- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My Edward Jones tax statements, which lists $378 in tax exempt dividends, doesn't specify which state the $378 of exempt-interest dividends are from. How do I proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Edward Jones tax statements, which lists $378 in tax exempt dividends, doesn't specify which state the $378 of exempt-interest dividends are from. How do I proceed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Edward Jones tax statements, which lists $378 in tax exempt dividends, doesn't specify which state the $378 of exempt-interest dividends are from. How do I proceed?

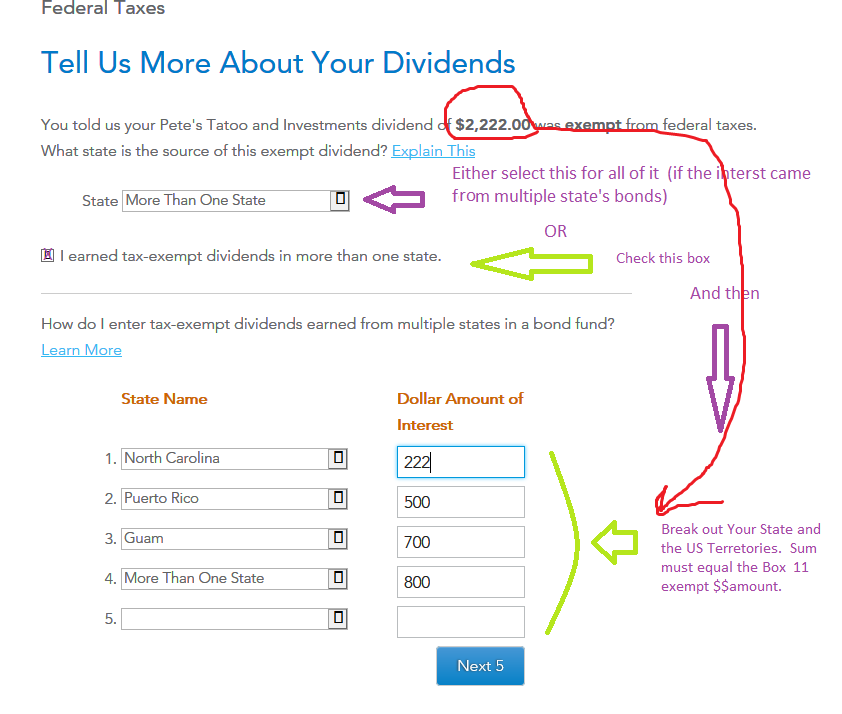

Choice #1 (simplest for that low amount): go to the bottom of the list of states and indicate "Multiple States" for all of it (desktop software uses the term "More than one state" ).

Choice #2 : Break out the sub amount for your own state, and any US Territories (like Puerto Rico)...to do this You have to talk to your broker to find out where the listing is for whatever funds you own, and calculate the amount yourself to do the breakdown.

Example: if you were a NC resident, and had $1000 in box 11 of a 1099-DIV from only one bond fund, and the broker/fund indicates that 2% of that came from NC-muni bonds. Then 2% of 1000 = $20, and a breakout might save me ~$1 in NC taxes since NC taxes income at ~5%. A lot of work for little return..and if multiple funds contributed to the box 11 value on a 1099-DIV, you have to calculate the amount separately for each.

________________________

Note: MN and CA residents have severe fund restriction on whether a state breakout is allowed for box 11 $$ on a 1099-DIV form. For IL residents, it isn't allowed at all .

CA, MN and IL are allowed a state breakout for any $$ shown in box 8 of a 1099-INT form since those are individual bonds, and not bond funds

_________________________

Here's and example of an NC and US Territory breakout for a different NC situation to show how it would look:

______________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Edward Jones tax statements, which lists $378 in tax exempt dividends, doesn't specify which state the $378 of exempt-interest dividends are from. How do I proceed?

Don't you know what tax-exempt products you're invested in?

P.S. if it is not your own residence state, it's not a very productive investment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Edward Jones tax statements, which lists $378 in tax exempt dividends, doesn't specify which state the $378 of exempt-interest dividends are from. How do I proceed?

@fanfare wrote:Don't you know what tax-exempt products you're invested in?

P.S. if it is not your own residence state, it's not a very productive investment.

_____________________

Opinion:

When investing in individual Muni bonds....For many people, it's great for Federal taxes, even if they did not buy their resident state's bonds. Some states don't have a lot of readily available Muni's to choose from, so the ones readily available may be for other states. For Muni Bond Funds from Mutual fund collections, if the fund company offers a bond fund directed to only, or mostly your resident state's muni bonds, that gives you the best Federal and state tax advantage, but those state-specific fund collections may only be available for a few states

Of course, it's Always best to invest in your home state's bond, but the tax advantage is usually far greater on a Federal tax return, unless your Federal marginal tax rate happens to be at the low end of the scale.

_____________________

Of course, it's immaterial state taxwise, if your resident state doesn't have an income tax at all.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abcxyz13

New Member

anth_edwards

New Member

rhartmul

Level 2

RyanK

Level 2

RicN

Level 2