- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

I got the same error, I had no boxes checked and all inputs were correct. Idk what the problem is, I just refiled so fingers crossed its accepted this time....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

T K:

I have the same issue as you had. Can you explain to me how got to the “Forms View” on TT? Which Schedule

did you change once you got to the “Forms View”. Like your case, my income from a non-qualified salary continuation plan

I would appreciate any help you can give to me. I have included a portion of your comment below for reference. Thanks.

“So I went to Forms view in TT and zeroed-out the amount shown in the second box in the Line 10 area under where it says: "Distributions from sect. 457 and non-qualified plans"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

So at the top of the TT desktop screen, you will see View. Click on that and switch to Forms. Find the W2 that contains your non-qualified pension, then perform the updates in the Box 10 area as I earlier suggested.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

I'm having the same problem ! turbotax no help at fixing it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

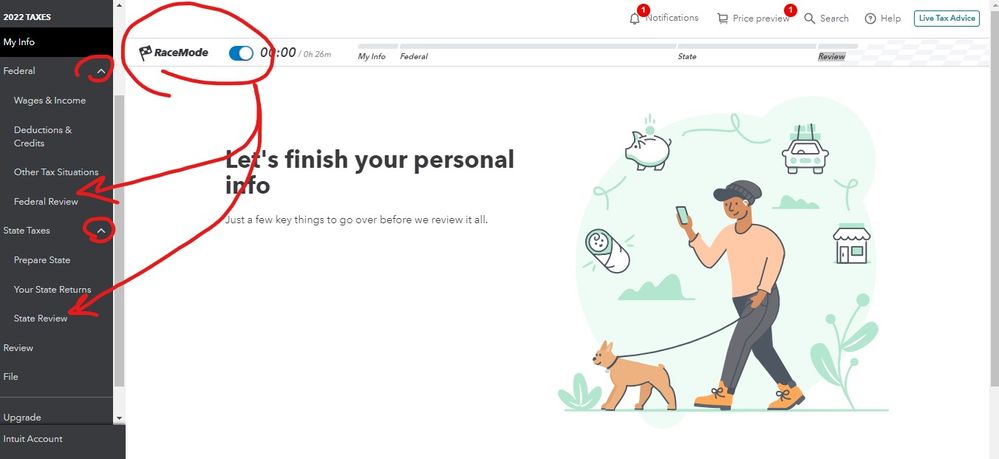

Click on the federal and/or the state review tabs to release the Refund-O-Meter ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

I was told by a TT employee in another thread that the solution to the problem is in this thread, but I cannot find it.

What is meant by "Click on the federal and/or the state review tabs to release the Refund-O-Meter ..."? Is this a solution to the Reject Code FW2-001-02 problem? I am already seeing the refund amounts in the top line, how does that help?

(I am using the online version and I do not have any W-2 errors. The W-2s shown by TT are exactly the same as the actual W-2s. I do have a 457(b) (deferred compensation) payout so I have an entry on Schedule 1 Line 8t. )

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

Thank you so much for the help on correcting this issue!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

I have same issue. No incorrect data input. It seems to be an issue with data processing of W2 info for non qualified pension income.

spoke to TT support person who said she had no further information from TT and all I could do was wait and try to resubmit over coming weeks. No way for TT to send email that problem was resolved.

This is very unsatisfactory and poor service. This is a simple data processing fault which is affecting a number of early filers and there will be a lot more over coming weeks if it’s not fixed. I don’t understand why TT is not acknowledging problem and indicating timescale. It is totally unacceptable to suggest manual filing for such a relatively simple data fault. TT must review these pages and know there is a problem. More power to your elbowTT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

Hi this same thing happened with me this ain't my fault serious regrets using turbo tax the question is can I file elsewhere 🤔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

Hi Everyone,

I also had the FW2-001-02 error "the sum of all form W2s...cannot be greater, etc". After reading all these entries (which were helpful), I also found a discussion log in TT from a prior year titled: "Can someone explain these rejection codes to me and what I did wrong? Fw2-001-02 IND-423 F1040-034-05"

