- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- New in 2021- Not updated in TurboTax - Arizona Exempts 100% of Military Retired Pay from State Income Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New in 2021- Not updated in TurboTax - Arizona Exempts 100% of Military Retired Pay from State Income Tax

New in 2021- Not updated in TurboTax - Arizona Exempts 100% of Military Retired Pay from State Income Tax.

Beginning with tax year 2021, if you received benefits, annuities, and pensions as retired or retainer pay of the uniformed services of the United States, you may subtract 100% of the amount you received. If both you and your spouse each received such income, each spouse may subtract 100% of the amount received.

Identifying Other Taxable Income | Arizona Department of Revenue (azdor.gov)

If you purchased TurboTax State product for Arizona, the interview has not been updated to reflect this change. This may result in an erroneous increased state tax burden for military retirees living in Arizona. I called TurboTax support and the issue was submitted to the programmers for a future update.

The workaround is to open Forms and select AZ Form 140. Enter the amount of the military pension on Line 29B. (Leave 29A blank unless you qualify for both.)

This will update the taxable income amount in TurboTax to the correct amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New in 2021- Not updated in TurboTax - Arizona Exempts 100% of Military Retired Pay from State Income Tax

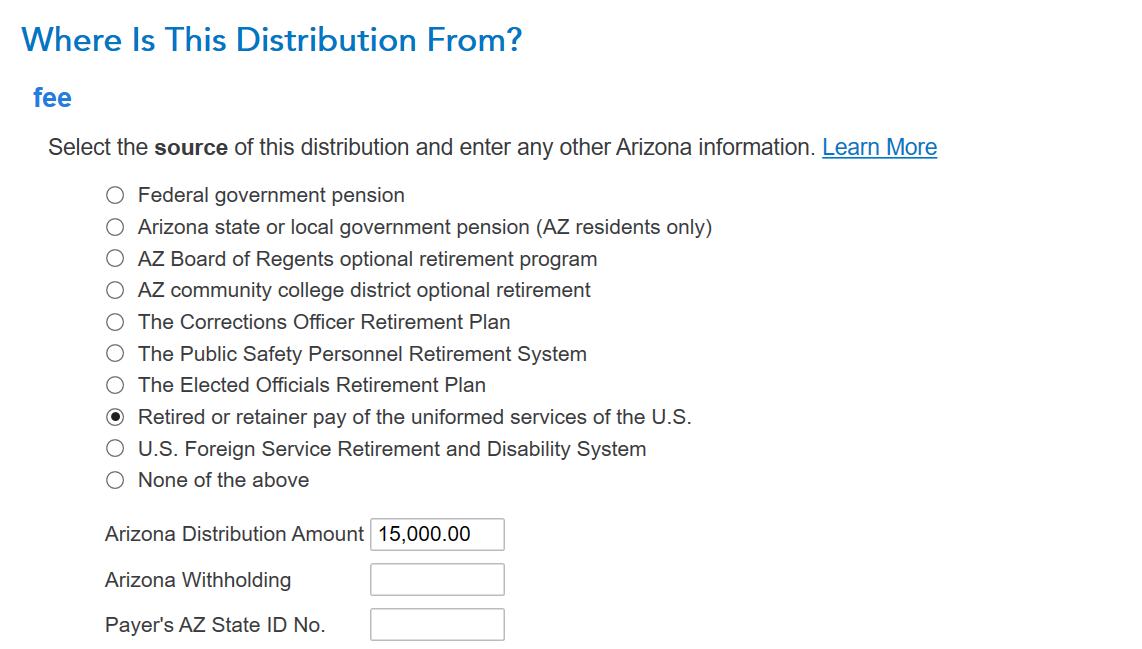

Yes, you can make this entry in the forms mode as you describe. However, in the step-by-step federal interview in the "Retirement" section, using the "IRA, pension 1099R" topic, after entering your form 1099R information, you will arrive at a page titled "Where is this distribution from?" One of the choices is "Retired or retainer pay of the uniformed services of the US". If you select that option, your military retired pay will be excluded from AZ income on line 29b form 140.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New in 2021- Not updated in TurboTax - Arizona Exempts 100% of Military Retired Pay from State Income Tax

Does anyone know if this exemption applies to filers who get a portion of their former spouse's military retirement pay?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New in 2021- Not updated in TurboTax - Arizona Exempts 100% of Military Retired Pay from State Income Tax

I do not see a requirement for taxpayer military service. According to the Arizona Revised Statutes as extracted below, the pay just has to be military retirement pay.

Benefits, annuities and pensions received as retired or retainer pay of the uniformed services of the United States in amounts as follows:

(a) For taxable years through December 31, 2018, an amount totaling not more than $2,500.

(b) For taxable years beginning from and after December 31, 2018 through December 31, 2020, an amount totaling not more than $3,500.

(c) For taxable years beginning from and after December 31, 2020, the full amount received.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmgretired

New Member

user17524531726

Level 1

drildrill23

Returning Member

cpo695

Returning Member

Anobikit

New Member