- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My 1099-DIV Exempt Interest-Dividends (Box12) includes all 50 states with amounts, for a total of $643.46. Do I answer with my resident state or list all 50?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-DIV Exempt Interest-Dividends (Box12) includes all 50 states with amounts, for a total of $643.46. Do I answer with my resident state or list all 50?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-DIV Exempt Interest-Dividends (Box12) includes all 50 states with amounts, for a total of $643.46. Do I answer with my resident state or list all 50?

No, you do not have to list all 50 states. You would enter your Form 1099-DIV with multiple states as per the instructions below. You would enter the amount of Dividends for your own state, any of the U.S. Territories, and the rest will go under "Multiple states". You will have to calculate the amount that goes under each yourself based on the information provided from your brokerage firm. Screenshots are provided for some additional guidance.

You can enter the amount that is in box 5 of your Form 1099-DIV as follows:

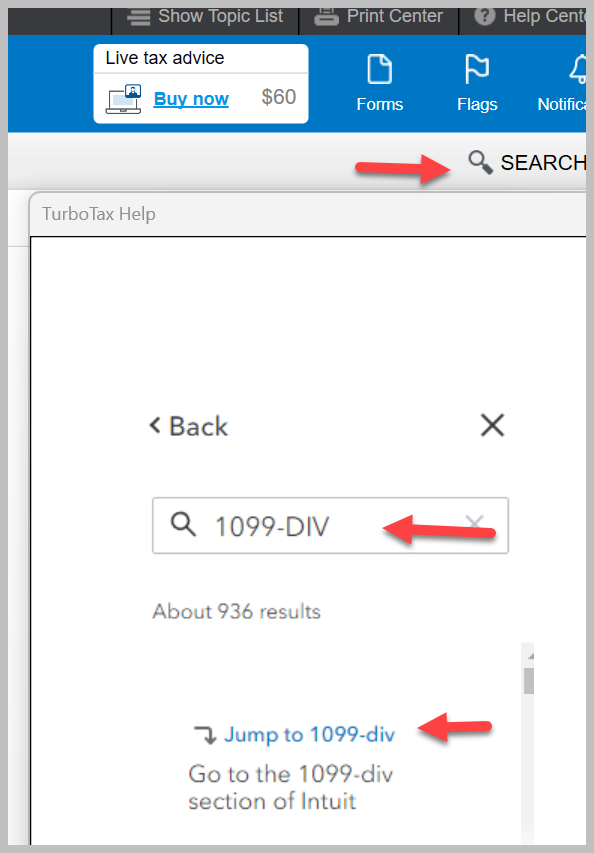

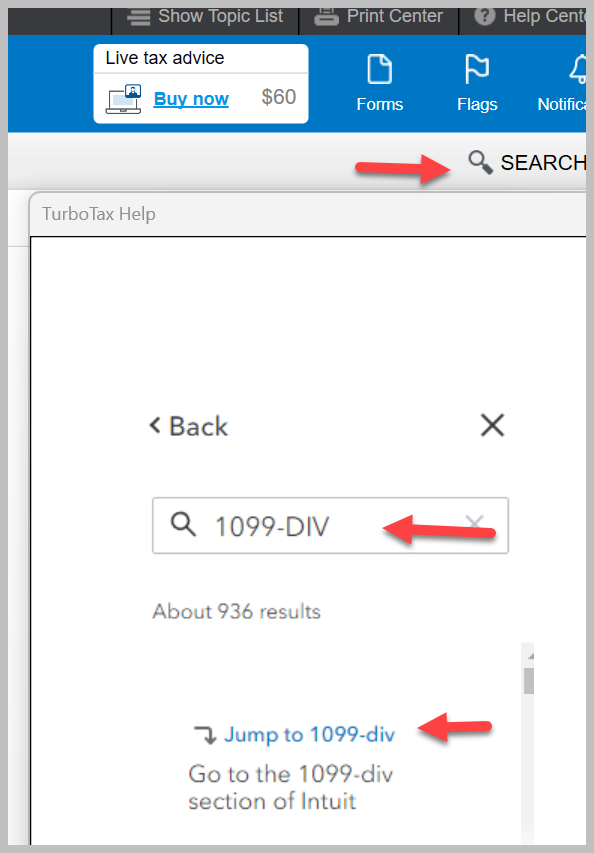

- Go to your search icon at the top right of your screen and click on it

- In the search bar, type "1099-DIV"

- Click on "Jump to 1099-DIV"

- Click on "Add Investment"

