- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 BOX16 checked, but without K-3

Hello,

I traded stocks (ProShares UltraShort Bloomberg Natural Gas) in 2022 and received K-1 recently.

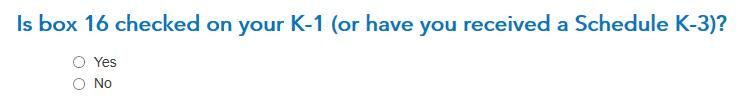

In the K-1, BOX-16 was checked, but without K-3. (The K-3 will be made available online by the end of June 2023).

My questions are :

1. how to fill out the tax return without K-3?

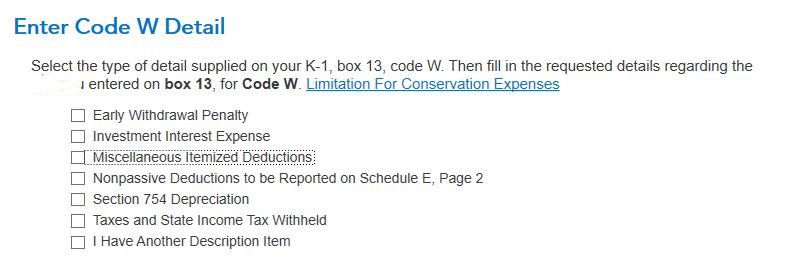

2. TT asks to provide details of BOX 13, code, W. Which I should select? In the instructions of K-1, it says Code W. other deductions, see page 12 of the IRS instructions.

3. Which should I select for the describe the partnership? The amount on L (ending captial account) is 0.

Thanks a lot

Topics:

April 8, 2023

8:57 PM