- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you are a custodial parent, by forgoing to claim your dependent, you are still entitled to claim other nondependent tax credits. In TurboTax online, here are the steps:

- Sign back into your account and select Pick up where you left off

- To your left, select My Info

- On the screen Your Personal Summary, scroll down to Dependents section- find the name and select Edit.

- Follow prompts

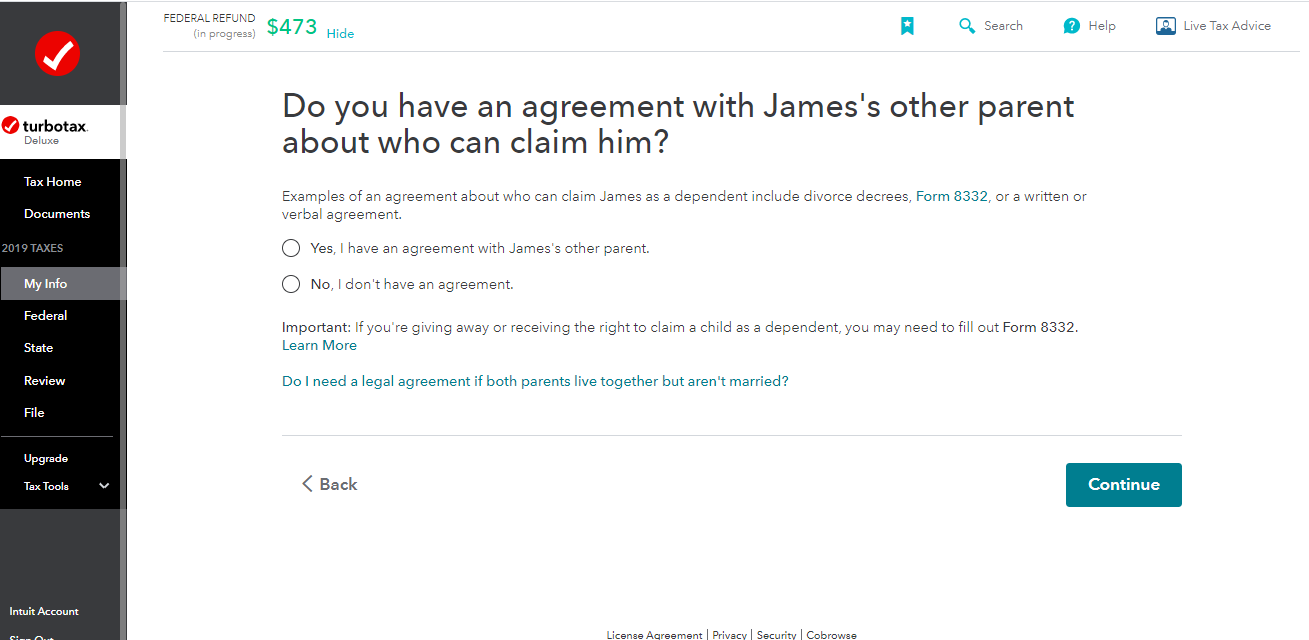

- On the screen, "Do you have an agreement with Your kid's other parent about who can claim him?", select Yes ( See the image below)

- Follow prompts to complete.

By law, if you have the kid for the most part of the year, you are considered as a custodial parent. By letting the other parent claim the dependency, you will be entitled to claim Head of Household, Earned Income Credit and Dependent Care Credit. The noncustodial parent will receive the dependency (Other Dependent Credit) and the Child Tax Credit. After you enter the information as instructed above, the program will calculate and allocate those three tax benefits for you on your taxes

@nealcarter37

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 15, 2020

7:40 AM