- Select "Skip Import"

- Click on the box for "Dividends". The box will turn green and a checkmark will appear

- Select "Continue"

- You will see "Lets get the info from your 1099-DIV"

- Enter your 1099-DIV as shown, to enter your exempt dividends, click on the box that says "My form has entries in other boxes"

- Click on "Continue"

- You will see "Do the uncommon situations apply"

- Select "None of these apply" if they do not apply

- On the following page, "Tell us more about your exempt-interest dividends" select "I earned Dividends in more than one state"

- Select "Learn More" and under "More than one state" there is additional guidance

- Enter your interest amount under your resident state and any of the U.S. Territories if applicable to your interest (The U.S. Territories are: Puerto Rico, Palau, Guam, American Samoa, the Northern Mariana Islands, Marshall Islands and the U.S. Virgin Islands..

- To enter the amount for "Multiple States" you will click on the down-facing caret next to "Select a State "and scroll to the bottom to select "Multiple States"

Click on search in the top right of your TurboTax screen and enter "1099-DIV" in the search box, then select "Jump to 1099-DIV".

Enter your 21099-DIV information. Select "My form has info in other boxes"

Select "I earned "Exempt-interest dividends in more than one state"

You will enter the correct amount under your state and any U.S. Territories if applicable. The rest will go under "Multiple States"

Click here for "Where Do I Enter Form 1099-DIV in TurboTax Online?"

Click here for "What is IRS Form 1099-DIV

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-DIV Exempt Interest-Dividends (Box12) includes all 50 states with amounts, for a total of $643.46. Do I answer with my resident state or list all 50?

No, you do not have to list all 50 states. You would enter your Form 1099-DIV with multiple states as per the instructions below. You would enter the amount of Dividends for your own state, any of the U.S. Territories, and the rest will go under "Multiple states". You will have to calculate the amount that goes under each yourself based on the information provided from your brokerage firm. Screenshots are provided for some additional guidance.

You can enter the amount that is in box 5 of your Form 1099-DIV as follows:

- Go to your search icon at the top right of your screen and click on it

- In the search bar, type "1099-DIV"

- Click on "Jump to 1099-DIV"

- Click on "Add Investment"

- Select "Skip Import"

- Click on the box for "Dividends". The box will turn green and a checkmark will appear

- Select "Continue"

- You will see "Lets get the info from your 1099-DIV"

- Enter your 1099-DIV as shown, to enter your exempt dividends, click on the box that says "My form has entries in other boxes"

- Click on "Continue"

- You will see "Do the uncommon situations apply"

- Select "None of these apply" if they do not apply

- On the following page, "Tell us more about your exempt-interest dividends" select "I earned Dividends in more than one state"

- Select "Learn More" and under "More than one state" there is additional guidance

- Enter your interest amount under your resident state and any of the U.S. Territories if applicable to your interest (The U.S. Territories are: Puerto Rico, Palau, Guam, American Samoa, the Northern Mariana Islands, Marshall Islands and the U.S. Virgin Islands..

- To enter the amount for "Multiple States" you will click on the down-facing caret next to "Select a State "and scroll to the bottom to select "Multiple States"

Click on search in the top right of your TurboTax screen and enter "1099-DIV" in the search box, then select "Jump to 1099-DIV".

Enter your 21099-DIV information. Select "My form has info in other boxes"

Select "I earned "Exempt-interest dividends in more than one state"

You will enter the correct amount under your state and any U.S. Territories if applicable. The rest will go under "Multiple States"

Click here for "Where Do I Enter Form 1099-DIV in TurboTax Online?"

Click here for "What is IRS Form 1099-DIV

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-DIV Exempt Interest-Dividends (Box12) includes all 50 states with amounts, for a total of $643.46. Do I answer with my resident state or list all 50?

@LindaS5247My broker's 1099DIV lists a percentage for "U.S.Possessions". It does not break it out specifically into Puerto Rico, Palau, Guam, American Samoa, the Northern Mariana Islands, Marshall Islands and the U.S. Virgin Islands, yet the TT interview drop down is asking for the amount for each specific U.S. possessions. How do I address this in the interview?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-DIV Exempt Interest-Dividends (Box12) includes all 50 states with amounts, for a total of $643.46. Do I answer with my resident state or list all 50?

You can choose one of the possessions and enter it all there. It won't have any affect on your tax to not break it out properly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MummyatLilliput

New Member

vicki1955vic

New Member

ed 49

Returning Member

dennison-jenna

New Member

Katie1996

Level 1