- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Mathematical Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

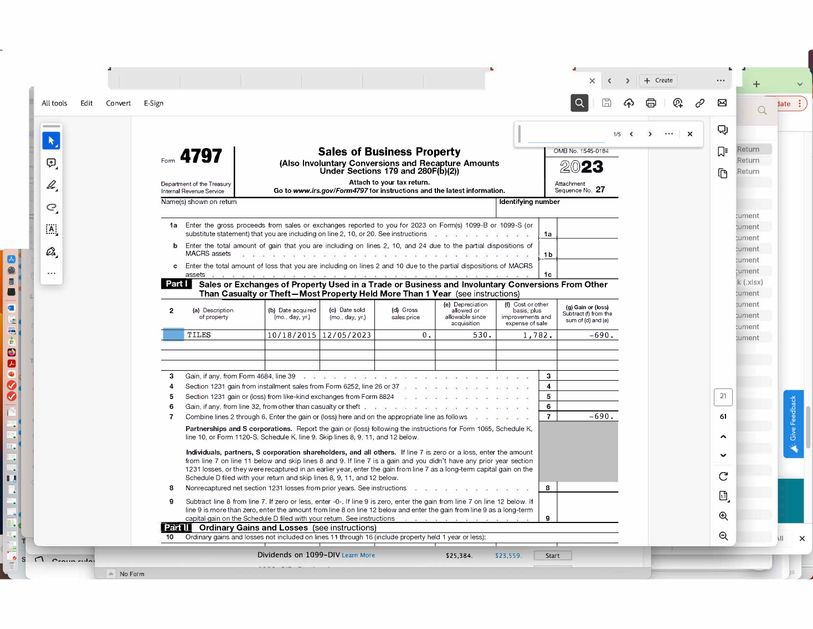

I cannot figure out why Turbotax insists that 530 - 1782 = -690. Shouldn't the result be -1252?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

On a MAC, please look for HELP rather than ONLINE

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

Any chance that Section 179 deduction was claimed on this asset?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

No. Would like to note that all seems good when I override this figure in the form - except that overriding disable e-filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

To look into this further and try to offer an explanation to your or submit it to the appropriate team for possible correction if it is an issue, it would be beneficial to have a diagnostic copy of the tax return experiencing the issue. You can help by providing that diagnostic tax file.

The diagnostic file will not contain personally identifiable information, only numbers related to your tax forms. If you would like to provide us with the diagnostic file, follow the instructions below and post the token number along with which version of TurboTax you are using and what state you are filing in a follow-up thread.

Use these steps if you are using TurboTax Online:

- Sign in to your account and be sure you are in your tax return.

- Select Tax Tools in the menu to the left.

- Select Tools.

- Select Share my file with agent.

- A pop-up message will appear, select OK to send the sanitized diagnostic copy to us.

- Post the token number here.

If you are using a CD/downloaded version of TurboTax, use these steps:

- Select Online at the top of the screen.

- Select Send Tax File to Agent.

- Click OK.

- Post the token number here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

Thanks for reaching out. Unfortunately, I cannot find the tools tab anywhere. I'm using download/MAC Premier edition. Please advise. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

@sjrosso As stated -

If you are using a CD/downloaded version of TurboTax, use these steps:

- Select Online at the top of the screen.

- Select Send Tax File to Agent.

- Click OK.

- Post the token number here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

Hi - thanks. There is no visible "online" tab anywhere on the screen- at least on the MAC version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

Try looking around way up at the very top. Move your cursor up to the top edge and the black Apple bar will show. It's probably in there somewhere. Under Help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

On a MAC, please look for HELP rather than ONLINE

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

Token #1187245.

Also, a snapshot of the form below. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

Thank you for providing your token number. I have taken a closer look at your return and will try to explain the situation below without including specific numbers from your return.

Even though your Form 4797 seems to show a mathematical error, it is correct. The loss shown on Form 4797 line 2 column g is the amount of loss that is being allowed on your 2023 return. The remaining loss is being carried forward as a suspended passive loss.

The amount that is allowed on your 2023 return is based on the fact that when you put both rental properties together on Schedule E, you have an overall profit. The loss from Form 4797 reduces that profit to zero and carries forward the portion of the loss that cannot be used in 2023. See Form 1040 Schedule 1 lines 4 and 5.

The suspended loss can be seen on Form 4797 page 3 attributable to your first rental property entered in the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mathematical Error

Hi Annette,

Thank-you for looking into this. I agree with your conclusion. However, it is misleading that line 2 of 4797 simply states column G= F-D+E. In the end, the numbers still work out correctly so will consider this resolved. Thanks again for your efforts.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Impatti

New Member

ssladyhawk

New Member

pleasepaytheman

Level 2

aburtonworks

New Member

federlegal

New Member