- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Itemized deductions - medical - can't enter amount for doctors

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deductions - medical - can't enter amount for doctors

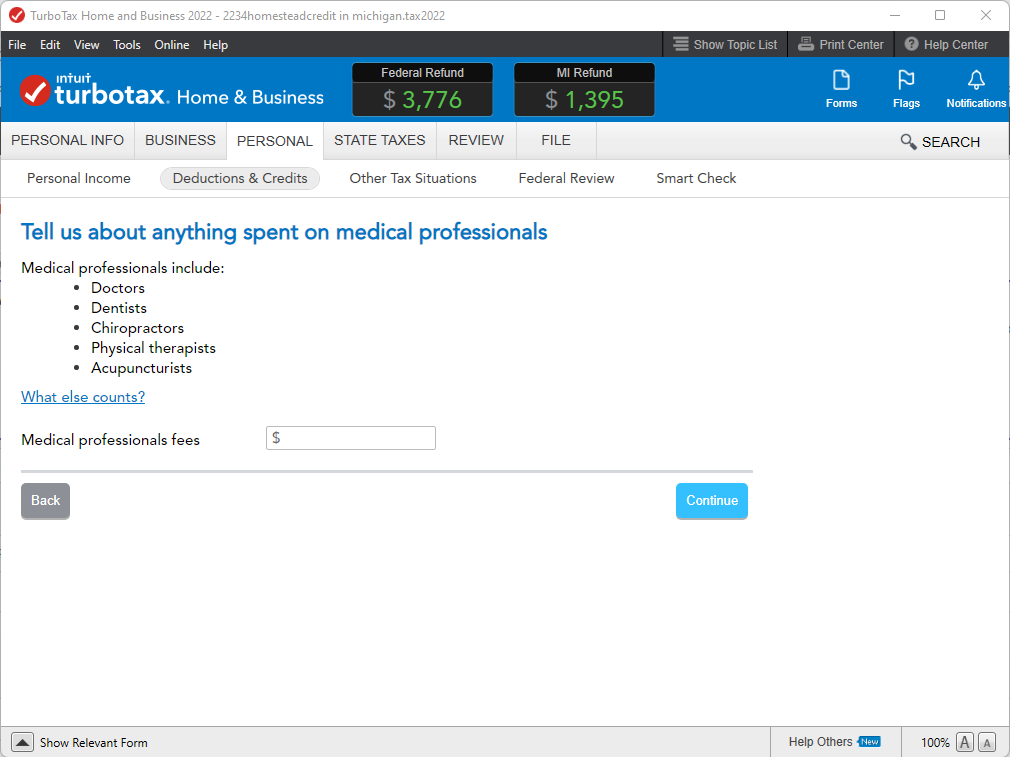

I'm using TT on my computer (not online) in interview mode and going through medical expenses. When I get to the question about doctors I cannot enter an amount in the box. Can't even enter zero. I can enter amounts for other medical expenses like hospitals, lab work, etc.

BTW, this isn't the first year I've run into this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deductions - medical - can't enter amount for doctors

After selecting Medical deductions and clicking start. It will ask you if you had more than xxxx.xx in medical expenses, answer the question. The first question is about prescriptions, then it'll ask you for Medical Professional Fees. This is where you enter your doctor costs. Similar in desktop and online version.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deductions - medical - can't enter amount for doctors

Yes, that's correct. That's where I cannot enter an amount. Couldn't enter an amount last year either. Can enter amounts for other medical expenses. Must be a program bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deductions - medical - can't enter amount for doctors

Desktop software correct? Double click on any field that won't let you enter a $$ amount...especially if it already shows a $0

____

DESKTOP SOFTWARE:

Whenever you see that "$0" (an actual zero, and not just a simple "$" )......then a "Supporting Details" sheet is attached to that entry field, usually transferred in from last year, but after the actual $$ entries from 2021 were stripped out.

Problem is that TTX reprogrammed that page such that the "Supporting Details" page doesn't pop up like it used to...so three ways to work around , #3 below.

___________

Here's what I think is happening...and how to fix it.

1) In 2021 you added "Supporting Details" to each of those fields...probably to describe when & how paid.

2) The Supporting Details sheets (empty) transferred into your 2022 file.

3) Workarounds :

3a) double-click in the field and the Supporting Details sheet pops up and you can either delete it (hit the big red "X"), and now make an entry...or you can use the SuppDetails worksheet to enter your $$....OR...

3b) Put your cursor in the box, and then go to the top menu on the screen and click on <Edit....then <<Add Supporting Details from the drop-down menu. IF the SuppDet box shows up you can either add your entry in there...or hit the Red "X" to delete the whole SupDet worksheet and then make your normal entry.....OR...

3c) Put your cursor on the box....switch to Forms Mode...., and enter the payment directly in the worksheet. You can also delete the Supporting Details sheet entirely (look for the REMOVE "X" when it pops up)..once that is done, you can make entries using the interview again..

and the are other places ..like Property Taxes, Federal Estimated taxes, etc.....where the same "$0" issue may pop up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deductions - medical - can't enter amount for doctors

Double-clicking opened the supporting details window and I was able to enter amounts there. Thank you for the help.

IMHO I still think there is an programming issue when you cannot enter an amount or right-click to open the supporting details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deductions - medical - can't enter amount for doctors

yep...it's been going on multiple years.....with no fix...ever since they rewrote area certain subroutines.

Of course, if you don't want the SD sheet at all, you can click the bog red "X" in it to delete that sheet and regain control of the normal immediate access to the interview entry box. But then you cannot do a detailed breakdown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized deductions - medical - can't enter amount for doctors

I don't know if this helps but I don't ever enter Medical or donations as they never help the refund. It's too much typing and then no difference.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy

New Member

peacemaker0751

New Member

CTinHI

Level 1

Random Guy 1

Level 2

StPaulResident

Returning Member