- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My friend owns a business, and I did an intangible service for his business. He decided to to pay me for this service. How should this be taxed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My friend owns a business, and I did an intangible service for his business. He decided to to pay me for this service. How should this be taxed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My friend owns a business, and I did an intangible service for his business. He decided to to pay me for this service. How should this be taxed?

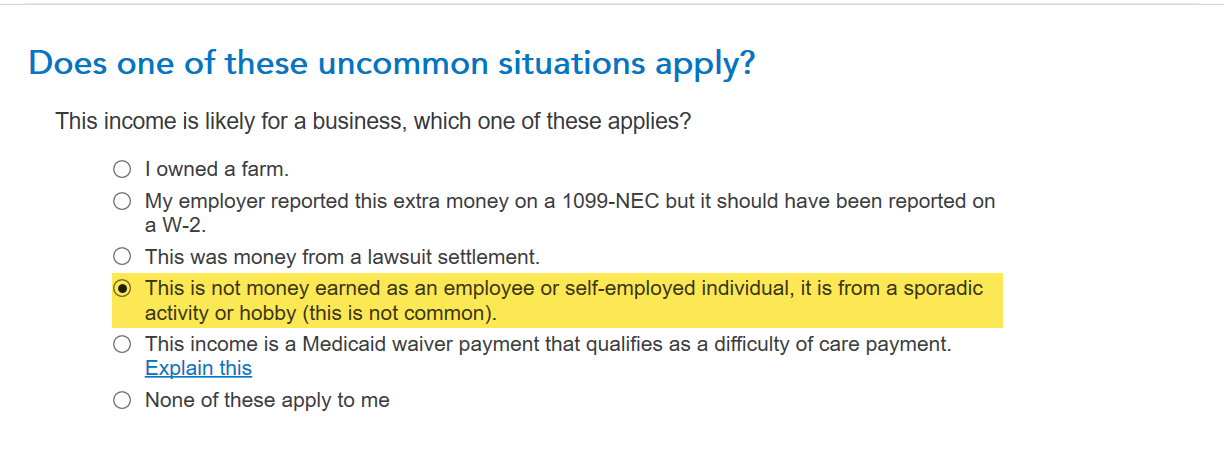

If it is a one time thing that is not related to your normal job, that was not done in the previous year and not to be done again in a future year and for which you did not have a profit motive, then it should be taxed as "other" income as opposed to self-employment income. It is OK if it was reported on a Form 1099-NEC, just make sure you answer the questions about it after you enter the Form in TurboTax. It will be reported on schedule 1 in TurboTax if it is not self-employment income, otherwise it will appear on Schedule C.

You should enter it in the Wages and Income section of TurboTax, then Other Common Income, then Income from Form 1099-NEC If it is not self-employment income. On the screen that says Does one of these uncommon situations apply? choose the option that says This in not money earned as an employee or self-employed individual, etc...:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

EdT72

New Member

asrogers

New Member

Mary625

Level 2

risman

Level 2

evltal

Returning Member