Details.

- Cycle through the screens to see whether there is a carryover and what kind of carryover that may be found there.

- Screen capture the items, and print out the pages. Retain the information for future use.

You may be able to remove the farm activity by selecting Delete to the right of the activity at the screen Farm Summary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ke-neuner

New Member

scatkins

Level 2

realestatedude

Returning Member

AS70

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

anonymouse1

Level 5

in Education