- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Non dependent tax credit how do you file on here without claiming the child as a dependent??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non dependent tax credit how do you file on here without claiming the child as a dependent??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non dependent tax credit how do you file on here without claiming the child as a dependent??

If you are the custodial parent, you could be able to claim the Earned Income Tax Credit (EITC) and/or the Child and Dependent Care Credit (for child care costs).You would enter the child in the Personal Info section and answer that the child lived with you for the entire year (or at least more than half the year) but the other parent is claiming the child. Answer all of the questions.

Then continue through the Earned Income Credit section and the Child and Dependent Care Credit sections.

The noncustodial parent will be able to claim the dependency Exemption and the Child Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non dependent tax credit how do you file on here without claiming the child as a dependent??

When I did this using TurboTax, it still listed my child in the earned income credit section. I selected the option saying the other parent is claiming the child. Did turbo tax claim the child on my taxes? I didn’t want it to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non dependent tax credit how do you file on here without claiming the child as a dependent??

If you are a custodial parent, by forgoing to claim your dependent, you are still entitled to claim other nondependent tax credits. In TurboTax online, here are the steps:

- Sign back into your account and select Pick up where you left off

- To your left, select My Info

- On the screen Your Personal Summary, scroll down to Dependents section- find the name and select Edit.

- Follow prompts

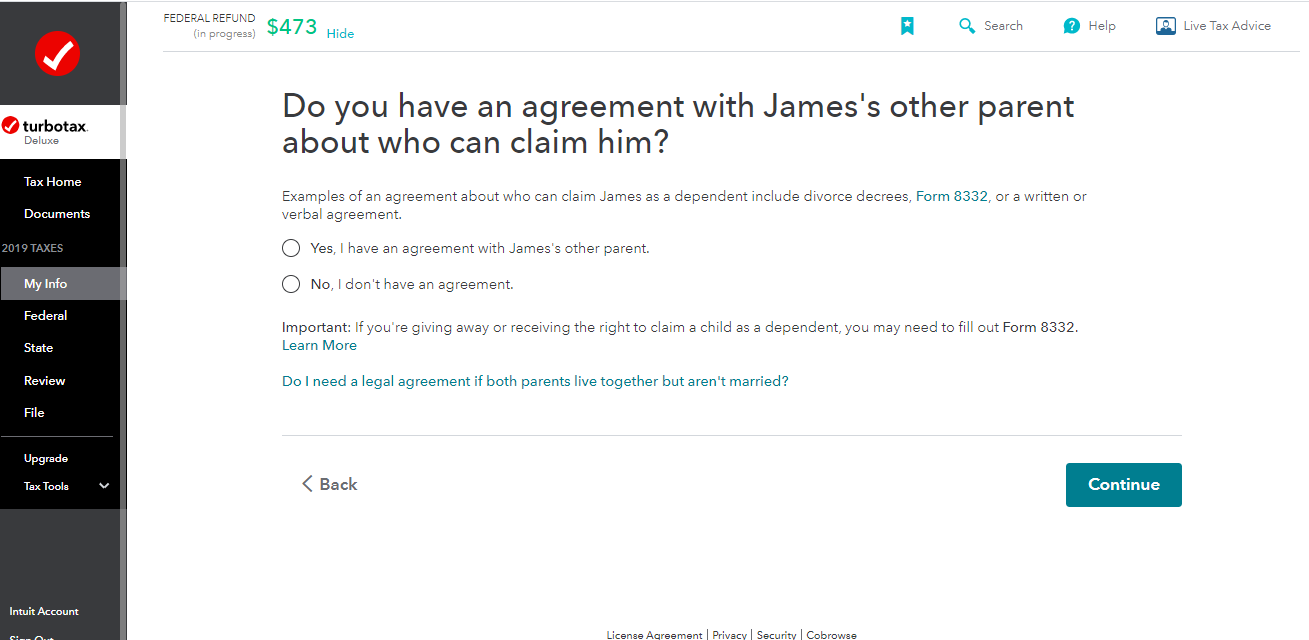

- On the screen, "Do you have an agreement with Your kid's other parent about who can claim him?", select Yes ( See the image below)

- Follow prompts to complete.

By law, if you have the kid for the most part of the year, you are considered as a custodial parent. By letting the other parent claim the dependency, you will be entitled to claim Head of Household, Earned Income Credit and Dependent Care Credit. The noncustodial parent will receive the dependency (Other Dependent Credit) and the Child Tax Credit. After you enter the information as instructed above, the program will calculate and allocate those three tax benefits for you on your taxes

@nealcarter37

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non dependent tax credit how do you file on here without claiming the child as a dependent??

Without claiming your child as your dependent, you can still qualify for the Earned Income Credit.

For further explanation, see my answer above.

@ZozoEspinoza

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non dependent tax credit how do you file on here without claiming the child as a dependent??

That does not answer my question. I don’t care about anything you just said. I did all of this. Does that mean I claimed my child?! I did not want to do that! I will have to amend my return if u claimed him.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non dependent tax credit how do you file on here without claiming the child as a dependent??

To verify if you have claimed the child as your dependent, please check your Form 1040.

On the Form 1040 front page, you should not have anybody as dependents on your Form 1040. As far as Earned Income Credit, without claiming the dependent, you should still get it. It will show on line 18a. Please see the images below:

If you have already filed and claimed the dependent, you might need to amend your taxes. Please continue to read:

If you have already filed, you might not be able to go back to fix. You can return to the program to make corrections without amending only if your return is being rejected. If your return is accepted, to edit your information, you will have to amend it. You cannot just go back to edit.

If your return got rejected for any reason, you can return to the program to edit information along with other changes and re-submit it. For instructions, click here Fix a reject 2019. You do not need to file an amendment 1040-X.

If your return has been accepted, you will have to amend by filing a Form 1040-X. Click here for instructions Amend 2019. Please note that the 2019 Form 1040-X is not available until 2/26/2020. Please come back later. Also, be aware that you should not try to amend your return until it has been fully processed and you have received your refund or your payment has cleared. If by editing the information does not change the refund or amount you owe, you do not need to submit the amendment.

@ZozoEspinoza

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bgoodreau01

Returning Member

bgoodreau01

Returning Member

tenacjed

Returning Member

in Education

srobinet1

Returning Member

aamandaxo03

New Member