In that discussion it was clearer what TT software did that caused the error. I had a W2 for a non-qualified plan. I entered that W2 in TT for box 1 and box 11 ("non-qualified plans") because that is how it was reported on my W2. The actual wages and salary amount that I entered was correctly omitted from 1040 line 1a via TT and instead correctly included on schedule 1, line 8t. Then the sum of schedule 1 (line 10) gets auto-filled on form 1040 line 8 under 'other income'...I could not see what the issue was until I read the other posts from the other discussion log. What is happening behind the scenes is that the Forms within TT - for the W2 that I entered for the non-qualified plans income had the box 11 correctly filled in but ALSO had box 10 filled in (which is for something else entirely). You have to go into the actual forms area, look at the W2's in forms and make sure the correct boxes have the correct value (and clear out the duplicative value - the bug in the system), save it. close it, open back up and e-file. I hope this helps you. Again, all of your discussion was very helpful to me, thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

I would love to know the same thing, I need an answer to if I can refile on cashapp or something instead of waiting God knows how long for TT to fix this...

I will NOT be filing via paper tho lol

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

Yes, same problem-is related to non qualified earnings reported on W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

Yes, related to non qualified deferred comp reported on W-2. In past, a questionnaire would show up under uncommon situations verifying that this was indeed non qualified earnings. Was left off questionnaire on 2022 return in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

It's important to remember that this is merely a forum of peers. this is not turbotax support.

also, this is not tax advice, and you should consult a tax professional for actual assistance.

I nor anyone else on this thread is responsible for the accuracy or validity of your return if you follow any instructions here. 🙂

What worked for me as posted previously, was within turbotax clicking VIEW and then selecting FORMS (under step by step) - then navigating to my W2's and comparing very carefully what boxes were populated or checked or had an X in them compared to what TT had downloaded from my W2 providers. In my situation box 10 was populated on ONE of my W2's that was NOT actually populated on my W2. I cleared this incorrectly populated box and was able to continue.

others had a checkbox indicating the W2 was from Statutory work - which in their case was not checked on their W2 - - in that case, unchecking it in "forms" and going back to step by step to continue the validation end efile worked for them.

outside those two scenario's there is the Error you are getting - this (as someone else pointed out) is a KNOWN irs bug for those that DO NOT fall into the category of a poorly imported W2 or a turbotax programming bug. this is an IRS bug, if you have checked the W2 and it's properly imported or corrected- the suggestion (from the IRS) is to paper file. -- in other words, it's likely you will have this issue with any Efile as it's a bug on the IRS side. (outside the turbotax failure to find obvious errors on the W2) as this "bug" has been known since end of November....

| 11/30/2022 | Form W-2 | Business Rule | Business rule FW2-001-02 will reject for TY 2022 returns when the total of 'WagesAmt' for all Form W-2s is more than ‘WagesSalariesAndTipsAmt' in the return. | Business rule FW2-001-02 will be modified in PY2023. | BR will be updated in PY 2023. | OPEN |

I hope this is helpful for anyone, I keep getting replies back and it seems some folks don't go back to page 1 on this thread where several folks provided potential workarounds. if those don't work, you're S.O.L and need to paper file. OR wait until the IRS marks it as resolved on their tracker. ( search for IRS known efile issues 2022) - Turbotax support isn't replying on these threads. and they seem to pretend they've never heard of this error when folks call... as is well documented on this thread. I see similar issues in competitors forums.

good luck everyone, I hope this is resolved before you're forced to mail it in!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return is being rejected with code FW2-001-02 which relates to a checked box 13 related to statutory income. My W2 had no such check in that respective box. Help?

I have the same issue and feel frustrated by it as well- I cant get a response from Turbo Tax- thanks for all the info.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alishabrinson3

New Member

triblegirl

New Member

jbscorp26

New Member

dave-k-alaska

New Member

blagmonaltonk

New Member