- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Negative Business income on 1040 that is ALSO added to a prior year carryover on Schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter passive Carryover Loss?

This is the first time I've used TurboTax (for self-employed), so it has no data to bring forward. I have a writing business, but my expenses exceeded income this year. I have a carry forward from 2020, but have not seen any place to enter it or prompt to go to another section. What am I missing? Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter passive Carryover Loss?

You will see an option to enter your business carryover loss when you go through the business entries in TurboTax.

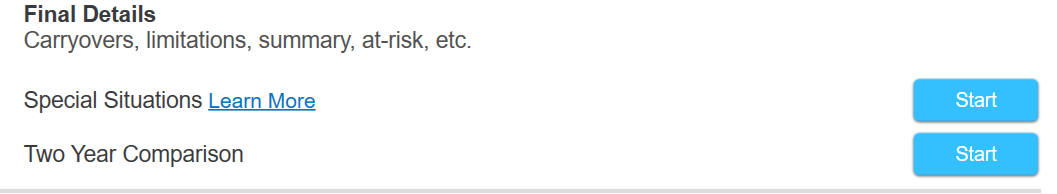

First, update your business income and expenses on the screen that says Lets gather your business Info. Then edit your business entry. On the screen that says Your (name of business) Business, choose Final Details, then Special Situations.

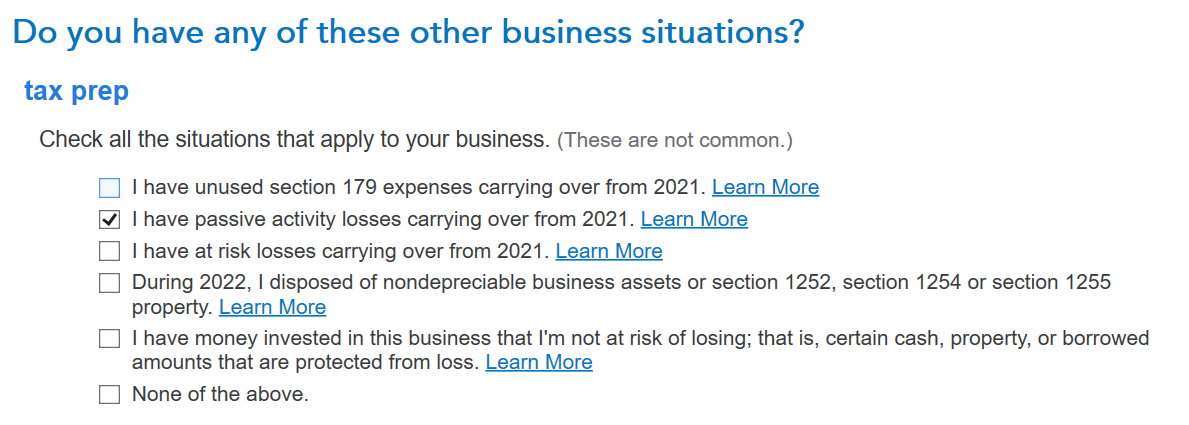

On the screen that says Do you have any of these other business situations? Choose I have passive activity losses carrying over from 2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter passive Carryover Loss?

Thank you very much. Now I'm wondering if I bought the correct version of TurboTax for my needs! I have the Self-Employed version and am not finding the steps that you outline--which sound exactly like what I am looking for. Argh. I am only presented with Other Business Situations under Federal as follows:

Regardless, thank you for your expertise and prompt answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter passive Carryover Loss?

