- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My broker's Consolidated 1099 is in PDF format. Can I upload that, or do I need to convert it to CSV or something else?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My broker's Consolidated 1099 is in PDF format. Can I upload that, or do I need to convert it to CSV or something else?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My broker's Consolidated 1099 is in PDF format. Can I upload that, or do I need to convert it to CSV or something else?

Yes, you can upload your broker's pdf file but you should upload it only for verification of your data and not as a substitute for data entry. I will highlight the steps below to assist you in that regard.

The steps below will utilize the screens from TurboTax online. The desktop version is very similar but not the same as accessing the screens to enter data.

- On the left side of your screen, click on Wages & Income

- Scroll to Investments and Savings and click on Start or Edit/Add if previous entries were made.

- Click on "Add Investments", and then "Continue"

- You can search for your broker from the list but I suggest you click on "Enter a different way". If your 1099 is a true composite including interest, dividends, stock transactions, and such you may want to try finding your broker and taking it from there, but you will still have to verify all items accessed. I suggest entering the interest, dividends, and such manually and entering the stock transactions via sales section totals.

- You will be asked a series of questions, to begin with. Answer each as they appear.

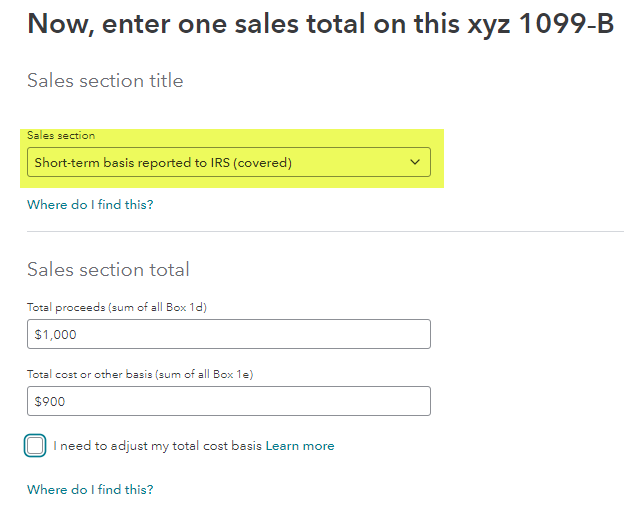

- Next, choose the box for Sales Section Totals, and then you will enter as summary amounts as they appear on your 1099-B

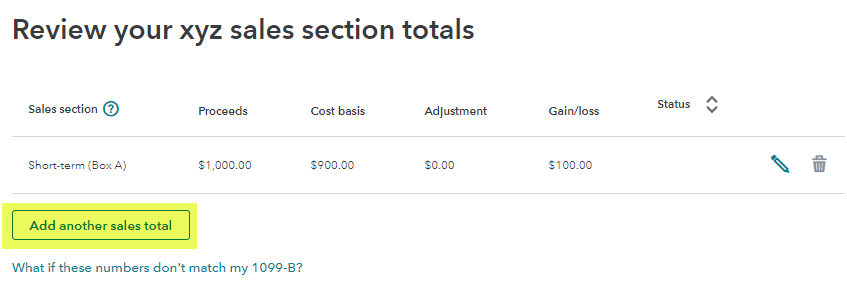

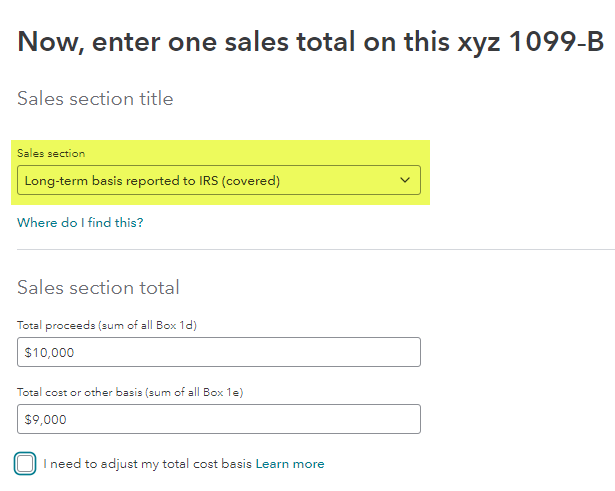

- The screenshots below should assist in your entry. The numbers shown are for example purposes only. The amounts you enter need to correspond with the totals on your 1099-B per section.

Next you would add another sales total for the next sales section shown:

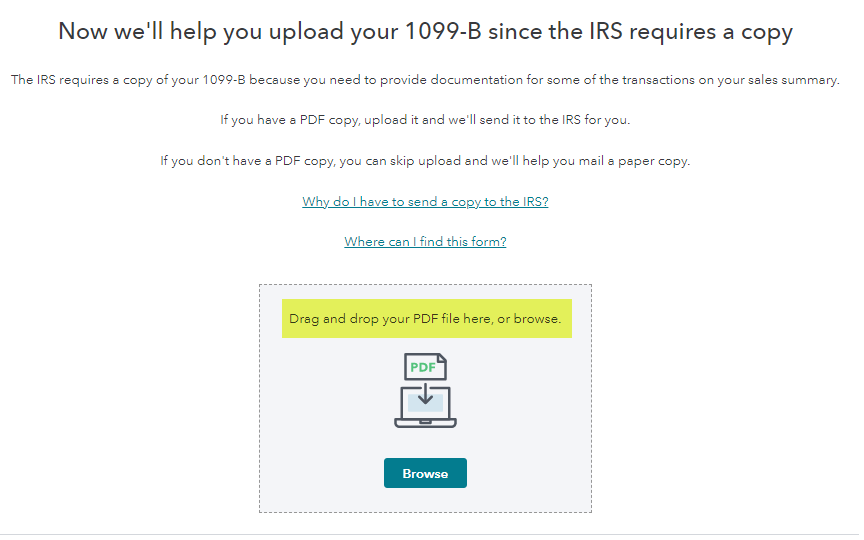

Next you will be taken to the screen to upload your pdf file:

While the process is not automatic, it does provide you with the ability to enter the data necessary to file your return and submit the verification documentation to the IRS

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17557017943

New Member

lkjr

New Member

Idealsol

New Member

user26879

Level 1

rolfarber

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill