- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

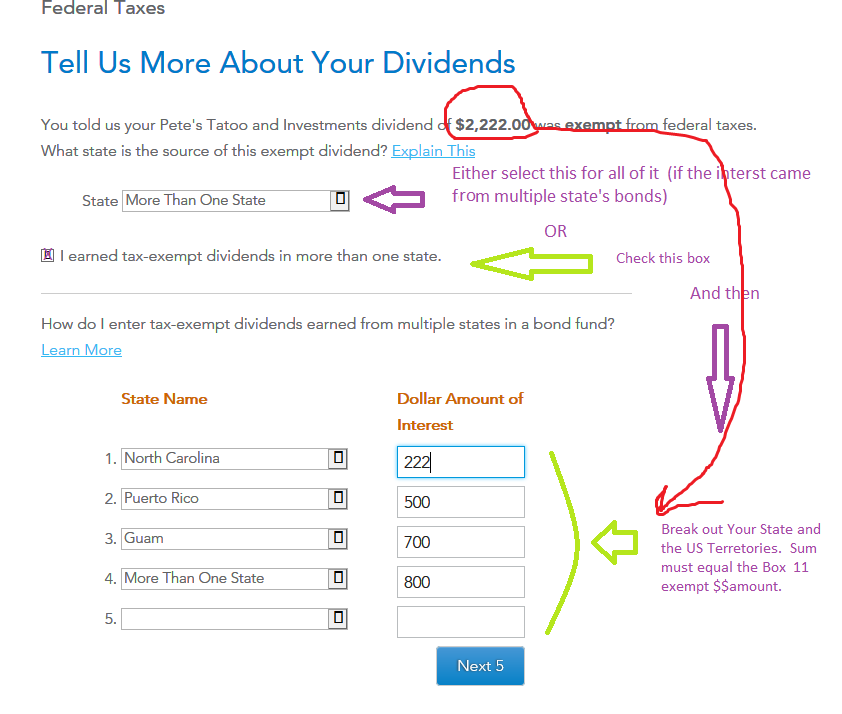

Choice #1 (simplest for that low amount): go to the bottom of the list of states and indicate "Multiple States" for all of it (desktop software uses the term "More than one state" ).

Choice #2 : Break out the sub amount for your own state, and any US Territories (like Puerto Rico)...to do this You have to talk to your broker to find out where the listing is for whatever funds you own, and calculate the amount yourself to do the breakdown.

Example: if you were a NC resident, and had $1000 in box 11 of a 1099-DIV from only one bond fund, and the broker/fund indicates that 2% of that came from NC-muni bonds. Then 2% of 1000 = $20, and a breakout might save me ~$1 in NC taxes since NC taxes income at ~5%. A lot of work for little return..and if multiple funds contributed to the box 11 value on a 1099-DIV, you have to calculate the amount separately for each.

________________________

Note: MN and CA residents have severe fund restriction on whether a state breakout is allowed for box 11 $$ on a 1099-DIV form. For IL residents, it isn't allowed at all .

CA, MN and IL are allowed a state breakout for any $$ shown in box 8 of a 1099-INT form since those are individual bonds, and not bond funds

_________________________

Here's and example of an NC and US Territory breakout for a different NC situation to show how it would look:

______________________