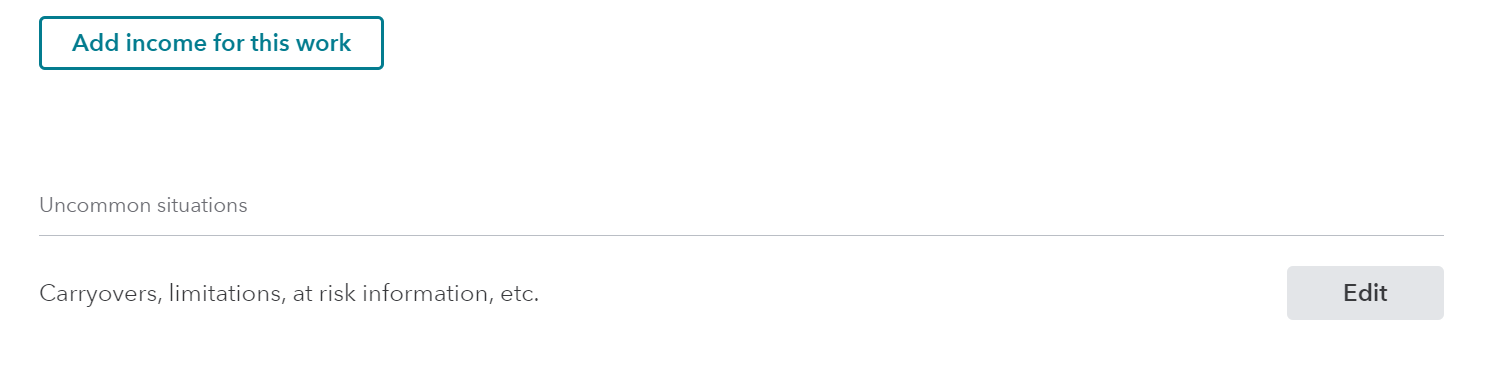

You should be OK. First, find the screen that says Your 2022 Self Employed Work Summary in the business section and click on the Review option to bring up the business you are working on. On the next screen you should see an option for carryover under Uncommon situations, just click on the Edit option and on the next screen you will see the option for loss carryovers from the previous year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter passive Carryover Loss?

Okay, I got that. Somehow the amount of loss I can carry over this year is being subtracted from my income instead of carried forward. 🙄 I knew my refund was too high! Time to go for a walk. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter passive Carryover Loss?

I'm doing a final review, but am confused about how my business loss this year is showing up.

I had $1223 more in expenses than income in 2022. Quicken has entered this negative value in 1040 Line 8, Schedule 1, line 10 (Business Loss) and Schedule C, lines 29 & 31. All investment is at risk (per my tax person last year) and NO SE is generated. It seems that I am deducting it from my total income and in addition, carrying it forward to be used against future profits. That doesn't seem right, but I don't know how to correct it.

In addition, form 8995 indicates a QBI Deduction of - $1382, and I have no idea how it arrived at that amount. It adds -$1382 to the previous year's loss of -$1463 to carry forward to next year a total loss of -$2855. Yikes! Where does Turbo grab that amount, or how is it arrived at.

I had hoped to filed this today, and everything else checks out, but this befuddles me. And worries me!

Thanks for any help you can provide.

Between the two, I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter passive Carryover Loss?

Yes, if you are unable to claim a business loss on your tax return, it is carried over to future years until it can be matched with income. Only that portion that cannot be used this year is carried over. You aren't reporting the same amount twice.

Once you have paid for your return, you can save all forms and worksheets in PDF format. Look for two worksheets that will answer some of your questions. The Federal Carryover Worksheet displays all carryovers by income type. The Qualified Business Income Component Worksheet for your business shows you how the QBI deduction was calculated, and the QBI Deduction Summary worksheet displays the outcome of this deduction. (These are TurboTax worksheets and not IRS forms). This article explains how to print your return: Can I print a copy of my TurboTax Online return before I file it?

The QBI deduction was created by the 2017 Tax Cuts and Jobs Act (TCJA) and allows most self-employed taxpayers and small business owners to exclude up to 20% of their qualified business income from federal income tax (but not self-employment tax) whether they itemize or not. You can read more about QBI here: What is the Qualified Business Income (QBI) deduction?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

scatkins

Level 2

HNKDZ

Returning Member

ripepi

New Member

fkinnard

New Member