- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- K-1 BOX16 checked, but without K-3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

Hello,

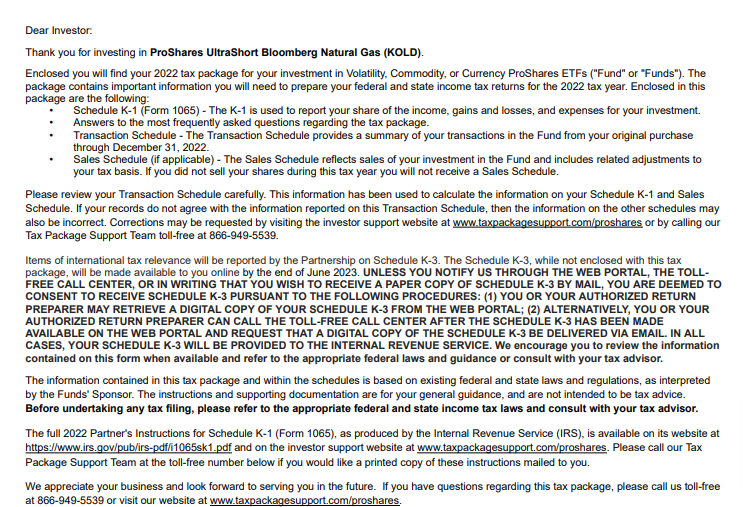

I traded stocks (ProShares UltraShort Bloomberg Natural Gas) in 2022 and received K-1 recently.

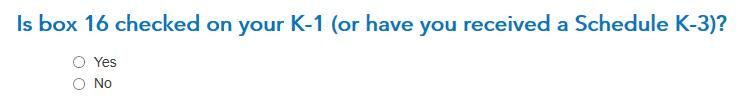

In the K-1, BOX-16 was checked, but without K-3. (The K-3 will be made available online by the end of June 2023).

My questions are :

1. how to fill out the tax return without K-3?

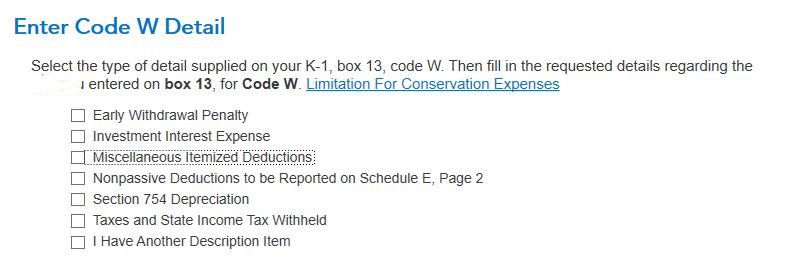

2. TT asks to provide details of BOX 13, code, W. Which I should select? In the instructions of K-1, it says Code W. other deductions, see page 12 of the IRS instructions.

3. Which should I select for the describe the partnership? The amount on L (ending captial account) is 0.

Thanks a lot

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

1. It depends. You have the choice to file now and amend later or request an extension of time to file.

To file now, uncheck Box 16 and e-file. When you receive Schedule K-3 later, you can file an amended return if the information you receive changes your tax liability for the year.

If you choose to request an extension, you have until October to complete and file your return. Note that your best estimate of taxes due on your return must be paid by the original filing deadline (April 18, 2023, for tax year 2022 returns).

2. You will need more information about the amount for Box 13W before you can choose how/where to report this deduction. Instructions for Schedule K-1 (Form 1065) contains a long list of possible entries for this amount. If the K-1 doesn't include more info, you'll need to contact the partnership for better instructions.

3. If none of the statements apply to your ownership of the partnership, you may leave those boxes blank. The ending capital balance on the K-1 doesn't influence your answers on this page.

[edited 4/9/2023 | 8:29 am PDT to complete answer]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

Which option would be better, an extension or filing now? I did not file any extension previously.

Thanks a lot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

I do not advise you to file the return without the K-3 information unless you are certain it will be blank. The Foreign Taxes paid or accrued box being empty does not guarantee the K-3 will be blank.

If you have not filed the return and do not have key indicators to file your return without the K-3 I recommend filing for an extension and completing your return when you receive it. If you have already filed, you should wait until you receive the K-3 and then amend your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

@AliciaP1 Thank you for your reply.

Is there any way to figure out if K3 would be blank?

The Foreign Taxes paid or accrued box of K1 is blank. I am a permanent resident without foreign income.

box 1,2,3,4a,b,c: blank

box 5: a small number

box 6a, b, c, 7: blank

box 8: 0

box 9a,b,c: blank

box 10: blank

box 11: code C, ~15k

box 12: blank

box 13: code w, a small number

box 14,15: blank

box16 : checked

box 17, 18,19: blank

box 20: code A and B, small numbers

code 21: blank

cover letter of K1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

If you have no other foreign income or foreign tax credits to report on your return you do not have to include the K-3. Keep it with your tax records. You could verify with the issuer of your K-1 if there is any foreign sourced income reported.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

Thanks for the reply. Just double check. I received a K-1 because I own a publicly-traded fund. Box 21 of my K-1 is empty (no foreign taxes paid or accrued). I also found a PDF from the fund web site, saying that "do not have any foreign activity and all income is US sourced." I am a US citizen and I have no other foreign income and no claim for other foreign tax credit on my return.

The box 16 of K-1 is checked. But on the K-1 form, it says the K-3 will be available by the end of June. So I don't have K-3.

My understanding based on the posts is that, I can file my return by unchecking the Box 16 in TT and later, when the K-3 becomes available, just use it for my record. Is that correct?

Thanks for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

Yes, The K-3 is used to report foreign income. If you know you will not receive foreign income or do not feel the K-3 applies to you then you can uncheck box 16. However, if you receive a K-3 at a later date with foreign income you will need to amend your return to include the income. If you will be receiving the K-3 with foreign income, you should file for an extension and file the return once the K-3 is received. Keep in mind that an extension gives additional time to file but not to pay your taxes. If you know a balance will be due, you will need to make an estimated payment to cover the tax to avoid any penalties for not pre-paying tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

keith

New Member

jacob-lederer

New Member

cougar91

New Member

shaynagile

New Member

auhbsmomma

New Member